Have a great Crypto portfolio and are looking for opportunities to cash out without selling digital assets? Then your answer lies in Lombard Finance. But what is Lombardfi? In this article, we will investigate Lombard Finance (Bard) and bring you all the answers.

What is Lombard Finance (Bird)?

Lombard Finance is a cryptocurrency platform aimed at improving Bitcoin utility by integrating BTC with Decentralized Finance (DEFI). Lombard intends to convert Bitcoin into a dynamic financial tool. This goes beyond being a dormant reservoir worth stagnant market capitalization. This protocol is attempting to achieve this using LBTC, a liquid Bitcoin token used for staking activities.

LBTC, which supports yields, allows Bitcoin holders to maintain liquidity even when betting crypto assets. The same will be possible through the partnership between Lombard and the Babylonian ecosystem. The Babylonian Ecosystem offers non-mandatory staking protocols. Users can receive an equivalent amount of LBTC by betting Bitcoin via Lombard. This can be traded and used on the Defi platform. Bitcoin holders can participate in debt activities such as lending and loans, and earn substantial rewards from the original Bitcoin.

Strong Points

- Bitcoin owners can earn passive income in a form of interest.

- LBTC unlocks the potential for Bitcoin defi, allowing LBTC users to take advantage of the bitcoin they have staked.

- This protocol extends Bitcoin utilities and use cases beyond the store of value and payment tools.

Cons

- New technologies can be challenging for users who are not tech-savvy or new to the encrypted field.

- There is a risk of smart contract vulnerabilities similar to other Defi applications.

- Rewards can fluctuate based on the volatile crypto market situation.

How does Lombard work?

Defi activity is related to Ethereum, but the lack of complexity and staking mechanisms has left Bitcoin utilities behind. Now, Lombard allows holders to wager Bitcoin by restructuring within the Babylonian protocol using a Proof of Stake (POS) system with new Bitcoin in place. Babylon allows BTC to protect L2 rollups and produce native staking yields.

When staking Bitcoin, users receive LBTC, a liquid asset with a yield supported 1:1 by Bitcoin deposit. LBTC is a cross-chain token that can be used in all defi platforms and activities, including trading, borrowing, lending and agriculture. A multiparty group of independent validators oversees staking, mint, burning and security checks. Non-legal security consortiums ensure decentralization, minimize trust and eliminate a single point of failure.

How does Lombard work with Babylon?

Lombard operates by issuing LBTC, a liquid stake token with a yield representing Bitcoin deposited on the Babylonian Staking Platform. LBTC holders will be able to earn yields on Bitcoin Holdings and participate in Defi activities while maintaining liquidity.

How it works

- Bitcoin holders deposit BTC in Babylon via the Lombard protocol.

- Lombard issues LBTC with yield.

- Investors can use LBTC to earn staking rewards from Babylon on holdings of BTC.

- Liquid LBTC acts as a collateral for the Defi protocol for activities such as Defi Loans.

- LBTC maintains a 1:1 value in BTC. This will keep the core values stable.

What is a bird token?

Lombard (Bard) is a utility and governance token for the Lombard Finance Bitcoin Defi protocol. Ethereum-based tokens are designed to embody the following values and utilities:

- Fluidity: Unlock Bitcoin potential via LBTC

- safety: Ensure the integrity of your LBTC bridge and platform through Bard Staking.

- community:Enable holders to participate in governance of protocols

In addition to the spirit of decentralization of Bitcoin, Bird also introduces BTC to the Defi industry with the aim of creating a sustainable, reliable, and collaborative ecosystem. Bard also ensures staking, unlocks liquid Bitcoin yields and bridge operations, positioning it as the core of the next generation of Bitcoin native defi.

