Sellers are tightening their grip on the crypto market following a bearish monthly close. Bitcoin price fell below $107,500 and broke through a key support level around $108,000, while Solana price fell to $176, losing October’s solid base between $178 and $180. A weak start to November made traders cautious, with SOL prices down more than 8% amid light trading volume and weakening bullish momentum.

The market capitalization of cryptocurrencies also declined as traders booked profits following the recent rally. With this pullback, Solana has officially entered a weekly downtrend, and if the selling pressure continues, the token could soon revisit the key demand zone around $165. This zone has historically served as a strong rebound area and could prevent further declines and prompt a fresh move towards the $200 resistance in the coming sessions.

What’s next for Solana (SOL) price increase?

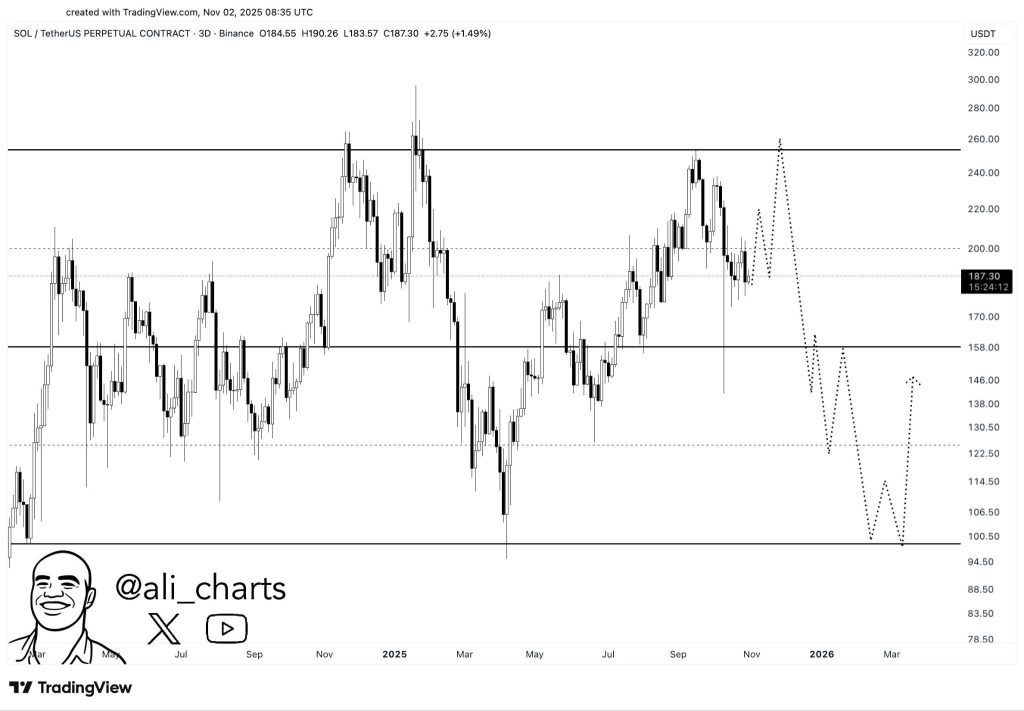

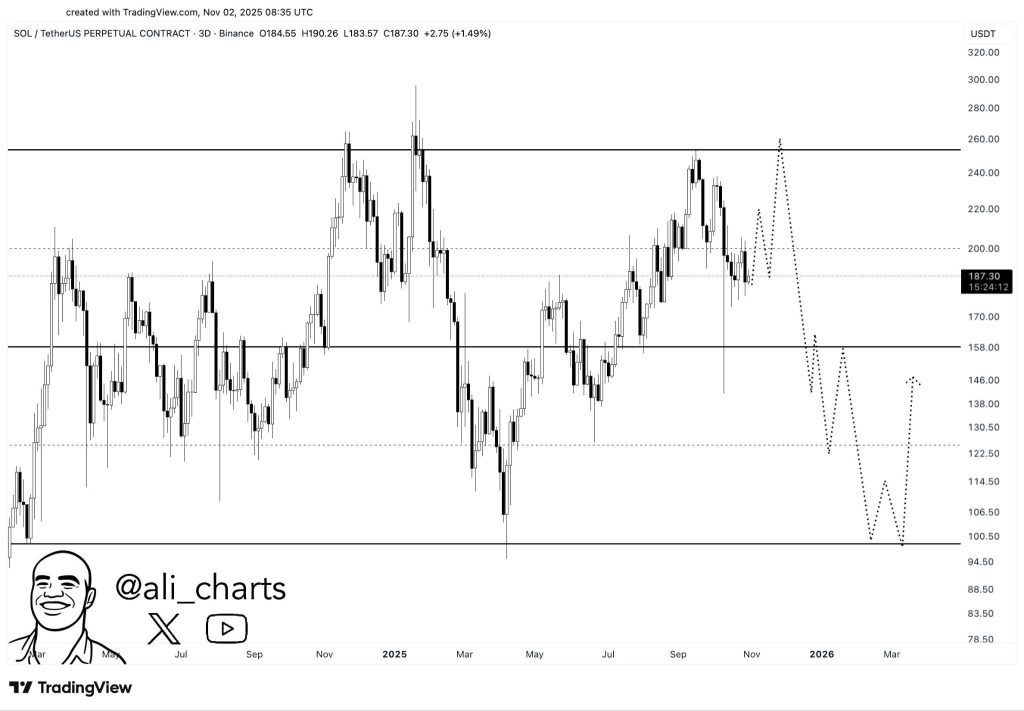

Solana’s price action entered a decisive phase as the token consolidated around $187 following a sharp decline from recent highs. The chart reveals a clear structure below the high, indicating bearish momentum is building after repeated rejections around $240. With the recent breakdown below $180, SOL is testing a key midrange support level and traders are wary of the possibility of a deeper correction. Overall market sentiment appears to be cautious, suggesting that volatility could intensify if Solana fails to regain the $200 resistance level soon.

A chart shared by popular analyst Ali shows Solana’s multi-month range between $100 and $260, highlighting the possibility of a downtrend if the support at $158 to $165 fails to hold. The dotted forecast suggests a possible short-term bounce towards $200 before the downtrend continues, potentially dragging SOL into the $130-$100 zone by early 2026. This setup implies a downside high structure consistent with bearish continuation unless buyers decisively break out of $200, which could reestablish bullish strength and challenge the upside resistance near $240.

summary!

Bitcoin’s drop below $108,000 continues to weigh on altcoins, with traders remaining cautious amid the general crypto market weakness. A recovery of BTC above $110,000 could provide much-needed momentum to Solana’s recovery and restore confidence among the bulls. Until then, SOL is likely to continue consolidating within a narrow range, waiting for a clear breakout signal.

Solana’s short-term outlook remains bearish, but its long-term fundamentals continue to offer hope for a rebound. The $165 demand zone is important in determining the next big move. A break above this zone could reignite buying pressure and set the stage for a retest of $200. However, if market sentiment worsens and BTC remains depressed, SOL could face further decline before a sustainable recovery emerges.

Trust CoinPedia:

CoinPedia has been providing accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by an expert panel of analysts and journalists following strict editorial guidelines based on EEAT (Experience, Expertise, Authority, and Trustworthiness). All articles are fact-checked against trusted sources to ensure accuracy, transparency, and authenticity. Our review policy ensures unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely and up-to-date information on everything cryptocurrencies and blockchain, from startups to industry giants.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making any investment decisions. Neither the author nor the publication is responsible for your financial choices.

Sponsors and advertising:

Sponsored content and affiliate links may appear on our site. Ads are clearly marked and our editorial content is completely independent of our advertising partners.