Reports show that the XRP is trading at nearly $2.78 towards the end of the year, with the market going less than 100 days until 2026. The token slipped over 10% of last week.

Related readings

Traders and analysts are looking at the mix of on-chain signals and community chatter for clues as to whether XRP can push into a higher price tier before the calendar flips.

Community predicted targets

Social media has become the biggest forum for price calls. Since 2013 posted as Pumpius, many years of Bitcoin investors have been active, placing a $25 target on XRP before 2026. This is a move that means profits of more than nine times greater than current levels.

#xrp Up to $25 before 2026

– Pumpius (@pumpius) September 24, 2025

Other voices offer different ceilings. AlexCobb was floating at $22 by December.

A few commenters proposed numbers above $30, linking those hopes to potential ETF flows. The thread’s replies aim to be a small win first, with a bit of $4, from bullish cheers to reminders.

ETF interest and market flow

Based on the report, optimism about potential XRP ETFs is the core driver behind the bigger predictions. Executives such as CEOs of Canary Capital have suggested that ETFs can open the door to new influx of billions of dollars.

The paper brought new life to the bull incident and brought momentum to speculation about double-digit prices. Market behavior, on the other hand, is mixed. XRP had a strong period in January and was lost again in July, but then lost momentum, causing traders to hesitate to balance ETF optimism with subsequent weakness in price.

Trade behavior and on-chain signaling

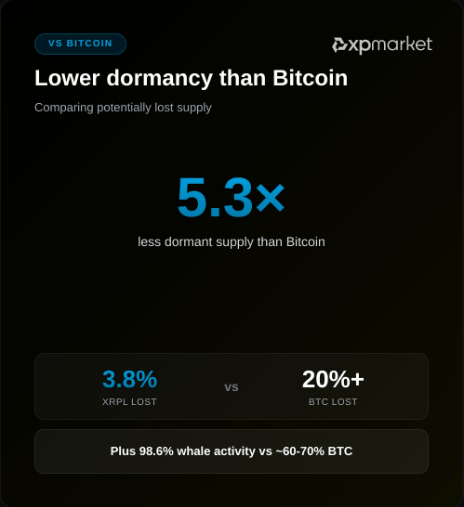

XRP shows that recent chain data is less dormant than Bitcoin and Ethereum. This indicates that XRP units change hands more frequently. This generally means active usage, such as payments, transfers, liquidity transactions.

Reports show that Bitcoin’s higher dormancy corresponds to a stronger “store of value” mentality, whereas Ethereum dormancy corresponds to developer and debt activity.

The active circulation of XRP fits the long-standing push of Ripple, primarily to make the token a bridge asset for payment, rather than a coin held for long-term profit.

Related readings

Dormant signals and meaning

As transaction usage continues to rise, it may help XRP build cases as utility-driven assets. However, even higher movements alone do not guarantee a price valuation.

The accumulation pattern is also important. Hoarding assets tend to build narratives of rarity that can support higher ratings.

Analysts and investors may check if it matches fresh purchasing pressure from institutional products before updating their long-term views.

Unsplash featured images, TradingView charts