Bard Toknomics

- Token name: Lombard token (bird)

- Total supply: 1,000,000,000 birds

- Maximum supply: 1,000,000,000 birds

- Circulating supply: 225,000,000 birds (22.50% of maximum supply)

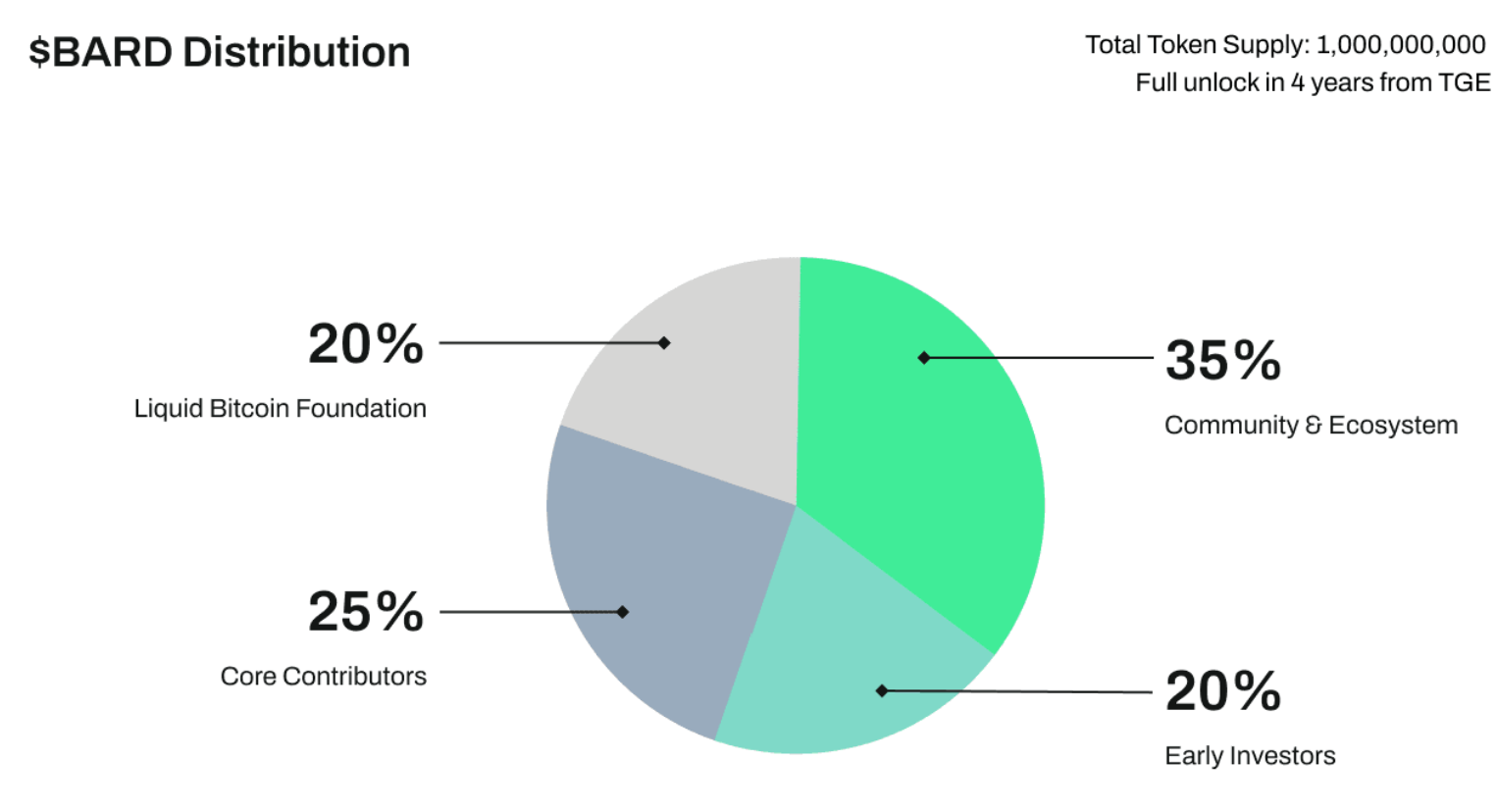

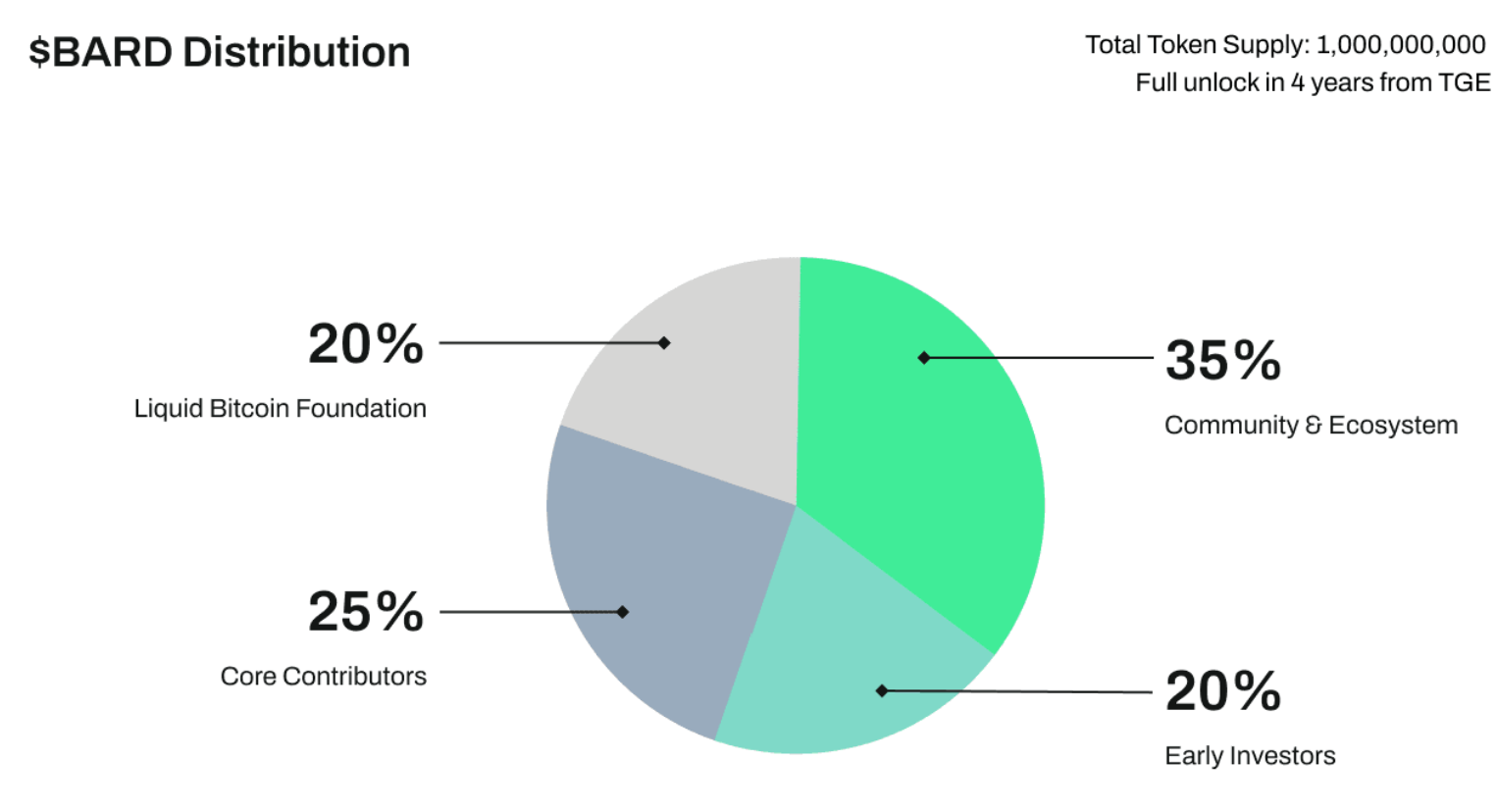

Token distribution

- Liquid Bitcoin Foundation: 20%

- Community and Ecosystem: 35%

- Core Contributors: 25%

- Initial Investor: 20%

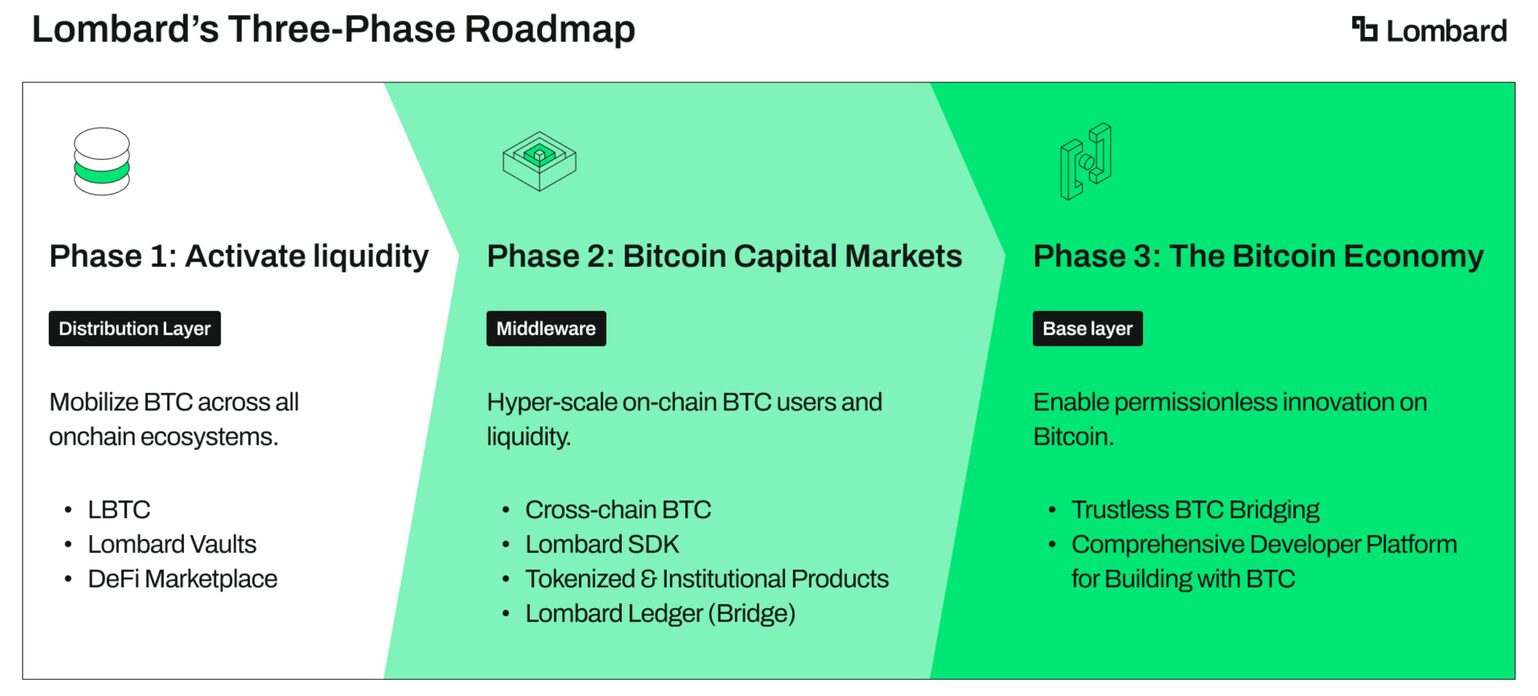

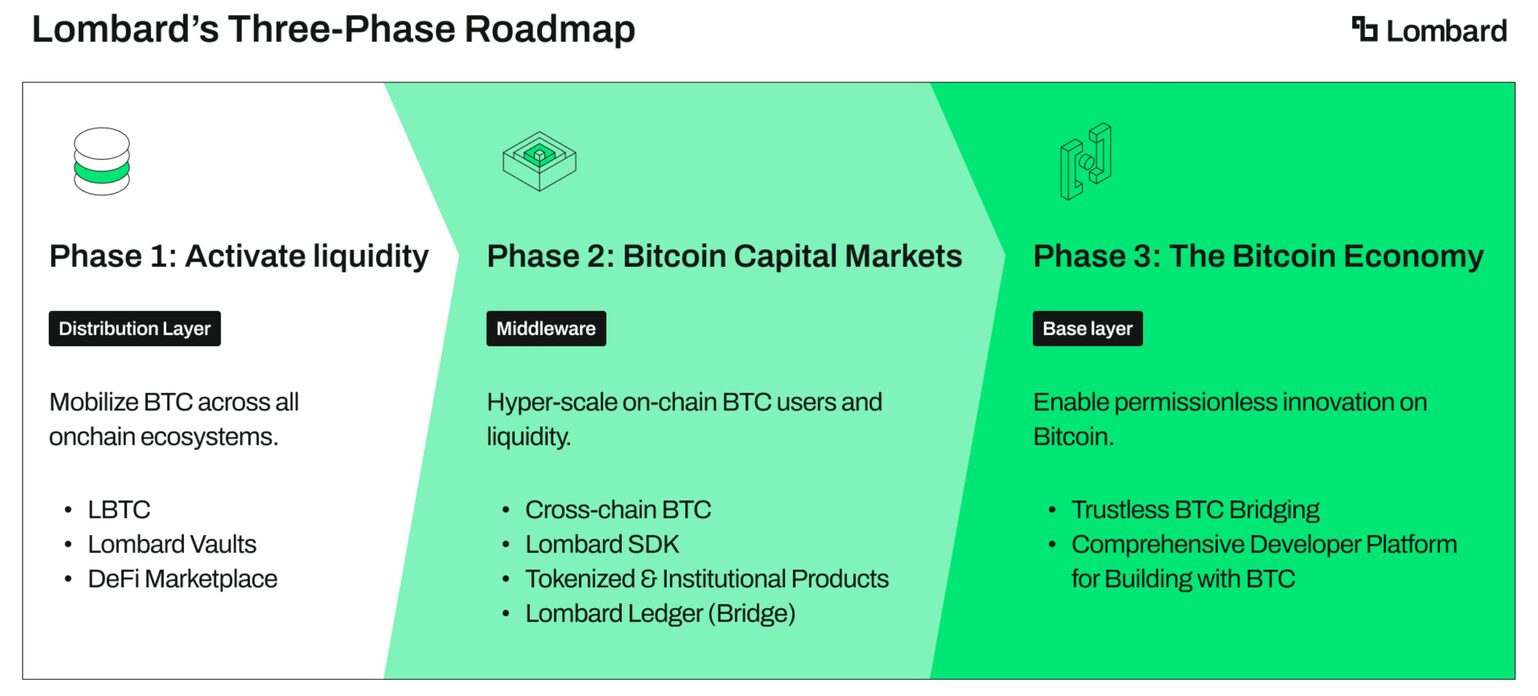

