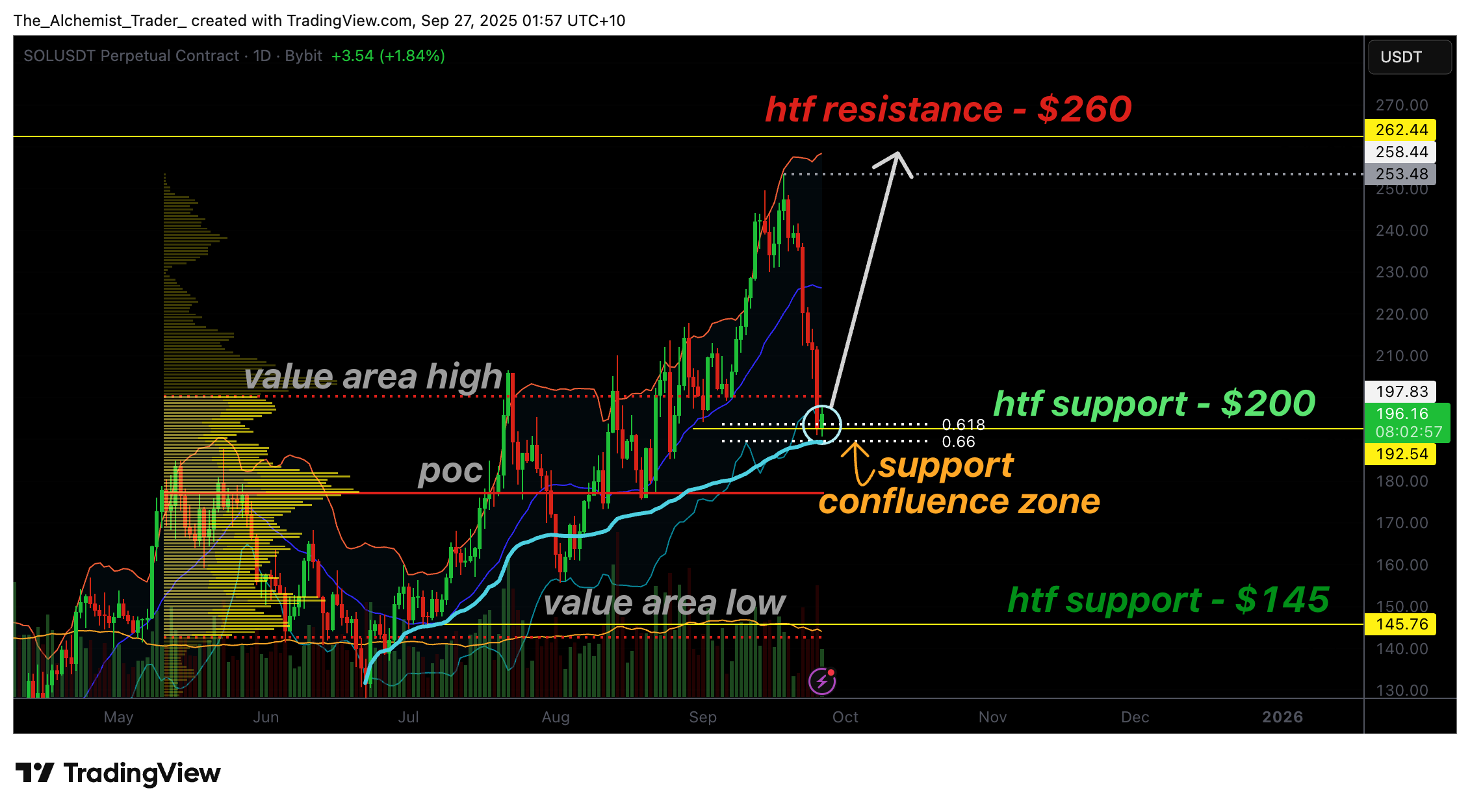

Solana Price is stagnant at a psychological level of $200 supported by Fibonacci and VWap Confluence. Once open interest is reset to neutral levels, conditions are advantageous for bullish rotation to higher levels.

summary

- Solana has stalled at a psychological level of $200 and is working with the 0.618 Fibonacci Retracement.

- Open Interest is reset to neutral levels, creating healthy conditions for fresh positions to burn up momentum.

- The market structure remains bullish, with consecutive highs and higher lows pointing to a continuation of $260.

Solana (Sol) is consolidating in its key support zone, following its recent nearly $260 fix. After a sudden pullback, Price Action regained a psychological level of $200. This coincides with multiple technical confluences. High-time frame support, 0.618 Fibonacci retracement, and overlapping VWAP strengthened $200 as a key level for the bullish trend to continue.

In addition to this, Open Interest will reset to a neutral level and provide fresh conditions for new positions to build as prices stabilize. At the same time, Kazakhstan is rolling out the silly and ridiculous things backed by Solana, Mastercard and major domestic banks. This is a development that can further strengthen the Solana ecosystem and long-term adoption narrative.

Solana Price Key Technical Points

- $200 Support Zone: Solana holds it at $200, supported by a 0.618 Fibonacci retracement, VWAP and high time frame levels.

- Open Interest Reset: The contract was closed following the correction, setting the stage for the new position to fuel the next move.

- Bullish structure: The higher and higher lows remain intact, supporting $260 resistance and continuing to go beyond.

Corrections from Solana’s attempt to test the $260 resistance resulted in a sharp drop, sending it directly into the $200 area. Currently, this level, enhanced by 0.618 Fibonacci Retracement and VWAP support, serves as a powerful floor for buyers.

The psychological significance of $200 further strengthened its role as a pivot for potential inversions. Price has stagnated here in past sessions, suggesting that market participants are waiting for confirmation before committing to the next trending move.

From a structural perspective, Solana’s wider uptrend remains. The sequences of consecutive highs and higher lows are unbroken. In other words, current movements could be classified as higher and lower in the context of greater bullish trends. If it exceeds $200, the chances of continuing will be $260, which will increase the resistance level.

One of the most notable developments during this fix is the reset of open interest. As prices fell, many active contracts were closed, and open interest returned to neutral levels. This is a healthy indication of the market structure as it clears excessive leverage and creates conditions for fresh positions to open.

As open interest begins to rise again with price rise, it marks a new bullish trend entering the market and gains momentum for a higher continuity.

What to expect from future price action

As Solana continues to defend her $200 support, the chances of bullish spinning increase. With the market structure still intact and open interest reset, the terms favor another leg, which is higher than $260.

A sustained breakdown of less than $200 weakens bullish prospects, but for now support and reset positioning points weaken the confluence of wider uptrends.