This week, two rails were published for real-world funding in XRPL: redemptions to the tokenized Treasury RLUSD and cut-offs for validators to land in four days. Both have changed operations.

RLUSD will be a live redemption railway for tokenized funds

With Ripple and Securitize, holders of BlackRock’s Buidl and VBill Redeem Fund will directly turn the shares into stock in Ripple USD (RLUSD). The flow is run by smart contracts and settles in XRPL and Ethereum. It covers 24-7 liquidity without an exchange order.

Additionally, today’s reporting reiterates that RLUSD was launched earlier this year with monthly back-up proof and support in cash, short-term finance and deposits. These details frame RLUSD as a cash-like asset for settlement, not a transaction token.

In reality, this link plugs tokenized funds into a programmable off-ramp. We will also remove bespoke integrations at the fund level, as redemption logic is in the securitization agreement. Therefore, the institution can wire revenues to RLUSD and move them throughout the chain.

UNL Midider Deadline will hit September 30th

The default unique node list (UNL) for XRPL will be moved to XRPL Foundation on Monday, September 30, 2025. Nodes that trust legacy publishers must switch between keys and list URLs to avoid load failure of trusted lists. The documentation flags this as a necessary change for most upgraded mainnet servers.

Additionally, Community Alerts highlighted the cutover window this week and the results of missing it. Operators who are unable to migrate risk disconnection and consensus issues until the configuration matches the new default list.

Legacy lists aren’t just about switching next week. It is also on a path of total deprecation. Support for the old publishers will end on September 30th and will be fully retired on January 18th, 2026. Plans will be changed prior to the last suspension date.

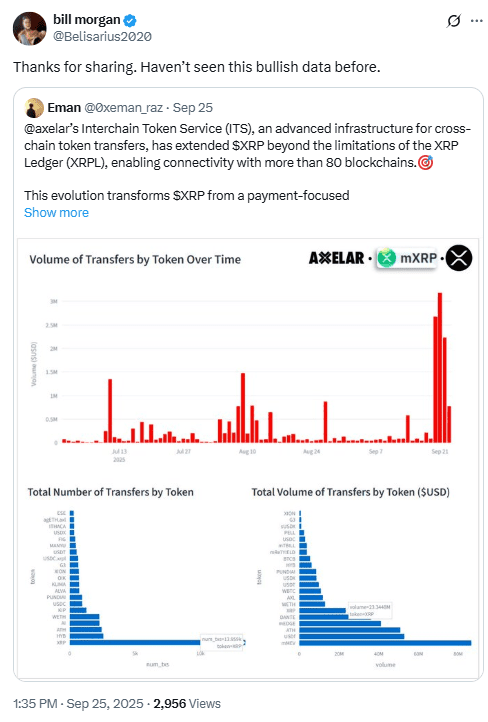

Cross-chain momentum: MXRP and Axelar transfer

Separately, Axelar and his partners have introduced MXRP. MXRP is an expression that carries the yield of XRP for the purpose of inter-gaze disturbances. Launch material and event posting will link MXRP to a simplified cross-chain movement and staking style strategy for XRP holders.

Additionally, today’s fresh trackers cite XRP as the most recent inter-gaze transfer of major Axelars, approximately $23.3 million, and nearly 14,000 transfers over the measurement period. It shows non-replacement utilities that grow outside of the base ledger.

As these routes expand, they complement the payment role of RLUSD. One handles redemptions like programmable caches, while the other moves XRP-transformed exposures throughout the chain. Together, it spreads the institutional and developer surface of XRPL.

Core software status before cutoff

XRPL’s reference server “Rippled” remains in version 2.5.1 after rollback from 2.6.0. 2.5.1 build fixes the consensus stall detection issue and is the recommended target before next week’s UNL switch.

The XRPLF repository release notes check the bug fix scope and September 2025 tags. Operators who paused the upgrade during the rollback window should complete the move now to minimize operational risk.

In short, keep the node at 2.5.1, update the UNL configuration, and check for the new publisher key. These steps change the default list so the services remain consistent.

