Please join us telegram Channels where you can get the latest information on breaking news

XRP price has fallen 3.9% over the past 24 hours and is trading at $2.49 as of 3:46 a.m. ET, as trading volume drops 8% to $5 billion.

This was submitted by Canary Capital. Updated the S-1 for the Sports XRP ETF (exchange traded fund) to remove a “delay amendment” that would allow the SEC to control the timing of registration.

The move sets the stage for a potential launch on Nov. 13, pending approval of the 8-A filing by Nasdaq.

🚨Scoop: @CanaryFunds has filed an updated S-1 $XRP Spot ETF removes “delayed amendment” that halts automatic effectiveness of registration; @SECGov Control of timing.

This sets the canary. $XRP Assuming the ETF is scheduled for a release date of November 13th… pic.twitter.com/MKvEN23t5P

— Eleanor Terrett (@EleanorTerrett) October 30, 2025

After the update, the ETF became automatically eligible to become effective under Section 8(a) of the Securities Act of 1933.

The move also comes at a time when SEC Chairman Paul Atkins has signaled support for companies using the auto-validation methodology used by Bitwise and Canary to launch the SOL, HBAR, and LTC ETFs.

Mr. Atkins praised the use of the 20-day statutory waiting period during the government shutdown and emphasized its effectiveness in expediting initial public offerings.

The updated filing allows Canary’s XRP ETF to proceed without formal SEC approval and appears poised to proceed once the statutory 20-day period has passed. The only potential problem is if the SEC issues additional comments or concerns.

