Aster (Aster), a Binance-Linked-Linked Onentralized Exchange (DEX) token, has experienced a sharp decline following its recent peak, raising questions about the future outlook and the potential impact of unlocking key tokens. Despite recent turbulence, technical and fundamental indicators suggest possible rebounds in October, with key support levels and trading volume providing the basis for optimism. However, traders are cautious as market dynamics and token unlocking could affect its trajectory in the coming weeks.

-

Aster is currently supported between $1.60 and $1.80. This is a zone that has historically led to a significant rebound of 15-35%.

-

The token scheduled for October unlocks $325 million worth of Aster – about 11% of market capitalization – does not destabilize the market given daily trading volume and robust liquidity.

-

The technical pattern shows a potential bullish breakout if Aster violates $2, with target gains of up to 35% in the short term.

-

If the token falls below $1.60-$1.80, if the token decreases to $1.25, it could lead to a decrease to $1.25.

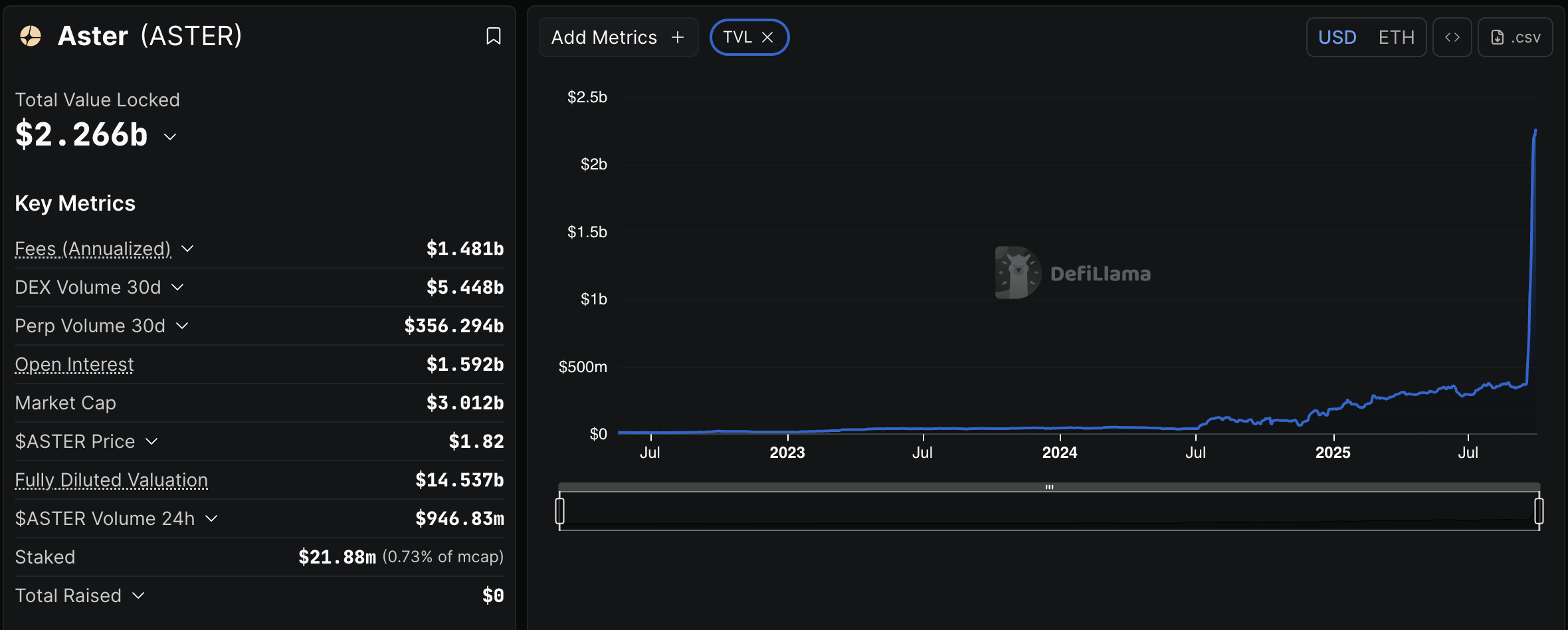

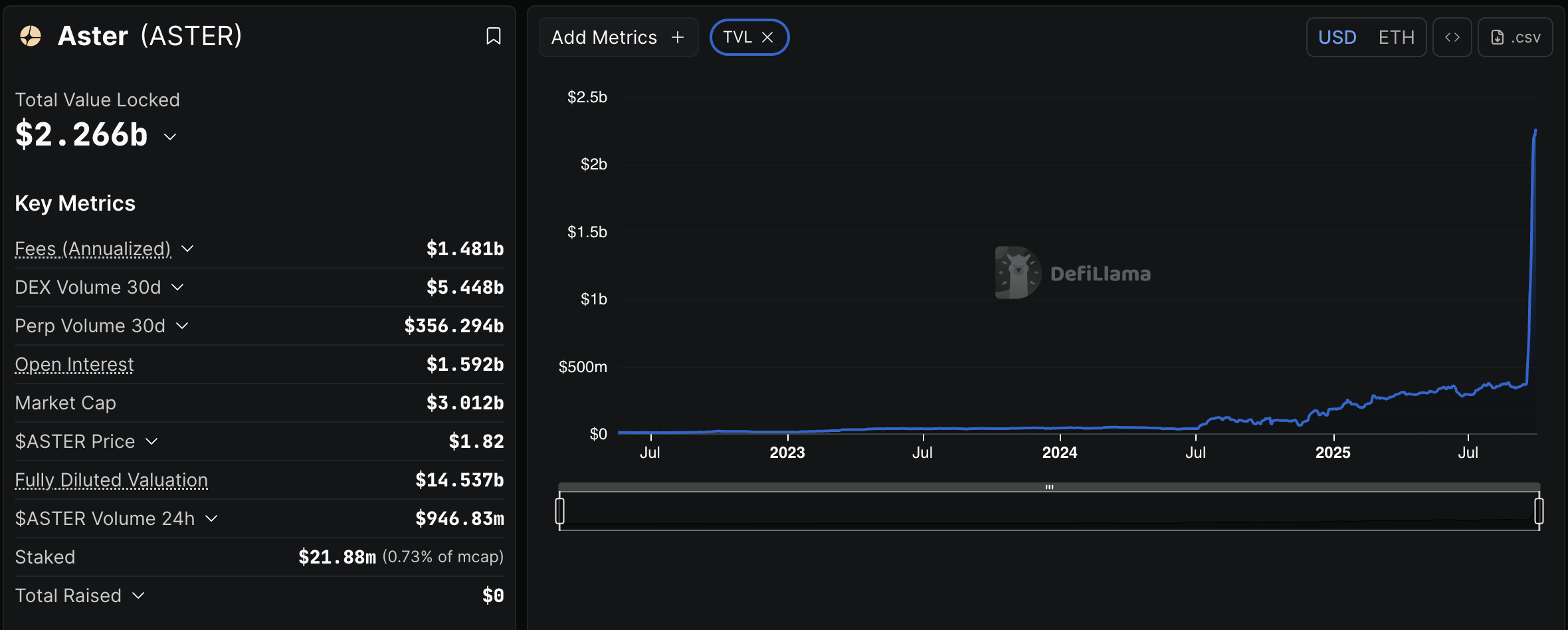

Aster (Aster) saw a price retreat from its recent high of around $2.43, falling to around $1.80 as of late September. The amendment will release 183.13 million Aster Tokens worth around $325 million amid growing concerns about the critical token unlock scheduled for October 17th. This is about 11% of the market capitalization. Nevertheless, Aster has a daily trading volume approaching $1 billion and holds a total lock (TVL) of over $2.26 billion, demonstrating strong liquidity that helps to absorb supply growth without causing a massive recession.

Support level indicates the possibility of rebound

According to technical analysis, Aster’s recent DIPs are located between $1.60 and $1.80 within the “Hot Support” zone, the range where analyst Michael Van de Poppe historically preceded a 15-35% rebound. Given this pattern, it seems likely that bounces over the next few days. Especially if the token is broken above the $2 level, it could propel you towards an all-time high of over $2.43.