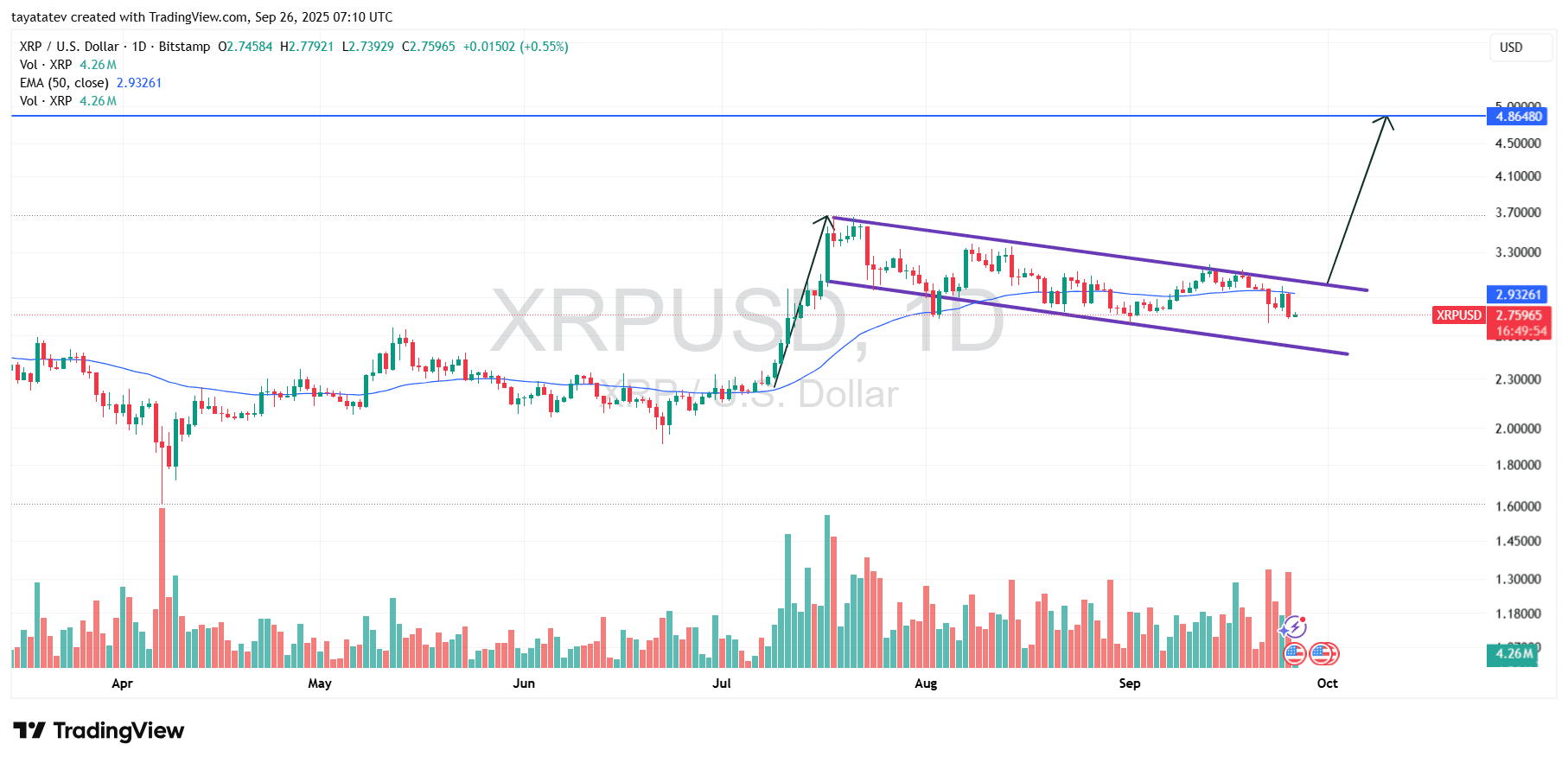

XRP will form a bullish flag on September 26th, 2025. A confirmed breakout means a 77% move to $4.88

The XRP/USDT Daily Chart was captured in the universal time ruled at 07:10 on September 26, 2025, with a clear bullish flag formed after the vertical progress of July. Bullish flags are short, downward integrated integrations followed by sharp rallies in near parallel trend lines, usually resolve higher in the direction of previous movement. When the price collapses and the flag’s cap rises above the flag’s cap and the volume rises, the pattern refers to continuation.

The setup continues with an tidy, falling channel that starts with an impulsive upward-flap-pole in July and stretches through August and September. The candle respects both the purple rails at the top and bottom on the chart. This indicates ordered integration rather than distribution. As trending participants re-enter, volume contracts will be reduced through pullbacks, which often precede breakout expansions.

At the time of the snapshot, XRP traded at nearly $2.76, just below the 50-day index moving average of just $2.93. As a result, the trigger is simple. Regain the 50-day average and punch the flag’s downward resistance near low $3.00 seconds. If that breakout is confirmed, the measured movement is listed as a 77% advance from the current price – to project the project to about $4.88, consistent with the overhead reference line plotted on the chart. Until then, the lower channel rails near $2.00 will serve as support within the integration, but the upper rails will remain at the level that beats for confirmation.

