The US government signed its first closure in six years on Wednesday. This is a political position consistent with the rise in Bitcoin and gold as investors sought safe inventory assets.

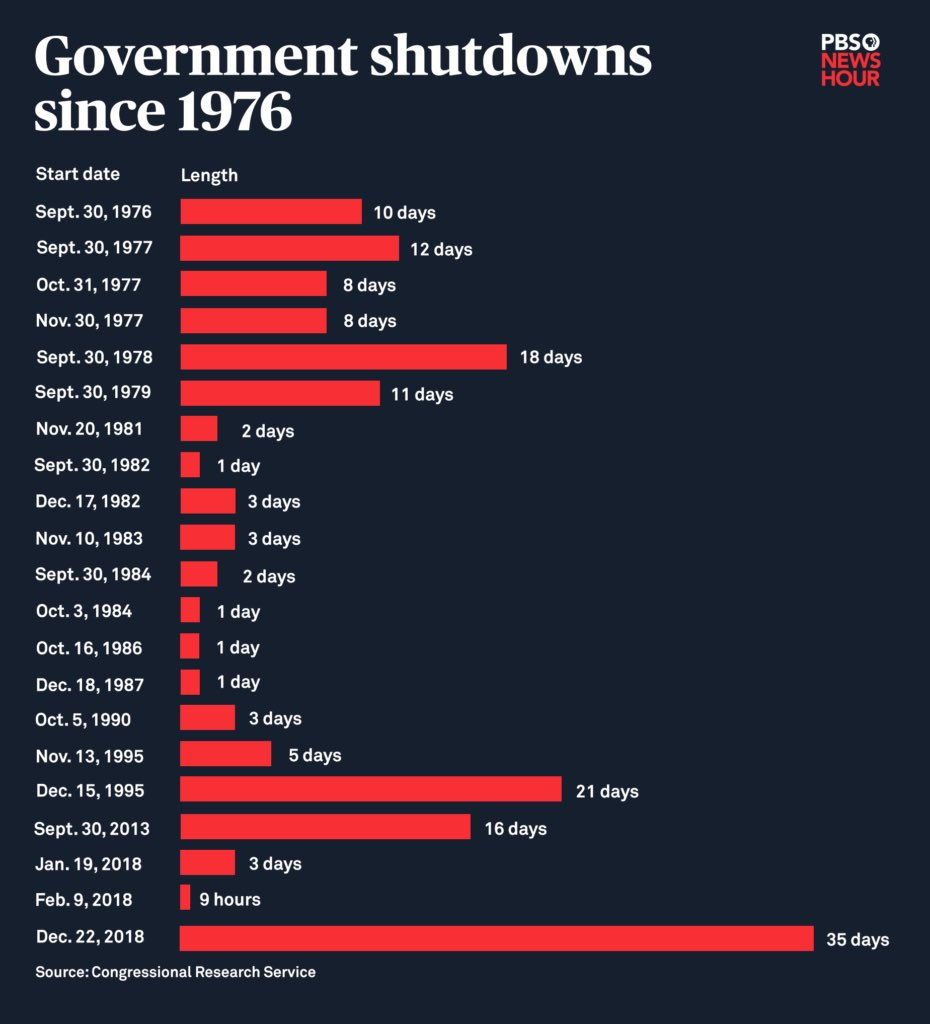

The US government has experienced its first closure since its 35-day closure in December 2018, due to the deep partisan sector that failed to pass the major funding bills needed in 2026.

The main disputes stem from temporary funding measures known as continuous solutions. Republicans have moved forward with the CR without any additional policy changes demanded by members of the Democrat. Leading by Senator Chuck Schumer, he called for a permanent extension of the Affordable Care Act tax credit.

Bitcoin (BTC) has risen 2.9% in the last 24 hours, trading at $116,427 at the time of writing, according to data from Cointelegraph. Gold prices also rose 0.7%, indicating that large investors’ demand for safe haven assets could increase due to the uncertainty surrounding the government’s closure period.

Related: The French central bank’s deficit is “great” for Bitcoin: Arthur Hayes

US government closures could signal Altcoin Bottom

According to Ryan Lee, chief analyst at Cryptocurrency Exchange Bitget, both Bitcoin and the S&P 500 could benefit from government shutdowns, which is likely to lead to a period of low US interest rates.

“Bitcoin will also benefit from this closure as government immunity and political uncertainty are attractive to traditional investors,” Lee told Cointelegraph. “While there’s a good chance the correction is in progress, it appears that the most promising altcoin on the market has bottomed out.”

Bitcoin, which regains its $116,000 level, is a positive sign for the broader crypto market heading towards the “historically positive month of October,” and could set the tone for the rest of the year, Lee said.

Related: Ether Supercycle Discussion, Circle Reversity Plan, Aster’s Surge: Financial Redefinition

Global equity and digital assets markets have previously shown mixed reactions to government closures.

Macro Investment Resources According to Milk Road Macro, stocks fell during the government shutdown in 2013, and Bitcoin rose again, and the 2019 shutdown saw both stock and Bitcoin valuations declined.

“Shutdowns always destroy government flows, but the market response is by no means uniform,” he wrote in X-Post Tuesday.

Following previous government shutdowns, the US Federal Reserve has become more stubborn in its approach to interest rate policies, resulting in an average annual increase of 13% for the S&P 500, according to a letter from trading resource Kobeissi.

“Historically, the market actually welcomes shutdowns,” he wrote in Wednesday’s X-Post.

In forecast market platform polymate, traders may have a 38% chance of ending by October 15th.

https://www.youtube.com/watch?v=-cpjxnan8s4

magazine: Stopping Trump’s top crypto jobs was not easy: Bo Hines