Lombard Technology: Core Products

1. Liquid Stake Bitcoin (LBTC)

LBTC is a major Lombard Finance product that users receive when they deposit their BTC. The LBTC acquires user yields from staking via the Babylonian protocol, but remains liquid. This means that holders can use it on various defi platforms.

2. DefiMarketplace

This is a dedicated market for a wide range of distributed finance (DEFI) services. This includes a variety of activities, from lending to trading, where participants can use LBTC to obtain additional yields and generate utilities.

3. Bitcoin Staking

Bitcoin staking in Lombard refers to a platform-based protocol that converts Bitcoin into liquid stake token LBTC. LBTC utilizes the Babylonian network to promote proof (POS) security and enable users to earn staking rewards.

4. LombardSDK

Software Development Kits allow users to integrate Bitcoin sediments and surrender to various chains, protocols, wallets, or exchanges.

5. defi vaults

Lombard’s Defi Vault refers to an automated yield management system that helps maximize Bitcoin ROI within the Defi ecosystem. Users can deposit tokenized Bitcoin like LBTC and WBTC to access a variety of Defi strategies without having to manually manage it. Defi Vaults simplifies the process by removing the technical complexity associated with related investments.

6. Cross-chain Bitcoin (coming soon)

Lombard is a pioneering system to protect cross-chain bitcoin transfers. This innovative creation protects users’ LBTC tokens during migration between different blockchains.

