Plasma (XPL) appeared as one of the most closely watched blockchain projects in 2025, attracting a lot of attention from both retail and institutional investors.

What is plasma?

plasma XPL A dedicated EVM compatible layer 1 blockchain designed specifically for Stablecoin payments. Its design goal is to allow users to move speeds quickly at zero charges for basic transfers with stable latency. The network is protected through variants of Byzantine Disorder Tolerant Consensus (Plasmab Feet) and derives legitimacy and stability from the support of major organizations in the crypto space.

At launch, Plasma claimed to have placed throughput above 1,000 transactions per second in the high performance class of blockchain systems, exceeding block times of less than one second. It is also supported by industry and financial names such as Tether/USDT, Bitfinex and Founders Fund.

Recently, plasma quickly became the focus of the market FOMO thanks to several notable signals. At launch, the network attracted more than $2 billion in Stablecoin liquidity, and within just two days, Plasma’s Stablecoin Supply exceeded $7 billion, reflecting an unprecedented capital inflow. Trading volumes skyrocketed over 300,000% in 24 hours, increasing prices by 50-85% within a day.

In just two days, Plasma’s Stablecoin Supply exceeded $7 billion.

The future is bright. pic.twitter.com/ud3dgs6e9i

– Plasma (@plasma) September 27, 2025

Only 1.8 billion XPLwas distributed at launch, creating a rarity that encouraged speculation. Large investors reportedly committed tens of millions of people with USDT during early sales, strengthening the story of strong whale interest. Binance quickly listed XPL, distributed 75 million tokens via Hodler Airdrop, and booked an additional 200 million tokens for future marketing campaigns. Together, these factors placed plasma as a target for prime “jewel hunting,” but also highlighted the hype-driven volatility and the risk of future token unlocking.

What does plasma solve?

First, fee friction: networks such as Ethereum and BNB chains require users to have a small amount of gas token in their wallets to pay for gas fees. In some cases, it can cause inconvenience to new users. Plasma addresses this issue via the Paymaster mechanism. This design allows basic USDT transfers to be performed directly to the end user at no charge, thus removing dependencies on keeping native tokens and making Stablecoin payments more efficient.

Second, latency and finality: many existing chains have a trade-off between throughput and finality (until irreversible confirmation). Plasma’s consensus (Plasmabft) is designed to allow for fast finality in seconds.

Third, user experience and onboarding: users new to Crypto don’t want to manage multiple tokens just to send Stablecoins. By allowing custom gas token support (users can pay for gas with stubcoin or other approved ERC-20S), plasma reduces cognitive overhead.

Source: Plasma

Fourth, Scaling Payment Flows: Stablecoin use cases (remittances, SALEs, micropayments) require high throughput and predictable cost structure. Plasma is optimized for large amounts of payments as well as general DEFI or NFT workloads.

Finally, Security Trust: To reassure financial institutions and stablecoin issuers, Plasma designs strong security measures, including anchors and strict consensus, reducing the risk of Reorg and censorship.

Therefore, plasma lies between the extreme range of special payment rails (visa, rapid) and the general purpose blockchain, providing a “product of money” layer 1 to the dollar-excluded digital value.

How does plasma work?

From an architectural perspective, plasma layers its protocol into multiple cooperative components: execution layer, consensus/sequence layer, and mechanisms of gas extraction, Paymaster logic, and bridging.

One of the outstanding features of the plasma is the Zero FEE USDT transfer. For simple transmit/receive USDT operations, the protocol’s built-in Paymaster covers gas. This means that the end users don’t have to own it. XPL Move stablecoins.

Another important feature is the support for custom gas tokens. Developers can register ERC-20 tokens (including Stablecoins) and gas fees for smart contract interactions can be paid with tokens rather than forcing users to retain the XPL of the gas. This increases ease of use and flexibility.

Plasma also provides EVM compatibility via Reth as the execution layer via Reth. Developers can deploy contracts using standard robustness with minimal changes.

Source: Plasma

In the consensus, Plasma employs Plasmabft, a variant of the HotStuff (fast HotSuff) consensus mechanism. Plasma parallels many of the pipeline: proposals, voting, process commitment, and more, so that blocks work well with high throughput.

