- Bitcoin is nearing $111,000 but is struggling to regain key support levels amid trader skepticism.

- While major exchanges such as Coinbase and Binance are showing bidding activity, the rally risks fading unless institutional investor participation strengthens.

- The massive exodus of Bitcoin whales suggests continued circulation, adding downward pressure on the price.

- Key technical indicators, including the 21-week exponential moving average, continue to be crucial in confirming trends.

- Analysts have highlighted the Fibonacci retracement level as a potential bottom indicator, and a monthly close below it could signal the end of the bull market.

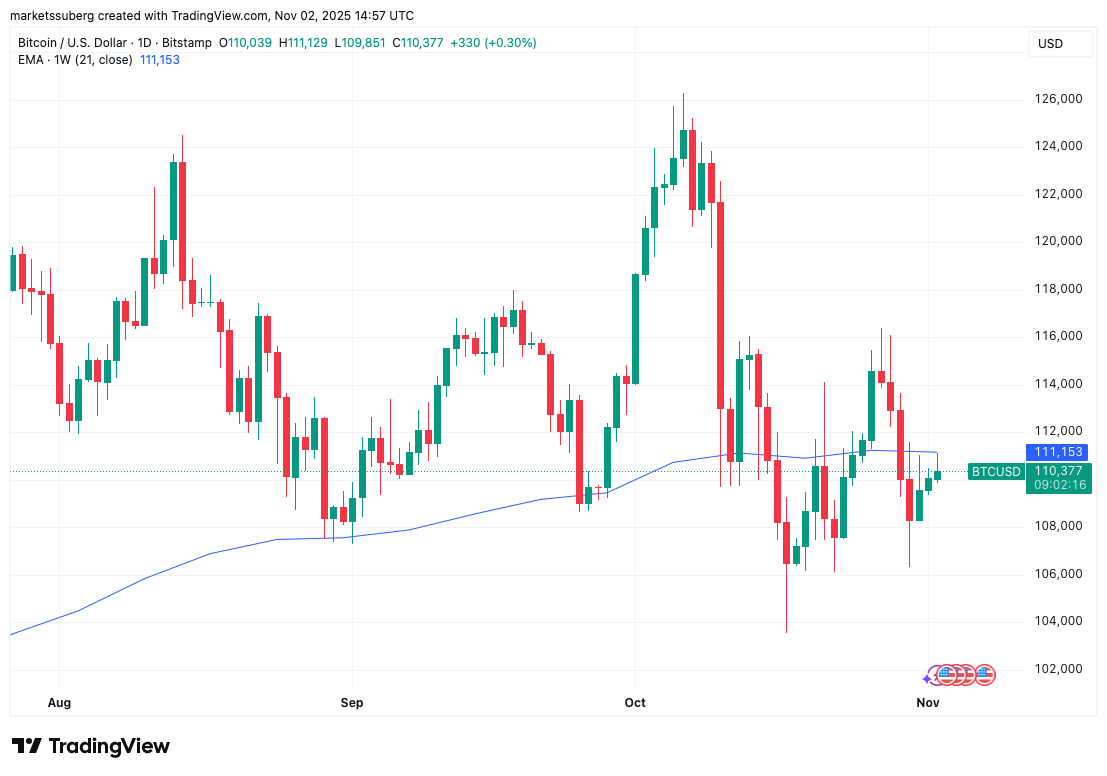

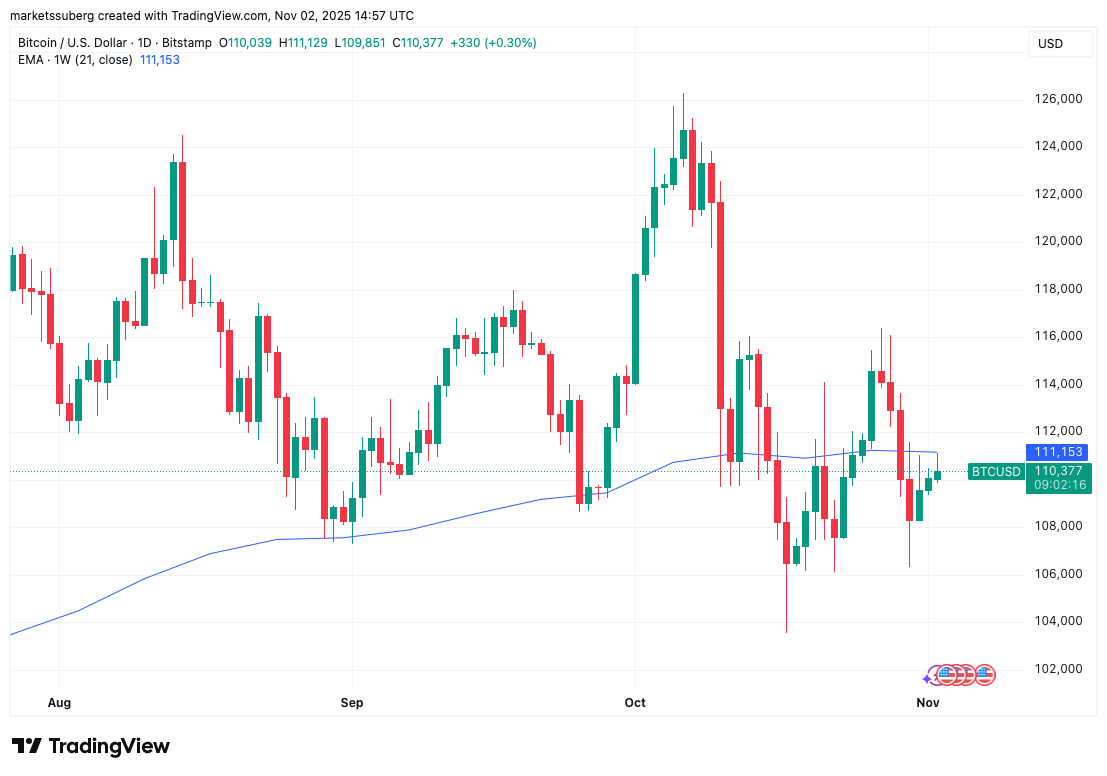

Bitcoin (BTC) surged late Sunday, approaching its weekly close, but has still failed to firmly regain a key support zone. The cryptocurrency’s price peaked at $111,129 on Bitstamp, setting a new high in November as buying interest increased on major exchanges.

Bitcoin traders are distrustful of “Sunday Pump”

Data from Cointelegraph Markets Pro and TradingView tracked price movements and revealed that Bitcoin’s local high of $111,129 was in line with the broader market range. Despite the temporary rally, participation remains cautious, with many traders skeptical about the sustainability of the move.

Cryptocurrency investor Ted Pillows noted that although Binance and Coinbase are seeing bidding activity, the trend remains fragile. “The U.S. deal in particular was characterized by sell-side pressure,” he said. He also warned that the weekend’s gains may not be sustainable once traditional financial markets reopen, stressing that a repeat of this pattern could end in disappointment.

Market analyst Exit Pump expects upside to be limited, predicting Sunday’s gains could cap out around $114,000. “If that happens, prices could easily reach 113,000 or 114,000 heading into Monday due to the nature of Sunday, but I’m not too confident in this outlook,” he said.

