Cryptocurrency markets have faced one of the most severe shocks in recent months. Bitcoin at one point fell below $100,000, and within hours, nearly $2 billion in market value was wiped out. The sudden fall spread fear in the community.

But according to financial analyst Shanaka Anslem Perera, this panic could be the final shake-out before Bitcoin begins a bull run, which she calls the $6 trillion endgame.

Reset instead of collapse

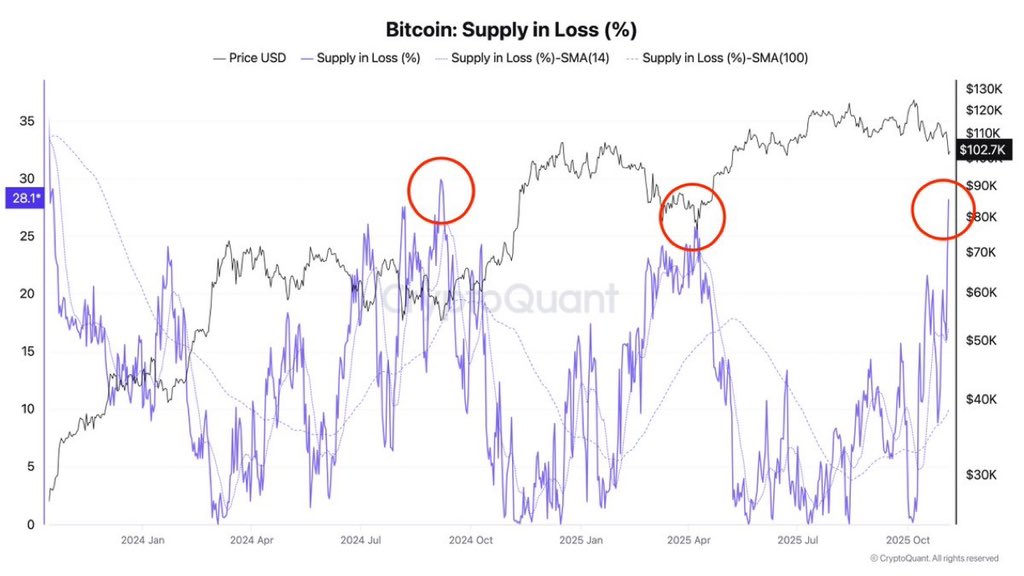

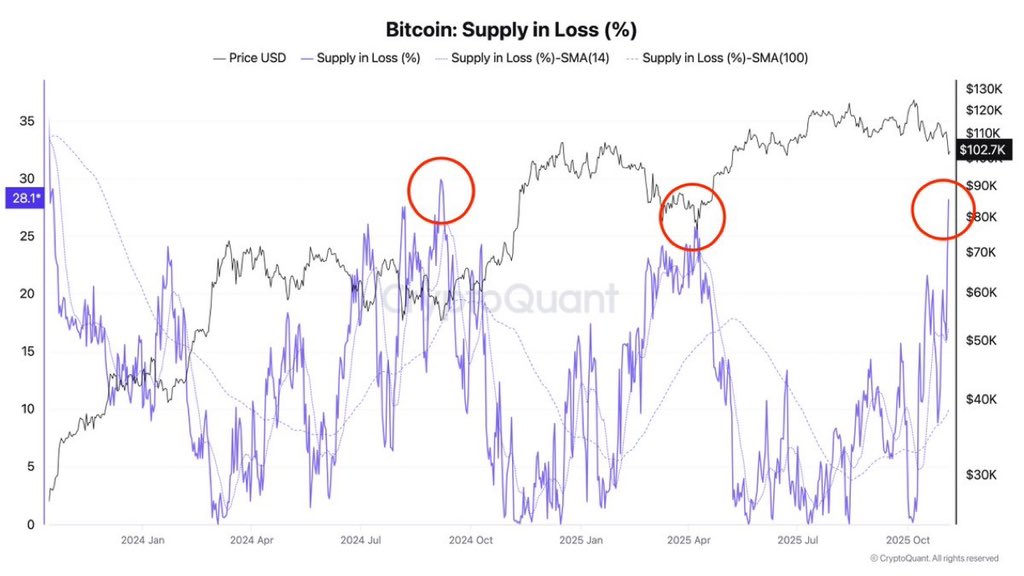

According to on-chain data, about 29% of Bitcoin’s supply is currently in losses, meaning these coins were purchased at a high price. While that may sound bearish, Perera explains that this is actually the same signal that appeared before every major Bitcoin rally in history, including 2017, 2021, and 2024.

Each time, Bitcoin rose between 150% and 400% within six months. This percentage represents what analysts call a “mid-cycle reset.” This is the point where new investors sell out of fear while long-term holders are quietly accumulating. It’s not a collapse, it’s a cleanup before the next leg goes up.

Additionally, the analyst explains that while more than 97% of wallets on some platforms are showing profits, that doesn’t tell the whole story.

Many of these wallets belong to early buyers who bought Bitcoin at much cheaper prices. This makes the numbers look higher than they actually are, but many new investors are actually losing money, a situation that often occurs before a big rally.

“The final stage of $6 trillion”

Perera suggests that the global financial system, which has more than $100 trillion of fiat currency (M2) in circulation, is gradually moving towards scarce hard assets like Bitcoin.

He calls this shift the “$6 trillion endgame,” because he believes trillions of dollars could eventually move from traditional markets, bonds, and cash reserves to Bitcoin and cryptocurrencies, creating a multitrillion-dollar market capitalization for Bitcoin alone.

market flash panic seller

Over $19 billion of leveraged positions were recently extinguished, resulting in a 42% drop in open interest. With funding interest rates almost zero, the overheated derivatives market has completely cooled down.

This is important because it eliminates “forced sellers” where liquidations often cause chain reactions. The current market is what Perera describes as “indestructible and stable,” giving Bitcoin a solid foundation for organic growth.

Whales and institutions are quietly buying

As retail traders panic, long-term holders currently control about 70% of Bitcoin’s circulating supply and show no signs of selling. Meanwhile, institutional investors have been quietly accumulating wealth through ETFs, with inflows exceeding $149 billion.

Even the supply of stablecoins, often considered “dry powder” for purchase, has expanded by $50 billion since July, all indicating strong liquidity waiting to be re-entered.

If this pattern plays out, Perera believes the next 180 days could be the start of Bitcoin’s next bull market.

Trust CoinPedia:

CoinPedia has been providing accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by an expert panel of analysts and journalists following strict editorial guidelines based on EEAT (Experience, Expertise, Authority, and Trustworthiness). All articles are fact-checked against trusted sources to ensure accuracy, transparency, and authenticity. Our review policy ensures unbiased evaluations when recommending exchanges, platforms, and tools. We strive to provide timely and up-to-date information on everything cryptocurrencies and blockchain, from startups to industry giants.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making any investment decisions. Neither the author nor the publication is responsible for your financial choices.

Sponsors and advertising:

Sponsored content and affiliate links may appear on our site. Ads are clearly marked and our editorial content is completely independent of our advertising partners.