As the crypto market prepares for what experts predict is a new dynamic altcoin cycle, industry leaders emphasize that established digital currencies with ETF potential are likely to attract the bulk of new institutional investment. Insights from CoinQuant CEO Maen Ftouni suggest that older cryptocurrencies such as XRP and Cardano are poised to benefit from their association with the upcoming ETF approval process. This forecast highlights how traditional financial institutions and institutional investors continue to shape the evolving landscape of blockchain investments, impacting both strategic capital flows and overall market dynamics.

- Market analysts predict that older ETF-related cryptocurrencies will attract large amounts of money in the next altcoin season.

- Institutional investors are likely to focus on “dinosaur” coins like XRP and Cardano given the ETF outlook.

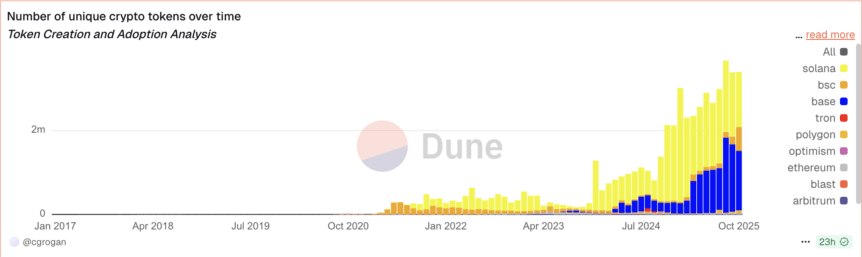

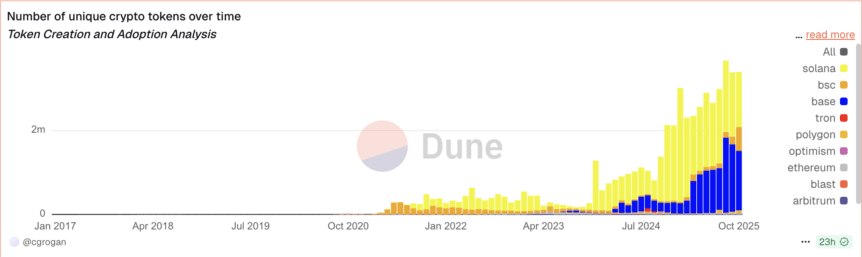

- The current cryptocurrency market is saturated with over 26 million tokens, raising concerns about demand and liquidity.

- Experts predict that the current cycle will see a short-term rally in altcoin prices, rather than a sustained one.

Older cryptocurrencies with pending or potential exchange-traded funds (ETFs) are expected to absorb much of the investment during the upcoming altcoin season, according to Mene Huthuni, CEO of algorithmic trading tool provider Coinquant. During a discussion at the Global Blockchain Congress 2025 in Dubai, Futuni explained that institutional investors tend to flow into established coins, also known as “dinosaur” cryptocurrencies, including XRP and Cardano.

“Right now capital flows are mainly coming from traditional finance and ETFs, so those investors are primarily focused on these major tokens, which may eventually gain approval for ETFs, which explains the recent rise of these dinosaurs,” Futuni noted.

“Right now most of the capital flow is coming from traditional finance and ETFs, so those people are probably looking at these major coins, all the established coins that might get ETFs. And this is why we’re seeing an increase in these dinosaurs.”

This sentiment is reflected in the ongoing debate among market analysts regarding the structure and future trajectory of the cryptocurrency market, especially in relation to altcoin season (a period characterized by rapid increases in altcoin prices). The current market environment is characterized by a glut of tokens, increasing concerns about the mismatch between liquidity and demand.

As of early 2025, the number of cryptocurrencies listed on CoinMarketCap exceeds 26 million, more than doubling since the beginning of the year. This proliferation has led some experts, such as economist and trader Alex Kruger, to warn that saturation is likely to hinder a sustained market recovery.

“When there are too many tokens, more tokens emerge, which means supply exceeds demand,” Krueger said. “It is unlikely that there will be an extended alternative season during this cycle.”

Krueger advised traders to temper their expectations, suggesting the market would see short-term price increases focused on specific tokens, rather than a long-term altcoin rally. These gains may last only a few weeks, reflecting changing market dynamics with only some assets seeing significant gains during this period.

Release date: The 2025 altcoin season is approaching…but the rules have changed