Additionally, on-chain analysis reveals that some large whales are actively distributing Bitcoin. Trader Bitbull highlighted whale wallets, which have seen a total of around $650 million in outflows since Bitcoin’s October peak, indicating a shift in sentiment and significant selling pressure as prices retreat from recent highs. Ongoing whale activity is raising concerns about downward momentum and the possibility of further correction.

BTC price support remains elusive

Looking at the technical level, analyst Recto Capital emphasizes that Bitcoin’s immediate challenge is to regain its 21-week exponential moving average (EMA), which is currently near $111,230. This level is important for confirming a possible uptrend reversal, as a break above this level could validate a post-breakout retest and a higher price target.

Pillows emphasized that the bulls need to reestablish support at $112,000 to sustain upward momentum. “Bitcoin needs to get back above $112,000 with heavy volume,” he said, adding that failing to do so could trigger an even bigger correction.

Meanwhile, trader Kass Abbe noted that Bitcoin’s recent price action closely aligns with the 38.2% Fibonacci retracement level, which has historically marked a market bottom since early 2023. “If Bitcoin closes the monthly candlestick below this level, the bull market could end,” he warned, suggesting that the recent support around $100,000 could be the last trough before a more sustained recovery, or a sign of a coming decline.

Investors remain cautious as markets approach crucial support and resistance levels. The coming days will determine whether Bitcoin can maintain its recent gains and continue its bullish trajectory, or whether a price correction marks the end of this short-lived rally.