US President Donald Trump’s latest promise of a tariff-funded “dividend” sent shockwaves through markets on Monday, with digital asset traders quick to shift prices to the prospect of extra cash in US pockets.

Related books

The plan, which would pay most adults at least $2,000, is said to be part of a broader push to use customs receipts as direct payments.

Tariff dividends cause market movements

The proposal is presented as a way to convert tariff revenue into direct payments to citizens, a move that proponents have linked to higher consumer spending and investors’ increased risk appetite, according to reports.

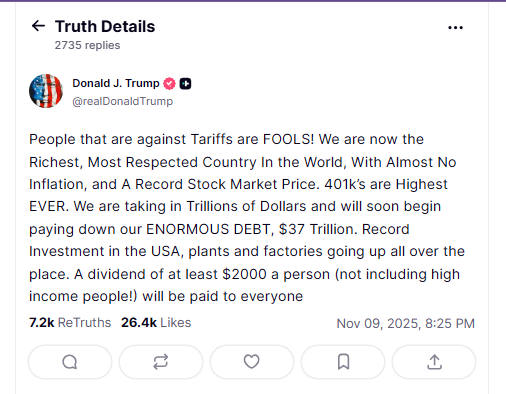

President Trump said the government can afford the new payments because the tariffs bring in huge revenues and factories across the country are attracting record levels of investment. He said the money would go to most Americans except high-income earners.

“People who oppose tariffs are idiots,” President Trump wrote in a post on Truth Social. “We have trillions of dollars flowing in, and we will soon begin repaying a massive $37 trillion in debt.”

President Trump also pointed to record highs in 401(k) savings and the stock market and said the tariffs helped the economy grow rather than slow it down.

The number publicly cited in support of the program is about $400 billion, but analysts and budget experts say the mathematical and legal path remains unclear.

Virtual currency prices rise

Cryptocurrency markets reacted within hours to news of the dividend. Bitcoin rose above $106,000 and Ether rose to the mid-$100,000s, reflecting a short-term spike in sentiment among traders hoping new liquidity could flow into risk assets.

These price movements followed a week in which some crypto indexes plummeted, so this announcement helped reverse some of that decline.

Market participants said the reaction was driven more by sentiment than confirmation of the funding mechanism. Some commentators compared the potential effects to past stimulus packages, noting that when households receive direct dividends, they often increase spending and, in some cases, send money to the market.

Still, regulators and budget experts question how the plan would work under current law and whether receiving fees would be a reliable source of regular payments.

Related books

Upgrading exchange activities

Traders on the exchange showed increased activity, with a small number of altcoins posting gains as momentum traders continued to jump in. Volume surged on some platforms as short-term buyers tried to take advantage of the momentum.

Observers warned that rallies associated with political announcements could be volatile and could wither away if policies stalled in Congress or faced legal challenges.

Legal and political issues are central. Treasury officials have suggested some of the payments could be met through tax changes already on the books, but court challenges over the scope of customs authority could make it difficult to roll them out quickly.

Featured image from Unsplash, chart from TradingView