Uniswap (UNI) soared on Tuesday after Uniswap Labs founder Hayden Adams announced “UNIfication,” a comprehensive governance proposal that would enable protocol fees and direct them to a coordinated token burn. This structural change, coupled with the rapid changes in the way Uniswap is building its team, has led to extremely bullish sentiment, with CryptoQuant CEO Ki Young Ju claiming that a real supply shock could be coming.

Uniswap (UNI) supply shock coming?

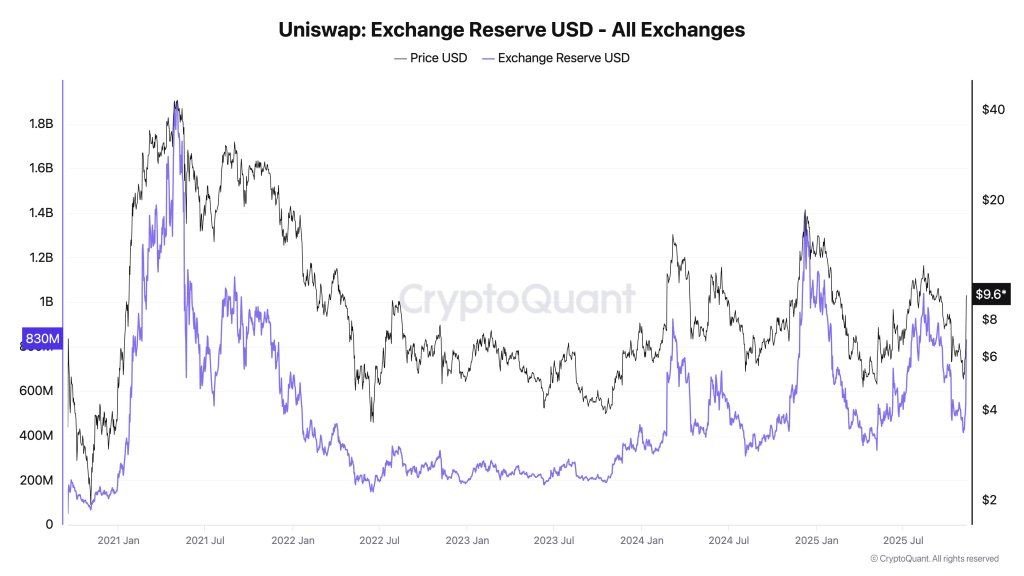

“Uniswap could go parabolic if the fee switch goes into effect. Just counting v2 and v3, the year-to-date trading volume is $1 trillion, and if the trading volume is maintained, it will burn about $500 million a year. The exchange has $830 million, so even with the unlock, a supply shock seems inevitable. Please correct me if I’m wrong,” Ki Yong-joo wrote.

In a thread posted early Tuesday, Adams said he was “very excited to be the first to make a proposal for Uniswap’s governance,” describing a framework that would “enable protocol fees and align incentives across the Uniswap ecosystem.” He described the move as the culmination of years of legal wrangling that have constrained Labs’ role. “UNI was launched in 2020, but for the past five years, Labs has been unable to meaningfully participate in Uniswap’s governance.” […] That ends today,” he wrote, adding that “the regulatory environment has changed.”

Related books

The on-chain economics he outlined are clear. Writing of the UNI is initiated using the protocol. Unichain sequencer revenue will go towards the same burn sink. And the Treasury will immediately destroy 100 million UNI to account for fees that “could have been incinerated had fees been on at the time of the token launch.”

Adams also discussed a new “Protocol Fee Discount Auction” to improve LP outcomes and internalize MEV, as well as v4’s “Aggregator Hook” architecture that allows protocols to capture fees from external liquidity.

In parallel, Uniswap Labs will cease charging fees for its interfaces, wallets, and APIs to facilitate distribution and adoption, while Uniswap Foundation staff will move to Labs under a growth mandate with funding from the Treasury Department. The final effect is integration. Uniswap’s development, growth, and pricing policies will operate under a single structure that is explicitly aligned to the token, while governance retains control.

Ki Yong-joo’s comments were reflected in the price action. As news spread, UNI soared to multi-week highs. At the start of European trading, UNI rose nearly 30% in a single day while many majors were stalling, highlighting UNI’s unique governance-driven rally.

Beyond the headline fireworks, what matters is whether the economic flywheel can be maintained without compromising the economics of liquidity providers. Historically, Uniswap’s governance has struggled with the trade-offs of “fee switch” designs and the risks of disintermediating LPs and pushing order flow elsewhere.

Related books

Adams argued that this blueprint is different because fee income is not distributed as passive yield and is discarded to concentrate value in the remaining float, while discount auctions and MEV internalization are aimed at keeping LPs competitive in net execution. The full rationale and parameterization (fee rates, split between pools, auction pacing, exactly how burn works) is provided in a governance post currently under Request for Comments, and implementation is subject to regular forum review and on-chain governance processes.

Positioning the proposal as an existential scaling step, Adams said, “I believe the Uniswap protocol can become the primary place where tokens are traded. This proposal sets the stage for the next decade of that growth.” […] Uniswap will be released relentlessly over the next few years, strengthening the ecosystem of developers, LPs, and traders,” he wrote.

BREAD, a member of MegaETH Labs, estimates that if Uniswap changes its standard trading fees by 0.3%, with 0.25% allocated to liquidity providers and 0.05% dedicated to UNI buybacks, the protocol could free up around $38 million in buybacks each month. This forecast is based on approximately $2.8 billion in annual fee income, meaning Uniswap’s repurchase capacity will be slightly ahead of PUMP’s pace of $35 million, but still below HYPE’s benchmark of $95 million.

At the time of writing, UNI’s price was $8.609.

Featured image created with DALL.E, chart on TradingView.com