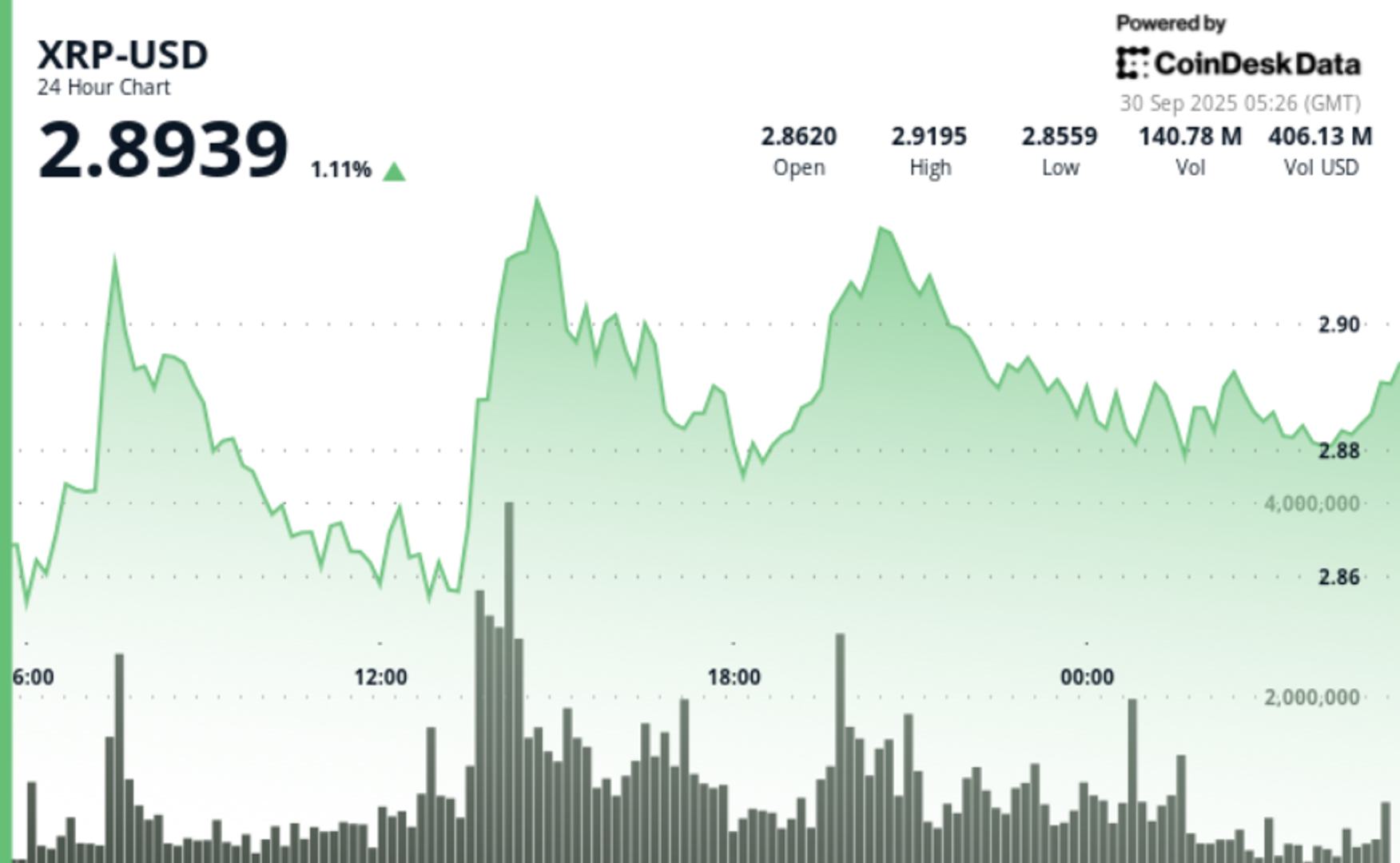

XRP won 2.1% during the 24-hour trading session from 21:00 until September 28th to 20:00, rising from $2.84 to $2.90, moving within the $0.10 range, representing 3.47% of the opening price.

News background

•Address of a large institution between 10 million and 100 million XRP tokens, where more than 120 million coins have been accumulated over the past 72 hours.

• Seven XRP Spot ETF applications are pending before the Securities and Exchange Commission. Grayscale submissions are scheduled for October 18th, with others waiting in line until November 14th creating a centralized window of regulated catalysts that can restructure recent trends.

• Market sentiment is supported in the hopes of increased exposure to the company’s portfolio. Analysts frame ETF approvals as a structural driver that can accelerate the adoption of XRP within institutional allocation strategies.

Price Action Overview

•XRP trades within a $0.10 corridor and fluctuates at a minimum of $2.84 to $2.93 high, reflecting 3.5% volatility over the period. Especially during the 14:00 session on September 29th, the price capped at nearly $2.93, which had increased sales pressure.

•The most important upward movement was at 02:00 and 07:00 GMT on September 29th, bringing volumes to over 97 million units. These surges significantly exceeded the daily average of 57.4 million, confirming institutional participation at the meeting stage.

•The final time of the transaction increased from $2.88 to $2.90 with a slow profit of 0.7%, so we extended the advance payment. The $2.90 psychological barrier violation was confirmed by a volume burst of 4.8 million units, raising the session to a high before settling around $2.9045.

Technical Analysis

• Resistance clusters between $2.92 and $2.93, with prices stalling repeatedly at higher volumes. This zone marks the next hurdle of continuance, and breakout confirmations could require more than $2.93 when expanding participation.

•Support has been integrated between $2.85 and $2.86, with buyers consistently defending bids during the retracement. Multiple successful retests of this band throughout the session highlight the importance of it as a storage zone.

• The $2.90 psychological level shifted to a short-term pivot. The price will regain it in the later sessions, and traders will monitor whether this can be held as support heading into the weekend.

• Volatility over the 24-hour window reached 3.47%, consistent with an increase in institutional position around the main regulated catalysts.

What traders see

• Whether XRP can be maintained will be reduced to above $2.90 to support this. This validates any continuation attempts to $3.00 or later.

•SEC’s October-November ETF Review Window. The grayscale date of October 18th is considered the first major structural catalyst of facility influx.

•Whale Wallet Activities. 120 million tokens have accumulated over three days, suggesting an even higher rate of increase as this continues.

• Broader macro conditions. The Treasury has Treasury yield volatility and Fed policy signals that affect risk appetite across both stocks and digital assets.