Such bullish emotions coincide with Aster’s ongoing fall patterns. This is when technical indicators often signal a reversal of trends. A confirmed breakout could project measured movements between $2.22-$2.45 and present a 35% or more gathering in October.

Trader Bitcoin Harve predicts that if Aster bounces decisively out of the support zone, the token could reach $3 in October, labeling the $1.60-1.80 range as accumulation area.

Factors that could reverse bullish cases

The bullish outlook rests on Aster, which is maintained above the $1.60-$1.80 support zone. Below this level could decrease to $1.25, close to the previous support level observed in late September. This potential drop is supported by a pattern of descending triangles (characterized by lower highs and flat support lines). If the pattern confirms a failure, the measured movement projects the slide to $1.26, which matches the October Van de Poppe’s downside goal.

This scenario highlights the importance of the level of support. Violations could accelerate sharper declines and test significant lows in the $1.20-$1.30 range.

Future tokens will unlock and unlock market impact

The token unlock on October 17th represents an important event, with 183.3 million aster tokens being set to enter the cycle. Given the high existing trading volume and substantial liquidity, many believe that the market can handle this influx without major tumultuous changes. Some traders see unlock as an opportunity to buy dip, potentially driving rally to new highs.

Nevertheless, market skeptics point out that around $700 million worth of Aster is expected to unlock by the end of the year, so if traders’ trust wobbles, this could lead to increased sales pressure and a gradual downside move. Trader Gordon, who profited from Aster’s short circuit, warns that the token may continue to “bleed” as supply increases, and cautions are given prior to unlocking. The project is also considering that new token vesting schedules will mitigate downside risk.

While the environment refers to potential rebounds for technicals, it highlights that fundamental factors such as toconemics and upcoming unlocking events could sway market sentiment and price action in the near future.

This article does not constitute financial advice. Investors should conduct independent research and consider market risks when engaging in crypto trading and investment decisions.