Additionally, Plasma develops or plans to secure payments. A module that allows for the privacy of the amount or sender/recipient while maintaining compatibility with smart contracts. As of late 2025, this feature is under investigation, but has not been released completely.

This protocol supports Bitcoin Bridge/Reliable recent BTC usage, allowing Bitcoin to be used natively within smart contracts via wrap variants (PBTC). In fact, it combines Bitcoin’s security and ubiquitousness with programmable logic.

Plasma MainNet Beta is published with liquidity of over $200 million and is the eighth largest chain by Stablecoin Supply.

With plasma, the future is bright. pic.twitter.com/kpalwq1ajq

– Plasma (@plasma) September 23, 2025

At launch, the network began with over $2 billion in Stablecoin Deposits/TVL and quickly placed it on TVL’s top tier blockchain for the new network. Mainnet Beta was launched with multiple defi integrations (aave, ethena, fluid, euler) from day one.

And finally, institutional grade security and integration with Stablecoin publishers are embedded in the design. Plasma is sold not purely as a crypto-indigenous blockchain, but as a digital dollar infrastructure, and aims to bridge legacy finance on the on-chain rail.

Plasma’s logic of working combines fast consensus, gas abstraction, and Stablecoin-Native support into a unified system that treats USD-equivalent value as a first-class asset.

XPL Toconomics

XPL Token Metric

XPL The token is:

- Token name: Plasma

- Ticker: XPL

- Total supply (fixed): 10,000,000,000

- Circulating supply: Approximately 1,800,000,000 XPL (18%)

- Market Cap on Listing: Reported over $2.4 billion as XPL debuted on the exchange.

XPL Token Assignment

The XPL token allocation is configured as follows:

- Public Sale: 10% (1,000,000,000 XPL)

- Ecosystem and Growth: 40% (4,000,000,000 XPL)

- Team (and future service providers): 25% (2,500,000,000 XPL)

- Investors/Strategic Supporter: 25% (2,500,000,000 XPL)

XPL Assignment

XPL Token Vesting Schedule

The vesting schedule for the XPL token is as follows:

Public sales

- allocation: 10 billion xpl

- Unlock: 100% is given to TGE (10 billion XPL will be released soon)

team

- allocation: 250 Million Xpl

- Unlock: 0% on TGE

- Vesting: 24 months of cliff + linear release

Investors

- allocation: 250 Million Xpl

- Unlock: 0% on TGE

- Vesting: 24 months of cliff + linear release

Ecosystems and growth

- allocation: 40 billion xpl

- Unlock: 20% on TGE (0.0 billion XPL), the rest will be given over time

Token vesting schedule

XPL Token Utility

XPL tokens are at the heart of the plasma ecosystem. The utility is:

