Crypto News

It was once considered a boring horn in cryptography.

They had no wild shaking of meme coins or any promise of explosive profit making headlines. But today, stubcoins are banks and big technology is circling around.

Swift, a global payment messaging giant that connects over 11K institutions, is currently testing payments using Ethereum’s Linea network.

The test includes BNP Paribas, BNY melons and dozens of other banks, with the centre having stable tokens.

It’s not just about sending messages between banks. It’s about moving real value through chains. It could turn out to be the biggest shift since the invention of credit cards.

Why Banks Are Concerned about Stubcoins

The reason for all the sudden attention is simple: cost and speed.

Swift wires can take several days and can cost up to $50. Stablecoins settle for a penny in seconds. According to chain melting data, $USDT is already above 1T per month, with USDC peaking at 3T$3T in October last year.

With a market size of $230 million, Stablecoins is no longer a side project. They are becoming part of the financial system.

Big Tech is interested in Apple, Airbnb, Uber and X, all with talks. Google Cloud already integrates PayPal’s $PYUSD.

Swift’s current trials use Ethereum’s Linea network chosen for ZK-Rollup technology, which maintains costs while maintaining security and privacy.

If Swift is successful in the Ethereum experiment, it doesn’t just make cross-border wire cheaper. It is possible that Stablecoins will mark the beginning of a new chapter where they will compete directly with legacy banking rails.

What the best wallet token ($best) brings to the table

Best Wallet Token ($Best) is more than a utility token connected to a Crypto app. It is designed as a key to unlock the entire ecosystem.

Holders will acquire substantial and tangible benefits. Reduce transaction fees, early access to upcoming projects, and reduce governance rights to the platform’s future.

So $Best is more than just a speculative play. This is a passport to the growing ecosystem where usage drives demand.

One of the most important utilities is access to upcoming Tokens, a pre-sale tool that allows investors to purchase new crypto projects directly within the app. This feature eliminates the risk of fraudulent mirror sites and fake launches that often target pre-sale buyers.

By combining that functionality with $$, the project creates a natural cycle that will become central to how tokens, one of the pre-sale, one of the pre-sale, one of the most active segments on the market, enter safely.

The wallet infrastructure backed by Fireblocks MPC-CMP technology itself guarantees bank-grade security, but it is tokens that exchange experiences.

With over 70,000 social media followers and a self-proclaimed monthly user growth rate of 50%, adoption is already accelerated, providing the perfect foundation for long-term traction.

Why buy $BEST now?

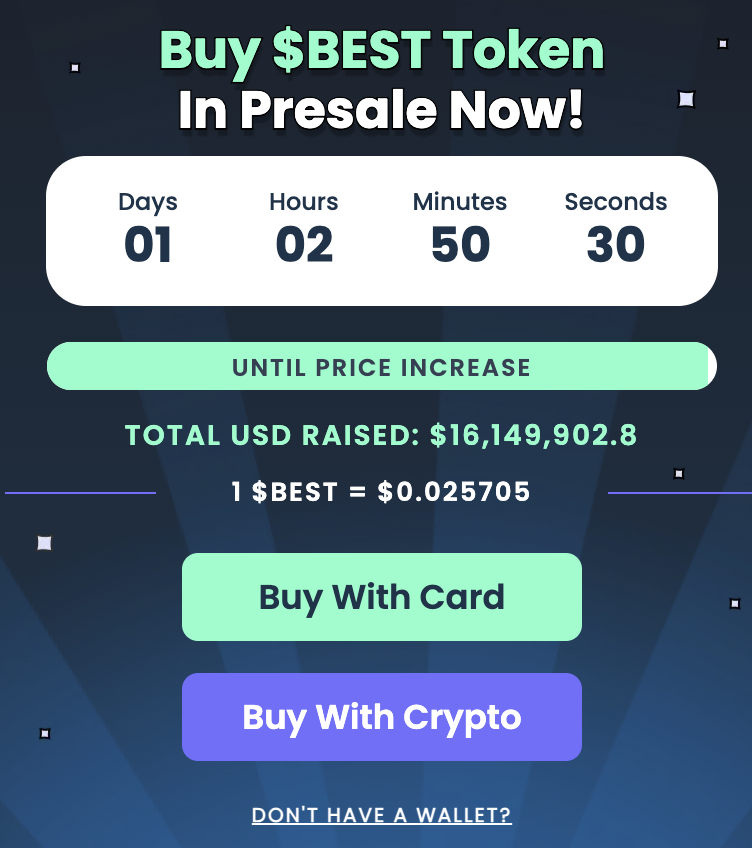

The numbers are already talking about volume.

The current pre-sale price is $0.025705, with $Best raising more than $16.1 million, showing strong demand before the token even hits exchanges.

Its early momentum is particularly important in markets where many new crypto projects struggle to attract attention.

But timing is the whole picture here. Swift is currently testing Stablecoin payments for Ethereum, which shows that the financial world is mainstreaming with Stablecoin and blockchain-based settlements.

$Best is placed midway through that shift, offering you payments, pre-sales, and tokenized financial exposure at once.

For investors who see the next wave of Best Altcoins, $Best is the chance to become part of the infrastructure that allows them to define how digital money moves across borders.

Stablecoins are moving through the central stage

Stubcoins are no longer a niche. Swift’s Ethereum testing shows that mainstream banks will ultimately become serious about them.

In such a world, the best wallet token ($best) is more than just another project. This is a shot of being part of the future of payments that everyone from Google to BNP Paribas prepares.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products or other materials on this page. Readers are encouraged to conduct their own research before engaging in cryptocurrency-related behaviors. Coindoo will not be liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, products or services mentioned. Always do your own research.