Please join us telegram Channels where you can get the latest information on breaking news

Uniswap’s price has soared 28% in the past 24 hours and was trading at $8.42 as of 2:29 a.m. ET, with volume up 584% to $3.3 billion.

This comes after Uniswap Foundation and Uniswap Labs promoted UNIfication, a new proposal aimed at reshaping the structure and future direction of decentralized exchanges.

The governance proposal submitted by Uniswap founder Hayden Adams aims to enable protocol fees, introduce a UNI burning mechanism, and rebalance incentives across the ecosystem.

Today, I am very excited to make my first proposal to Uniswap Governance. @Uniswap in line @devinawalsh and @nkennethk

This proposal would enable protocol fees and align incentives across the Uniswap ecosystem.

Uniswap is my passion and sole focus… pic.twitter.com/Ee9bKDric5

— Hayden Adams 🦄 (@haydenzadams) November 10, 2025

The announcement boosted investor confidence and the UNI token soared to a two-month high. According to the proposal, fees will be applied to Uniswap v2 and major v3 pools on Ethereum at the launch of UNIfication.

For v2, liquidity providers (LPs) earn 0.25% per trade and 0.05% is allocated to the protocol. For v3, Governance collects either a quarter or a sixth of the liquidity provider fee based on the fee level.

The proposal calls for a retrospective burn of 100 million UNI (equivalent to $842 million at current prices) from the Uniswap treasury. This represents the amount that could have been spent if the fee had been active since the inception of the protocol.

Uniswap could go parabolic if the fee switch is activated.

Just counting v2 and v3, that’s $1 trillion in YTD volume, which equates to about $500 million in writes per year if the volume holds up.

With $830 million sitting on the exchange, a supply shock seems inevitable even if unlocked. Please correct me if I’m wrong. pic.twitter.com/3FQzAmuOP3

— Ki Young-ju (@ki_young_ju) November 11, 2025

The proposal brings permanence to the growth funding model, with a budget of 20 million UNI per year allocated from 2026 with strong governance.

If approved by the DAO, this proposal would set a new precedent for decentralized decision-making.

Could this proposal still drive up the price of UNI?