- Gas and trading fees

- Staking and Network Security

- Validator Rewards and Incentives

- Ecosystem growth and incentive funding

- Governance and Protocol Upgrades

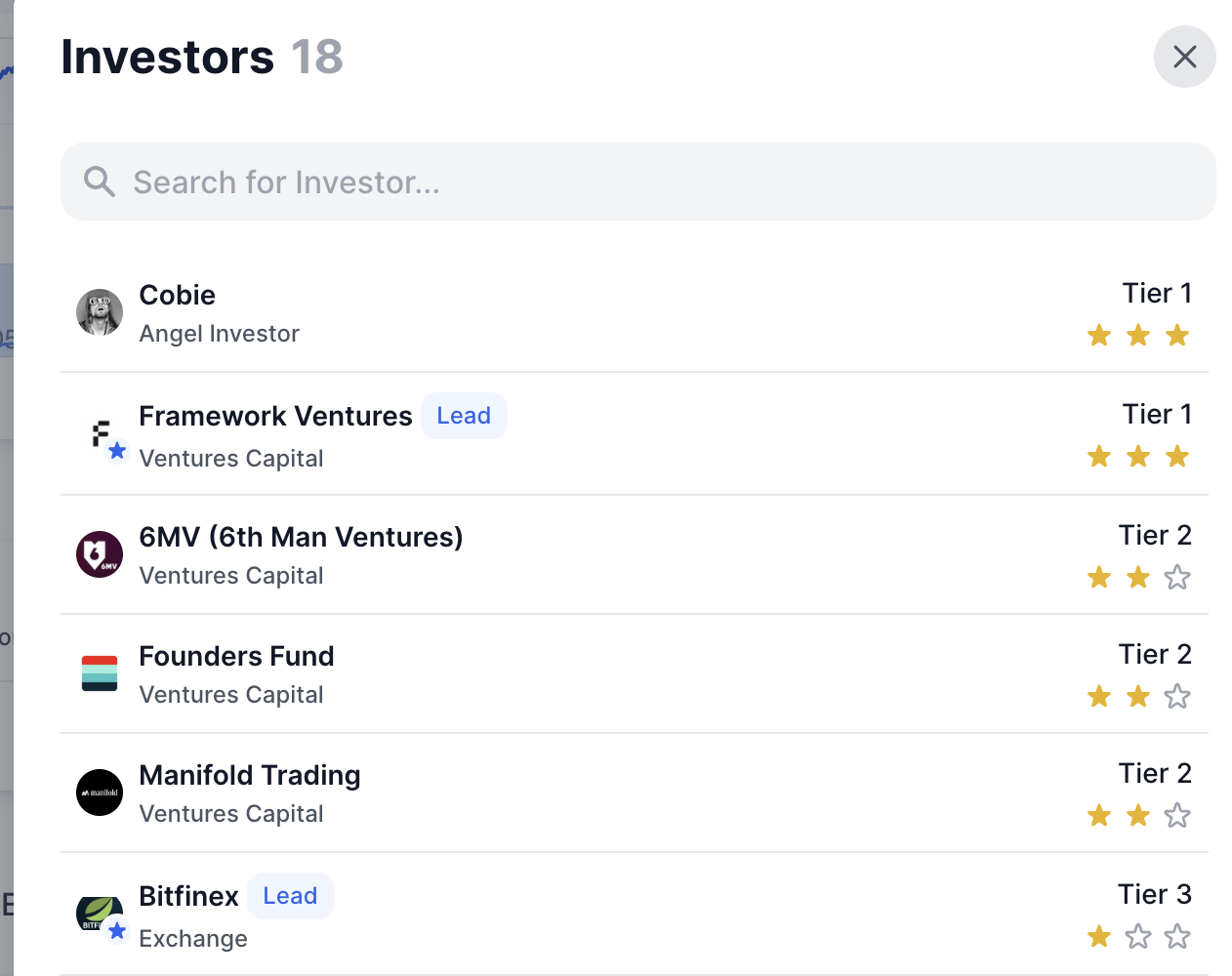

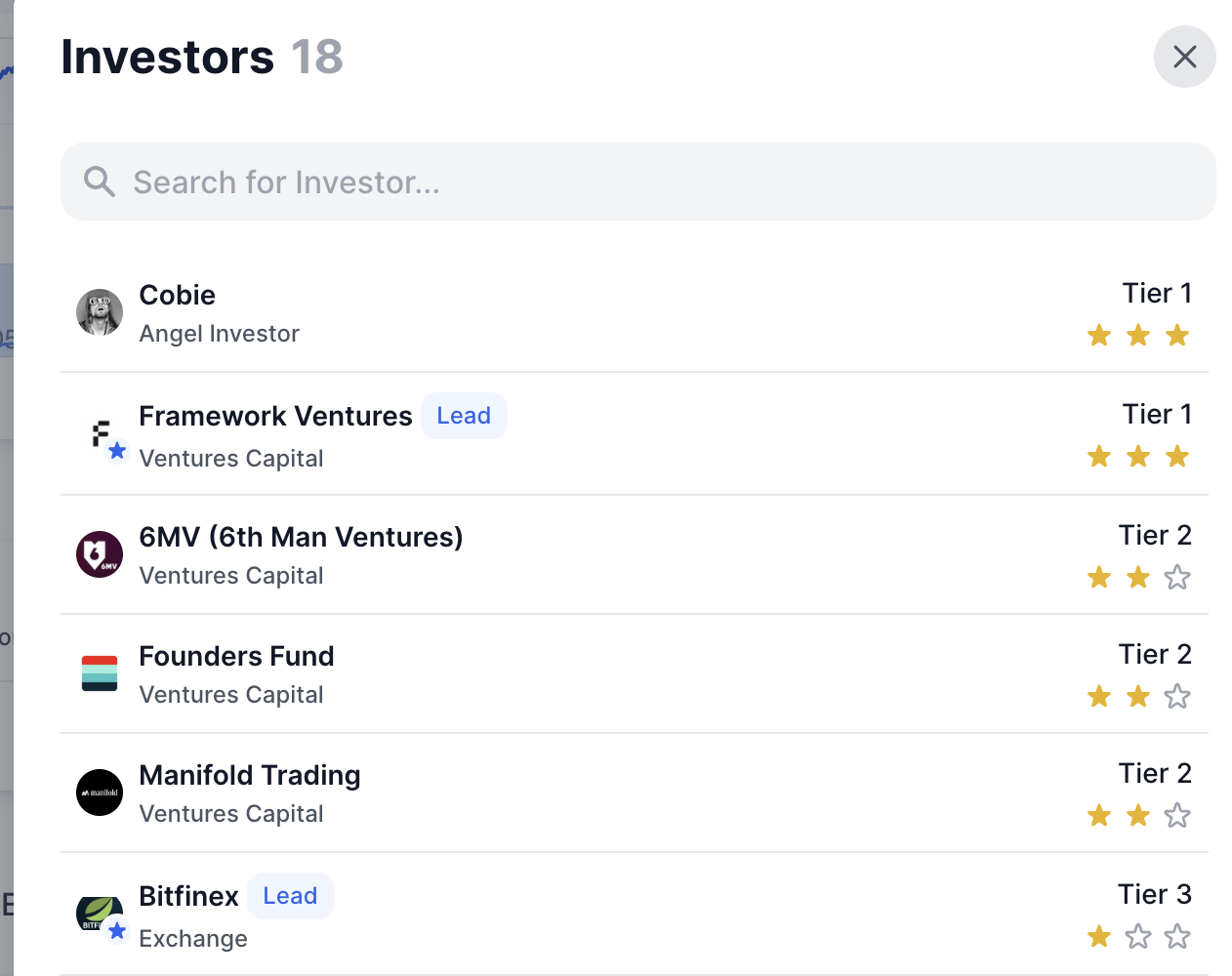

Plasma Investor

Plasma has gathered support from several well-known names in crypto and venture capital.

-

Cobby – Angel investor and recognized person in the crypto community.

-

Framework Venture (Led) – Tier 1 Crypto VC, early supporter of major Defi projects.

-

6MV (6 men’s venture) – Tier 2 VC focused on Web3 startups.

-

Founders Fund – A tier 2 venture capital company with a global presence.

-

Manifold trading – Tier 2 quantitative trading and venture companies.

-

Bitfinex (Led) – Closely linked to Tier 3 Exchange and Tether Ecosystem.

Plasma Investor

FAQ

What is plasma?

Plasma is a Layer 1 blockchain designed for payments for Stablecoin.

Do I need XPL to send USDT?

no. No gas is required for USDT transfer over the plasma. Only complex actions require gas.

How is the plasma protected?

Plasma uses plasma buff to protect your network. The consensus promotes fast finality and regular anchors in the chain to Bitcoin for additional guarantees.

How is plasma different from Tron or Stellar?

Plasma is built exclusively for Stablecoin Payments. It combines zero-fee forwarding, the option to use custom gas tokens, and full EVM compatibility. In contrast, Tron and Stellar are general purpose payment networks that do not have the flexibility of a complete smart contract.

What are the main utilities in XPL?

XPL is used as a gas for advanced transactions beyond staking, validator rewards, ecosystem funding, governance, and simple transfers.

Can I use XPL with defi?

yes. XPL tokens can be used as collateral.

What risks should be considered?

Like many other blockchain networks, if some top holders make up more than 51% of the network, risk involves valtter centralization. Moreover, they can also bear the sales pressure from unlocking the token. Protocols such as smart contract vulnerabilities.