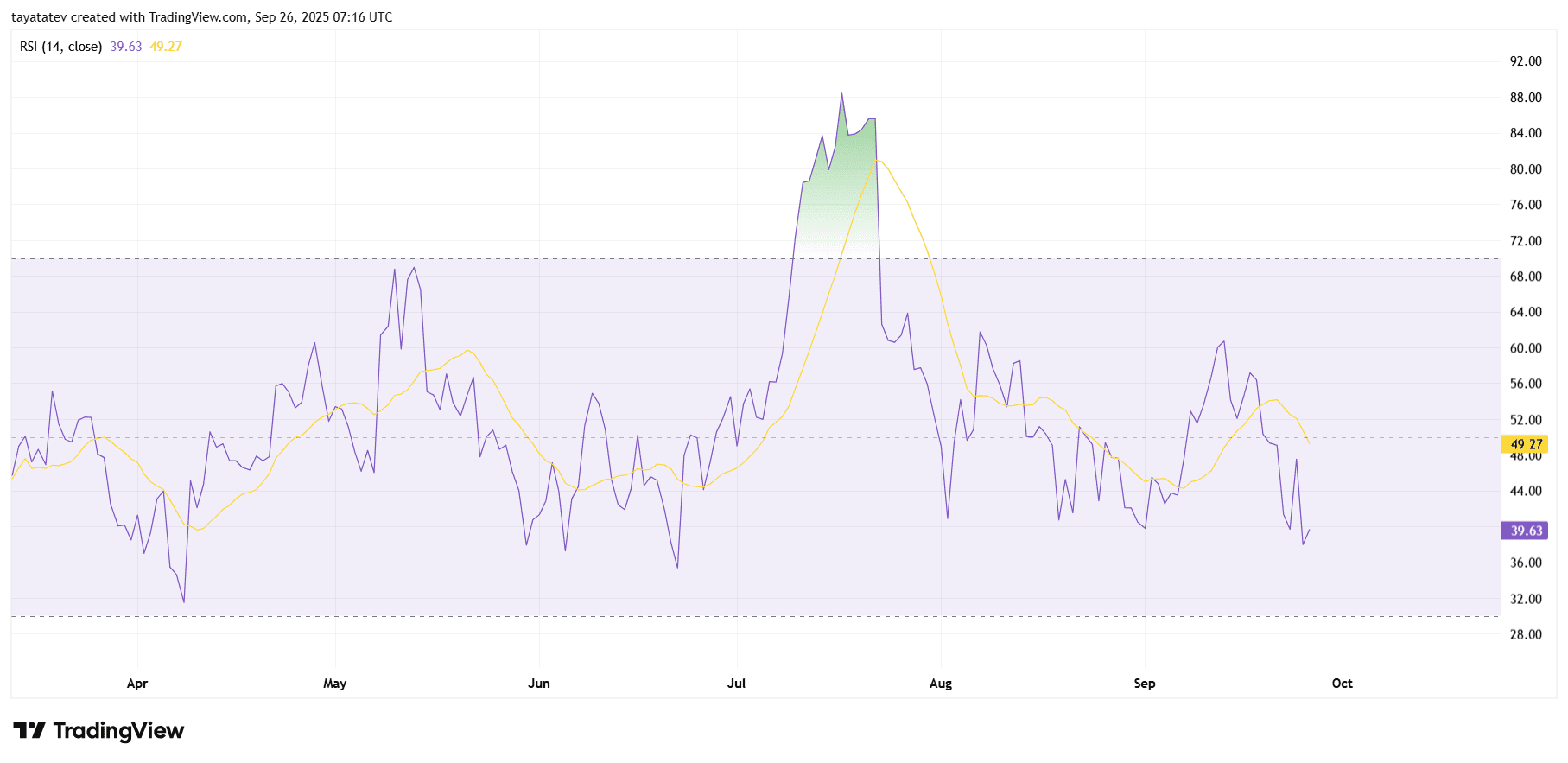

XRP Daily RSI refers to leaking momentum on September 26, 2025

The XRP’s 14-period relative strength index prints 39.63 under the neutral 50 lines, but the RSI moving average is high at 49.27. Therefore, momentum will tilt negative in the short term. The oscillator last went well above 70 in late July and skated until August and September.

Additionally, RSI is trading on its country’s average after an unsuccessful attempt to reclaim 50-55 bands earlier this month. This composition reflects control sellers and markets that have yet to regain trend strength. Upward attempts may not have follow-through until the RSI recovers above 50 and the RSI line returns above its average.

However, the indicators are held above the near 30 overselling threshold. This indicates cooling rather than yield. The base sequence starts with RSI stabilization in areas 40-45, then pushes back over 50 with an average rise. Conversely, the critical drop to 30 confirms the continued momentum on the negative side.