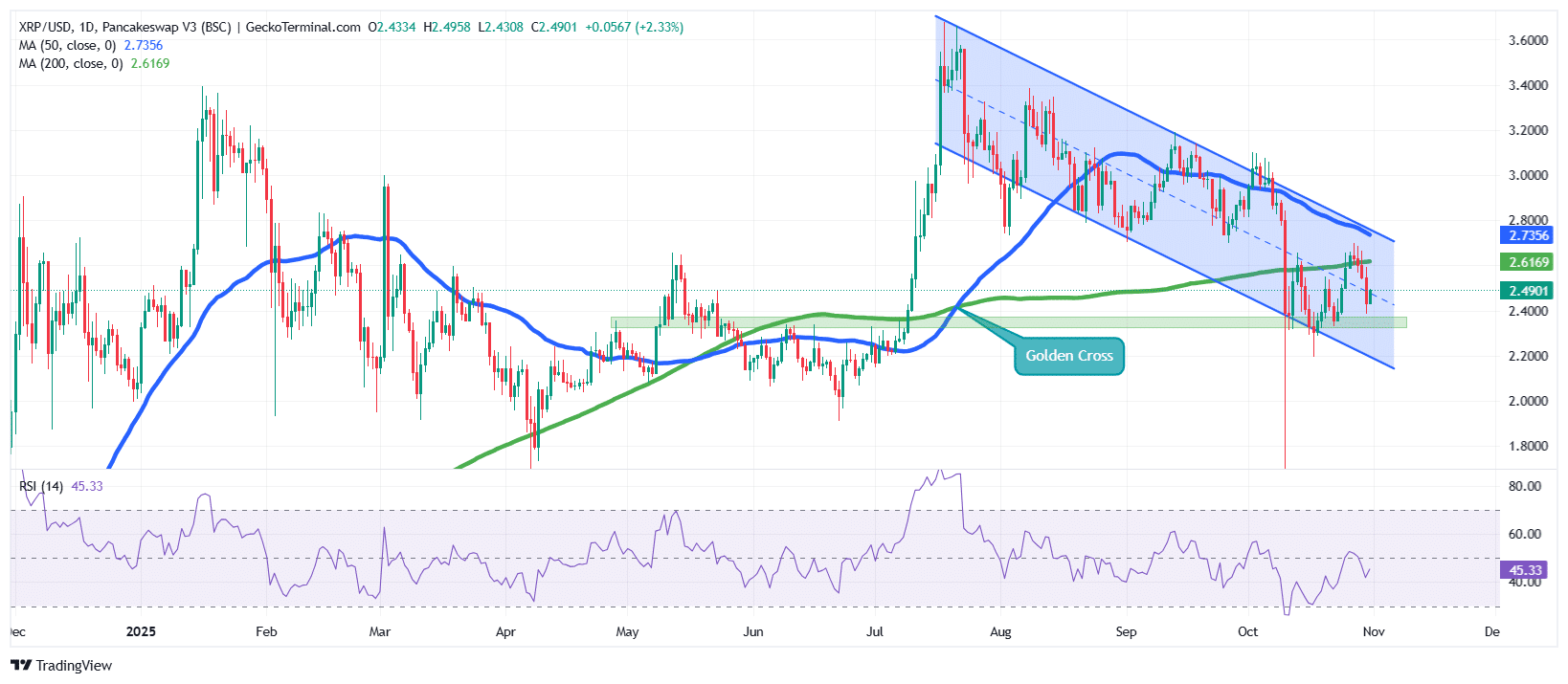

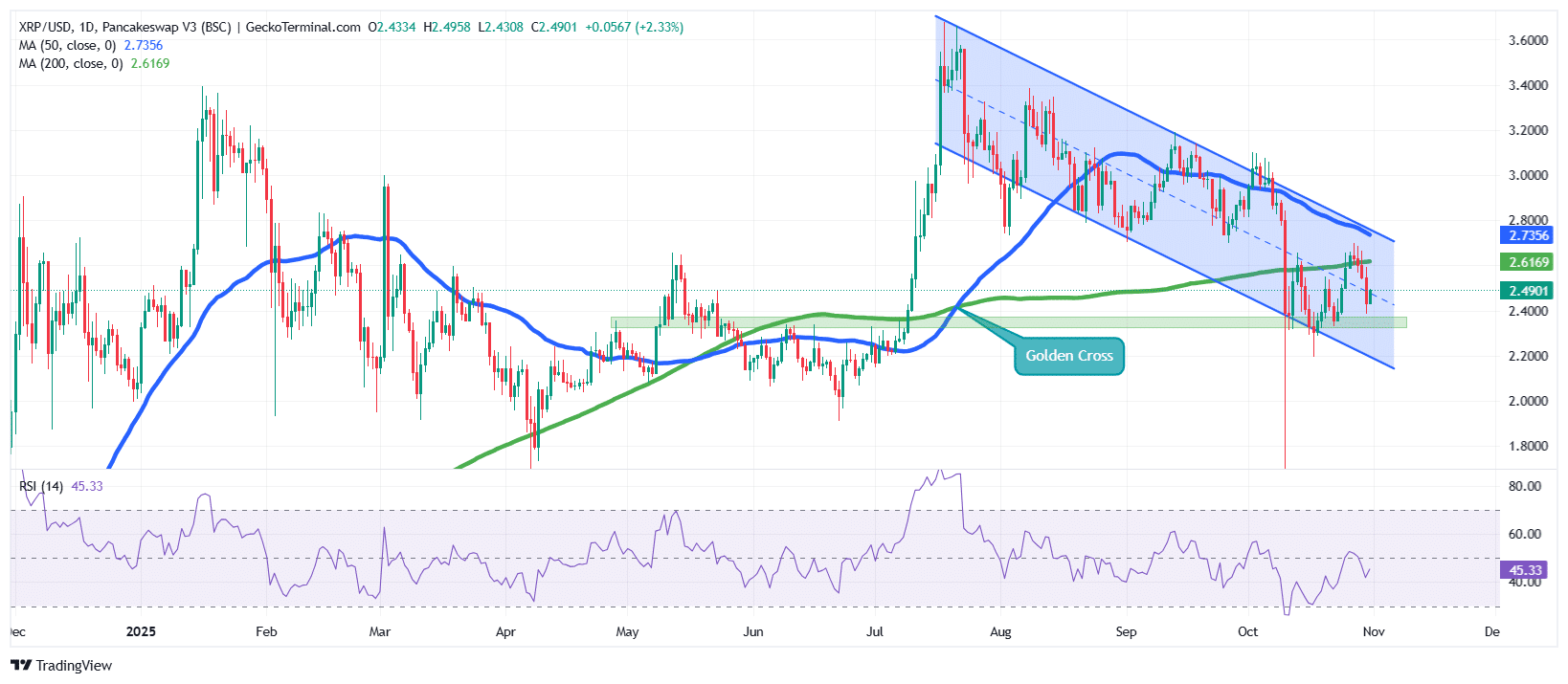

XRP price fluctuations suggest the possibility of bearish continuation

After a strong rise in July, XRP price Towards the $3.30 zone, the momentum changed as the bears regained control, causing a retracement and developing into a descending channel pattern.

Throughout this phase, the bulls have been trying to protect the $2.40 to $2.45 support area, but the recent market structure suggests that sellers continue to have the upper hand.

The ongoing correction has seen the Ripple token price currently below its 50-day simple moving average (SMA) of around $2.73, confirming that short-term momentum remains negative. The 200-day SMA is currently around $2.62 and serves as a short-term pivot level, below which a break could open the door to further downside.

Despite the previous golden cross (when the 50-day SMA rose above the 200-day SMA), the recent decline has neutralized that bullish signal, suggesting that XRP may need to retest deeper support levels before attempting a recovery.

Additionally, the Relative Strength Index (RSI) is currently hovering around 45.3, reflecting reduced buying pressure and a bearish trend.

Ripple token target support is around $2.35

Considering the current technical setup, XRP price looks poised to test the horizontal support zone around $2.35 that has been held numerous times in recent months.

If the price closes decisively below this level, the Ripple token could slide further towards $2.20, which coincides with the lower bound of the descending channel.

On the contrary, if the bulls manage to defend the $2.40 zone and push the Ripple token price above $2.73 (50-day SMA), XRP could attempt a breakout towards the upper channel boundary around $2.80-$2.85.

A confirmed close above that range would be the first signal of a possible bullish reversal.

Related new arrivals:

Best Wallets – Diversify your crypto portfolio

- Easy-to-use, feature-oriented crypto wallet

- Get early access to upcoming token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now available on App Store and Google Play

- Stake and Earn Native Tokens $BEST

- 250,000+ monthly active users

Please join us telegram Channels where you can get the latest information on breaking news