7. Lombard Ledger (coming soon)

Lombard Ledger is a Byzantine Fault Resistance (BFT) blockchain that records all your activities and provides transparency and verifiable records.

8. Structured and tokenized products (coming soon)

Lombard Finance plans to introduce a wide range of structured and tokenized products. According to the company’s roadmap, this includes options vaults, basic trading vaults, staking ETPs and ETFs, and financial management tools. Furthermore, their yield market consists of the options, arbitrage strategies and solutions of the Ministry of Corporate Treasury.

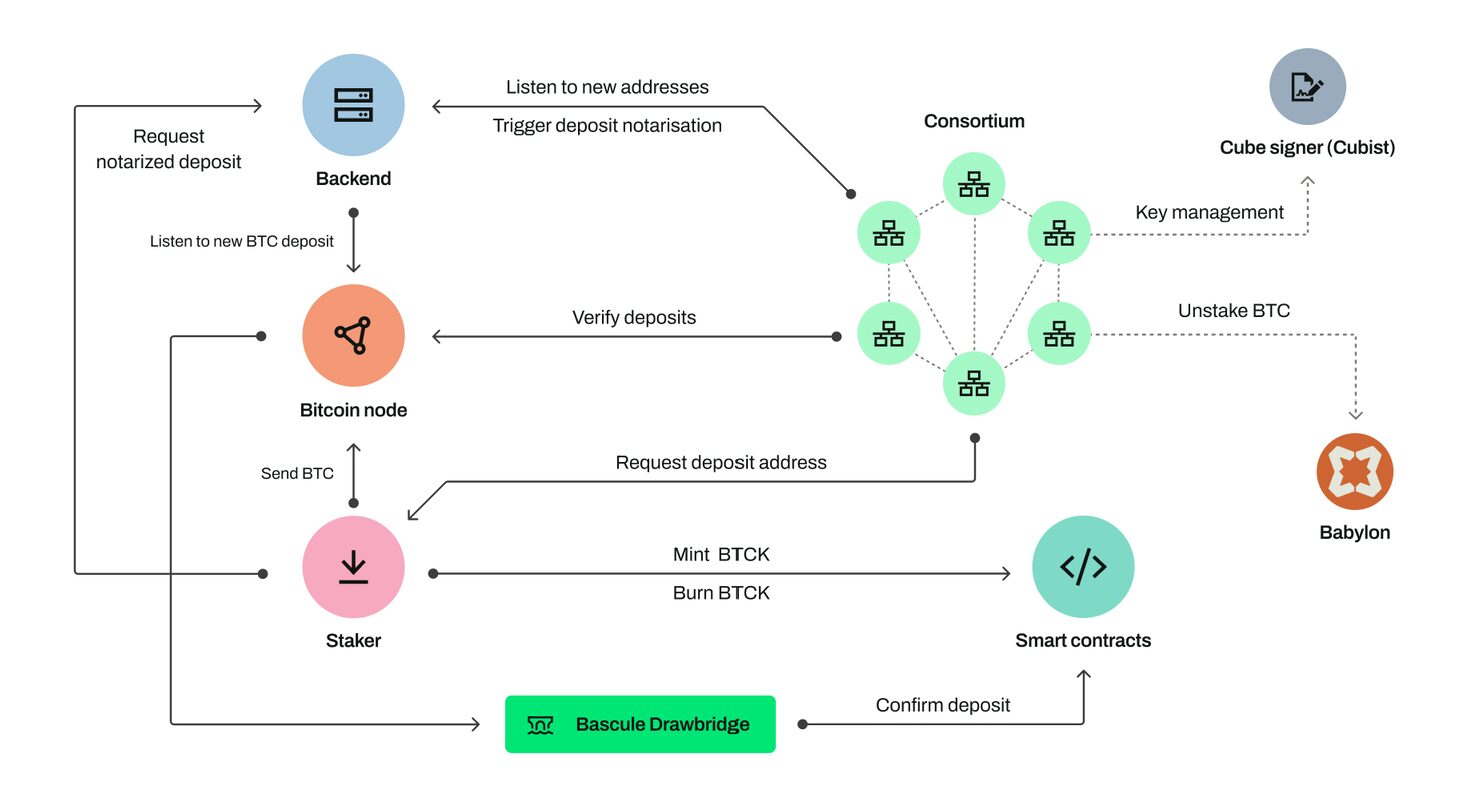

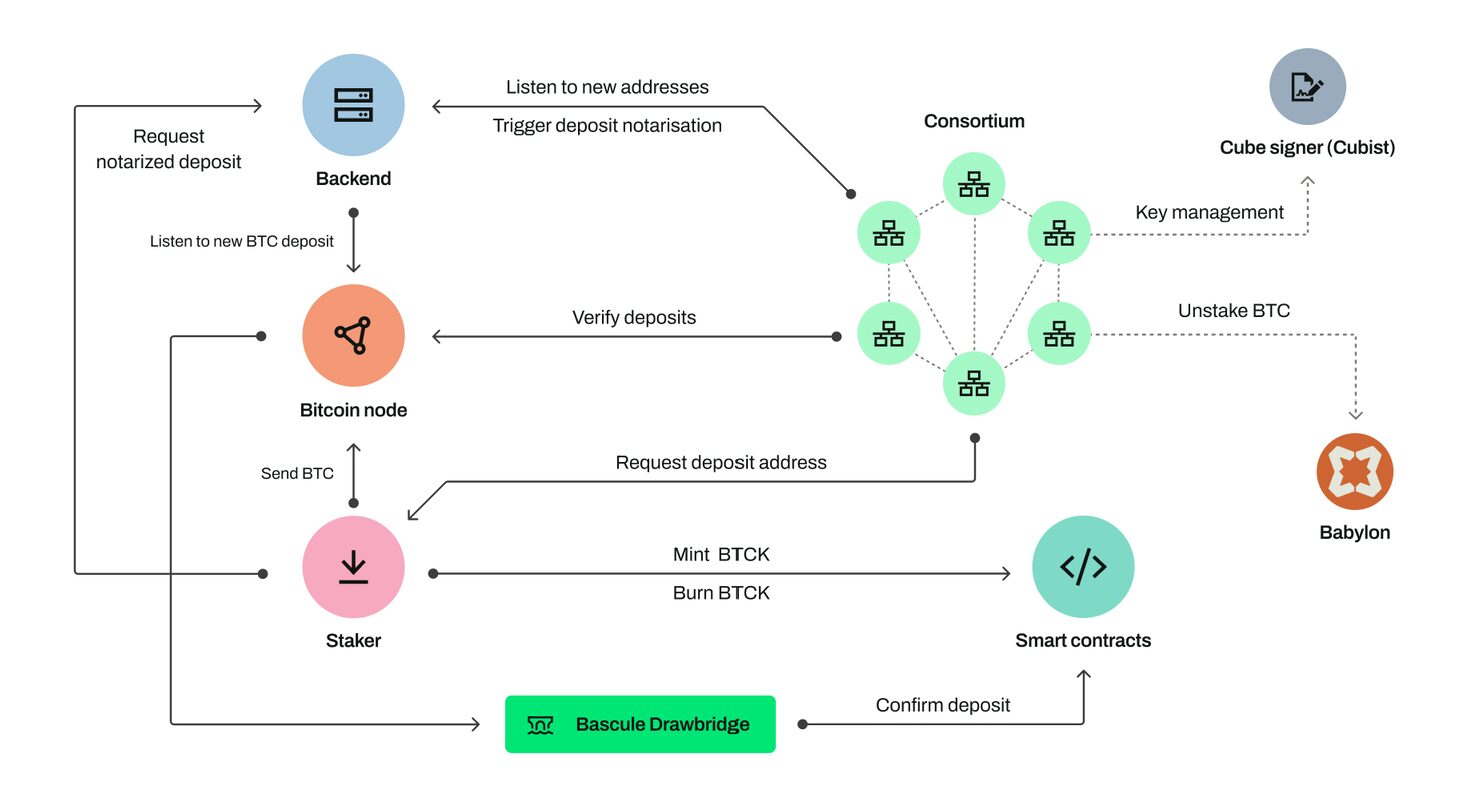

What is the protocol architecture for Lombard Crypto?