Uniswap price recovers and aims to rise above key resistance levels

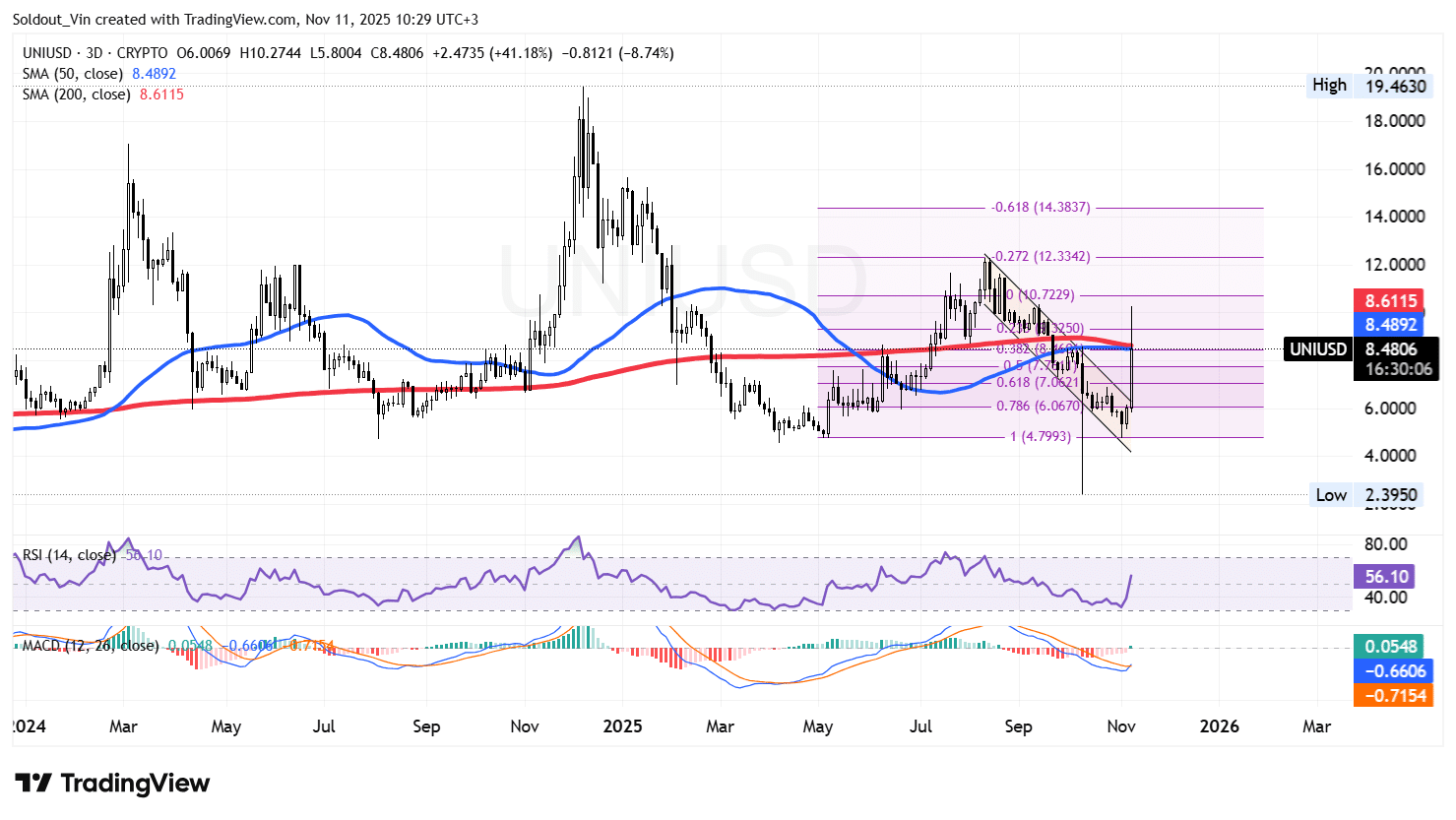

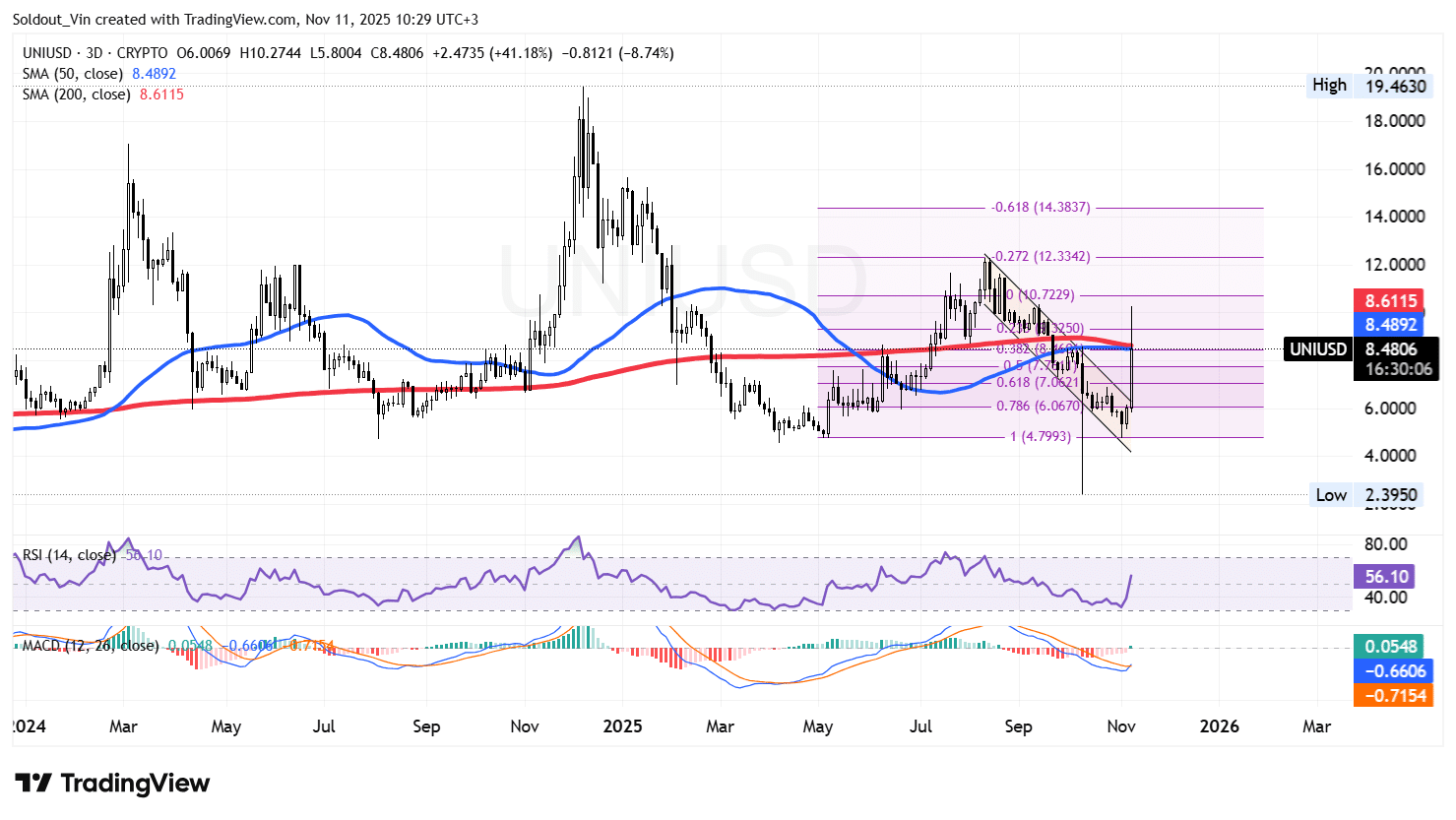

of uni priceAfter bottoming within the support at $4.79 in May, the price has continued to rise and cleared the key resistance level.

This surge, as indicated by the Fibonacci retracement level, allowed Uniswap price to reach a local high of $12.29.

After reaching this resistance, the UNI price went through a retracement and traded within a descending channel pattern as the bears took advantage of the death cross previously formed at the $8.28 level.

However, after reaching the $4.79 support again, the Uniswap token price recovered above the upper limit of the downward channel as a result of the governance proposal. The latest 3-day candlestick is rising above the main resistance at the Fibonacci retracement level.

As a result of the price increase, UNI rose above the 50-day and 200-day simple moving averages (SMAs) on the three-day time frame, solidifying the overall bullish outlook, but has since settled slightly below the price.

On the other hand, the 50-day SMA ($8.488) is approaching the 200-day SMA ($8.611), which could result in a golden cross. This could prompt the bulls to push the price higher.

The Relative Strength Index (RSI) is also supporting the bull market rally, with the RSI recovering below the oversold level and gaining momentum and now above the 50 midline level (currently 55.82).

Additionally, the Moving Average Convergence Divergence (MACD) has turned positive, with the blue MACD line crossing above the orange signal line but still below the zero line. This supports the upside while alerting traders to minimal bullish signals.

UNI Price Prediction: Bulls Eye $10+

According to UNI/USD chart analysis on 3-day time frame, all indicators including RSI and MACD line are pointing to a sustained bullish rise.

If the UNI price crosses the 0.382 Fibonacci level at $9.41, the next possible price is above the $10 level and the next important support levels are the 0.236 Fibonacci level at $10.52 and the 0 Fibonacci level at $12.29.

Conversely, if the current rally is short-lived and sellers start taking profits, Uniswap price could move back to the 0.618 Filib level at $7.66 or the 0.786 Filib level at $6.4 within the boundaries of the descending channel.

Related news:

Best Wallets – Diversify your crypto portfolio

- Easy-to-use, feature-oriented crypto wallet

- Get early access to upcoming token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now available on App Store and Google Play

- Stake and Earn Native Tokens $BEST

- 250,000+ monthly active users

Please join us telegram Channels where you can get the latest information on breaking news