important notes

- The HSBC veteran brings institutional investment expertise as Tether manages more than $12 billion in gold reserves and positions itself as a major commodity player.

- Amid geopolitical uncertainty and the US government shutdown, gold prices have rebounded above $4,100, driving demand for tangible, on-chain safe-haven assets.

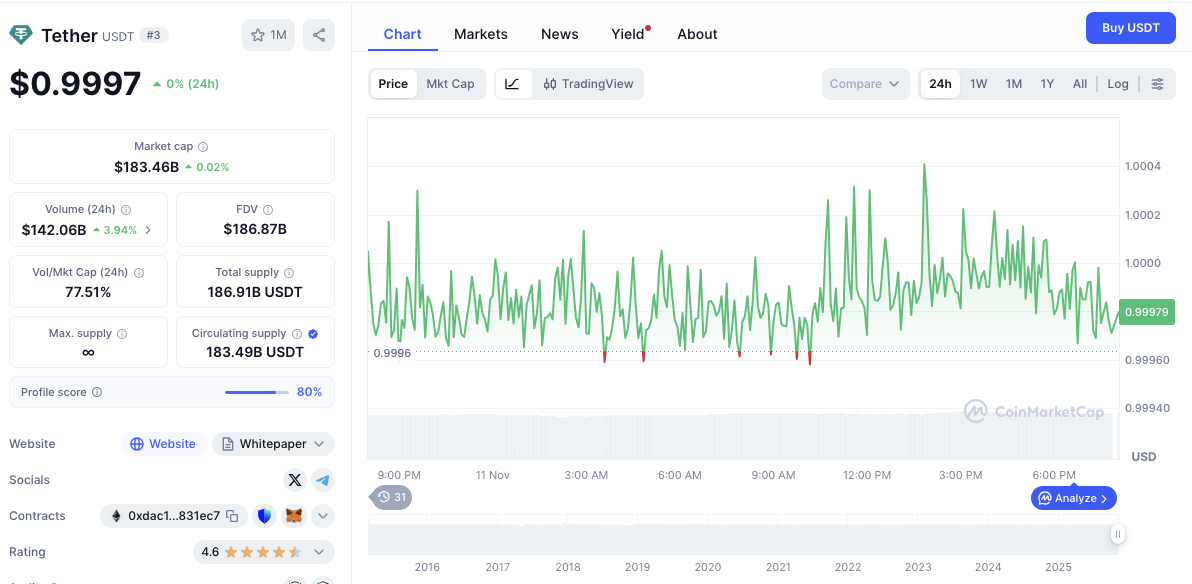

- Tether’s market capitalization exceeds $183 billion, with third-quarter growth of $17 billion and excess reserves of $6.5 billion under the new strategy.

Tether, the world’s largest stablecoin issuer, has hired a senior metals trader from HSBC to oversee the expansion of its gold reserves and precious metals trading operations.

This strategic adoption reflects Tether’s plans to diversify its balance sheet by increasing its exposure to physical assets, particularly gold, amid volatile macroeconomic conditions and sustained investor demand for tangible stores of value. Tether currently controls one of the largest private gold holdings in the financial sector. According to Bloomberg, there are gold reserves worth $12 billion as of September 2025.

Tether expands gold division with veteran HSBC trader

The new employees bring decades of experience in bullion trading, metals risk management and reserve allocation, demonstrating Tether’s ambition to become a major participant in the global precious metals market. The company plans to leverage this expertise to enhance liquidity, improve custodial efficiency and potentially offer new gold-backed financial products.

The move also comes during a historic rally for gold, with prices rebounding above $4,100 this week after retreating from an all-time high above $4,381 in October. Geopolitical uncertainty and the economic impact of the US government shutdown are accelerating demand for safe haven assets traded on-chain, such as gold, metals, and Treasury assets.

By leveraging HSBC’s institutional-level trading expertise, Tether is positioned to optimize reserve management of record revenues from stablecoin issuance and expand its influence in traditional commodity markets.

Vincent Domian, HSBC’s global head of metals trading, and Matthew O’Neill, former head of EMEA precious metals origination, are among the executives expected to join Tether’s metals division in the coming months, Kitco.com reported, citing anonymous sources.

Tether’s market cap exceeded $183 billion on November 11th | Source: Coinmarketcap

Tether’s USDT market capitalization is over $183 billion as of press time on November 11, according to data from Coinmarketcap. CEO Paolo Ardoino acknowledged that stablecoin supply increased by $17 billion in the third quarter, while the company’s excess reserves were $6.5 billion.

Next

Disclaimer: Coinspeaker is committed to providing fair and transparent reporting. This article is intended to provide accurate and timely information but should not be taken as financial or investment advice. Market conditions can change rapidly, so we recommend that you verify the information yourself and consult a professional before making any decisions based on this content.

Ibrahim Ajibade is an experienced research analyst with a background supporting various Web3 startups and financial institutions. He holds a Bachelor’s degree in Economics and is currently studying for a Master’s degree in Blockchain and Distributed Ledger Technology at the University of Malta.

Ibrahim Ajibade on LinkedIn