Lombard Crypto’s protocol architecture focuses on integrating Bitcoin and Defi Ecosystem. The platform uses multi-tier operation and security structures with the following core components:

- LBTC (Liquid Stake Bitcoin): Liquid staking tokens lock 1:1 to Bitcoin, allowing users to earn returns, participate in Defi applications, and maintain liquidity.

- Babylonian Protocol: Lombard’s Bitcoin Staking Program is promoted through Babylon to secure a Proof Demonstration (POS) blockchain, allowing users to earn staking yields

- Security Consortium: A group of 14 crypto-based institutions that validate and notarize transactions such as staking, staking, burning, building, bridge, and more.

What is Lombard Lux? How does it work?

Lombard Lux is a rewards system run by the Lombard Crypto project, designed to encourage users to use and promote LBTC. The program encourages users to bet on BTC and to keep LBTC as a way to contribute to the growth of the platform.

In addition to participating in other ecosystem projects, users can accumulate Lux tokens by staking BTC and receiving LBTC. Rewards are distributed every hour, and users earn more by holding LBTC for a long period of time. Additionally, within the Lombard ecosystem, which acts as a Lux Token multiplier, there are selected activities.

Lombard Lux acts as a metric that tracks the engagement and activity of users within the platform, but has no monetary value. It cannot be traded or transferred, but it acts as a digital representation of participation in the LBTC ecosystem.

The future of Lombard

Lombard Finance took the bold step of bringing Bitcoin to the Defi world and rewriting the rules of BTC staking. By leveraging a robust multi-party infrastructure and integrating LBTC through Babylon, BTC holders can now earn returns through Defi Composability and uncompromising security.

Through LBTC with bird tokens, Lombard successfully converted Bitcoin from passive assets to financial instruments. Lombard is now poised to drive the world’s flagship cryptocurrency into productive and safe assets with additional benefits.

FAQ

Who is the team behind Lombard?

The Lombard Finance founding team includes experts in Babylon, Polycaine, Coinbase, Maple and Argent. Among the key founding members are co-founders Jacob Phillips and Olivia Shett as directors of engineering. Others include Matthew Donovan as Head of Business Development and Charlotte Dodds as Head of Marketing.

Who will support Lombard?

Lombard is supported by 14 Crypto Asset institutions, including investors such as Binance Labs and PolyChain Capital. Others are major exchanges, cryptocurrencies, and debt protocols.

What are your major achievements since the launch of Lombard Finance?

Since its founding in 2024, Lombard Finance has achieved several important milestones.

- Within 92 days, it has been the fastest token in history to pay for the fastest yield in TVL.

- I successfully integrated defi activity with Bitcoin.

- Provided institutional grade security through a security consortium.

- It became the fastest growing protocol, with 80% of LBTC remaining active in Defi applications.

What is the role of the Security Consortium?

Lombard’s security consortium refers to a group of 14 digital asset institutions, which are the operational backbone of the protocol. Their role is to validate and approve transactions in protocols, such as Minting and Burning LBTC, and staking and non-staking Bitcoin.

How is LBTC different from Bitcoin?

Although LBTC differs from Bitcoin as it functions as a liquid staking derivative that Bitcoin earns yields, Bitcoin is a passive store of value.

What is LBTC?

LBTC is an innovative liquid staking token that allows Bitcoin holders to earn staking yields while maintaining liquidity. The token is backed by 1:1 in Bitcoin.

What are the risks associated with the use of LBTC?

Among the risks associated with the use of LBTC are market volatility, smart contract vulnerabilities, and potential losses in principal. Others are regulatory uncertainties surrounding defi space and potential fluidity fragmentation.

Can I withdraw BTC from Lombard?

Yes, you can withdraw Bitcoin from Lombard. This process involves redeeming the LBTC and redeeming the LBTC before retrieving the actual BTC. However, this process is long and requires network fees.