Donald Trump is stepping up his attack on Federal Reserve Chairman Jerome Powell. And confusion can have a big impact on cryptography.

The US president has repeatedly expressed frustration at Powell’s refusal to cut interest rates, hoping that the economist will step down before his term expires in May 2026.

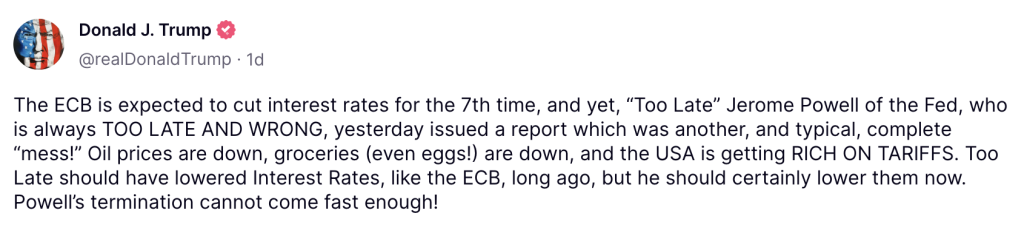

In a post on the True Society’s Fighting, Trump said, “Powell’s firing can’t come quickly enough!”

However, some of the people within the president’s inner circle, including Treasury Secretary Scott Bescent, have warned him that he will fire him because he could make the financial market even more unstable.

Standoffs are appearing. Trump suggests that Powell will leave his role if asked, but the Fed chief insisted that he is not.

At this point it’s worth watching why The White House does not have the authority to deny the head of the US central bank. The chair is fired only for causes – and the Fed is independent and intended to be free of political interference.

But it’s clear that Trump is determined to change all this. After he dismisses high-ranking officials in two independent institutions, the Supreme Court is looking into whether they should be resurrected. If the incident goes on to the president’s favor, it could theoretically allow him to insist on Fed control and show Powell the door.

Bescent is not the only one who is worried about how this will affect the US economy. Sen. Elizabeth Warren, a Trump critic and deep code skeptic, warned Wall Street would crash if the president had this power.

She told CNBC that giving the important economic lever to a “president who just wants to swing a magic wand” would make America “difficult to distinguish it from other two-bit dictatorships around the world.”

It’s fair to say that investors don’t end tariffs on major economies and that he’s already panicking after all that he doesn’t exist. The aggressive sale has resulted in a significant weakening of the dollar. This not only digs into the profits of foreign companies selling products in the US, but also makes imported goods even more expensive for domestic consumers.

The Fed last cut interest rates in December 2024, and Powell repeatedly said he hopes for compelling evidence of cooling inflation before doing so again. In comparison, the European Central Bank has already cut its main rate three times in 2025. This is the source of Trump’s complaints.

Despite all this uncertainty, some people argue that a dollar decline could be advantageous for medium to long-term Bitcoin. Raul Pal, founder of the Real Vision, has long believed that weaker greenbacks encourage investors to try to maintain their wealth through alternatives like BTC.

However, this has not been reflected in recent price actions. Until last year, Bitcoin often rose whenever the US dollar index fell. But despite DXY’s plunge 8.5% to date, its worst performance since 2005 – BTC is also nursing a loss of 9.5%.

If Trump succeeds in his desire to fire Powell, if the move sends the stock market to a free fall, Bitcoin is likely to tank too – stocks and cryptocurrencies have shown strong correlations recently.

Zoom out beyond recent BTC New York Times An article in opinion by the chairman of the Economic Security Project warned that US consumers should be extremely careful about Trump’s attacks on the Fed. He wrote:

“The US government will have significantly higher borrowing costs of $1,000 to date in the coming years. Households are also dependent on increased borrowing costs and increased inflation.”

Hughes went on to warn that even if Trump’s turn is over, consumer prices could go out of control. The dollar’s status is everything except its status as a global reserve currency.

At this stage, avid bitcoiner will argue that this is a good thing. They will point out that consumers in Latin American countries, destroyed by hyperinflation, have already switched to BTC to maintain their wealth. And they would argue that such a move could strengthen the Bitcoin narrative as a hedge against inflation.

But let’s clarify one thing. It is impossible to know exactly how Trump’s campaign against Jerome Powell will end. And that’s what it will have on the crypto market. In just three months’ space, traders are already in shock from the president’s refusal to buy new BTC for strategic preparation and the refusal to push worse than expected to tariffs on China.

There is no guarantee that this will be a pure positive for Bitcoin.

The post that Trump’s attack on Jerome Powell could mean for Crypto was first featured in Cryptonev.