Please join us telegram Channels where you can get the latest information on breaking news

XRP prices rose more than 9% after the Depository Trust Clearing Corporation (DTCC) listed five spot XRP exchange-traded funds (ETFs) amid growing optimism that an agreement to end the U.S. government shutdown is near.

Listed companies on DTCC’s website include Bitwise, Franklin Templeton, 21Shares, Canary Capital, and CoinShares, which fall into DTCC’s “active and pre-launch” category, which is often seen as an indication that they are ready for market debut.

XRP was currently trading at $2.46 12:58 a.m. ET After erasing last week’s losses, according to CoinMarketCap.

XRP price (Source: coin market cap)

Crypto ETF floodgates open as US government shutdown nears end

This comes as the U.S. government shutdown appears to be nearing an end, with senators reaching a bipartisan agreement to fund key departments through next year. The deal was initially passed by the Senate on a 60-40 vote and now goes to the House of Representatives for approval by President Donald Trump.

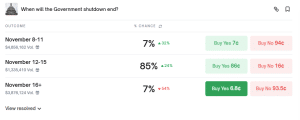

Traders at decentralized prediction market Polymarket are confident the shutdown will end this week.

Contract asking when the shutdown ends (Source: Polymarket)

The probability of a conclusion on the Polymarket contract on when the U.S. government shutdown will end by tomorrow has increased over the past 24 hours. Traders believe there is an 85% chance the shutdown will end between Nov. 12 and Nov. 15.

As the government shutdown nears an end, Novadius Wealth President Nate Geraci said this will lead to “an opening of the floodgates for crypto ETFs.”

Government shutdown ends = crypto ETF floodgates open…

Meanwhile, the first ’33 Act spot xrp ETF could launch this week.

— Nate Geraci (@NateGeraci) November 10, 2025

He added that the first spot XRP ETF could be launched this week.

Universal Listing Standards Pave the Way for Faster Approval of Cryptocurrency ETFs

The SEC’s newly approved generic listing standards for crypto ETFs also suggest a surge in new listings in the coming weeks.

Under this rule, applications for virtual currency ETFs can be fast-tracked through amended S-1 filings without procedural delays. This opens the possibility for pending spot XRP ETF applications to become effective by mid-to-late November.

Earlier this month, Grayscale and Bitwise revealed the fees for their respective spot XRP funds. Canary Capital CEO Steven McClurg also reportedly told attendees at last week’s Ripple Swell event that the company is ready to launch a spot XRP ETF this week.

Last month, several crypto ETFs had a decision deadline, which has passed several times as the U.S. government shutdown continues. Because government agencies are operating with reduced staffing, the SEC said it will not make decisions on new applications until the shutdown ends.

Related articles:

Best Wallets – Diversify your crypto portfolio

- Easy-to-use, feature-oriented crypto wallet

- Get early access to upcoming token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now available on App Store and Google Play

- Stake and Earn Native Tokens $BEST

- 250,000+ monthly active users

Please join us telegram Channels where you can get the latest information on breaking news