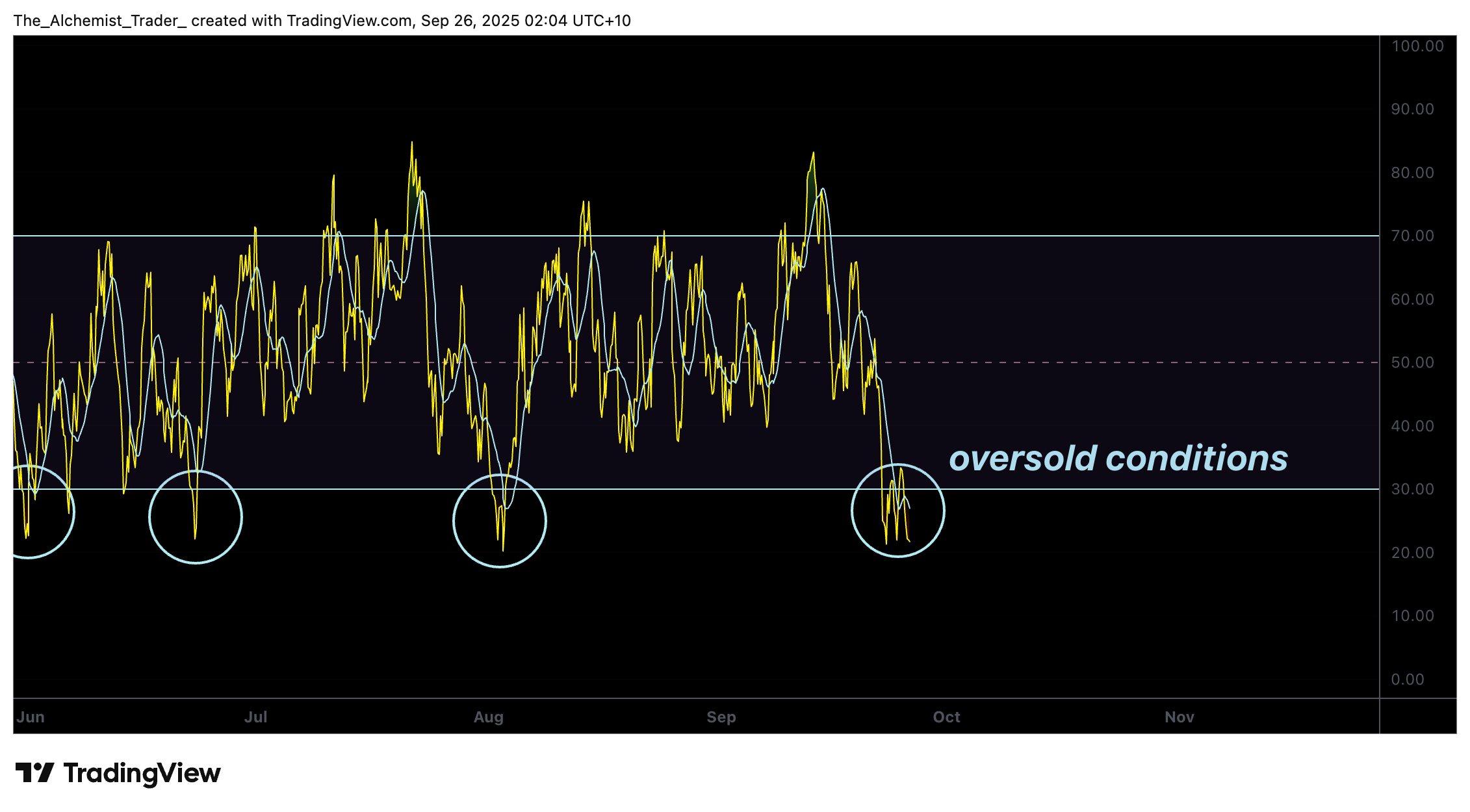

Solana Price has fallen sharply back from the $260 resistance mark and fallen into the $200 support zone. With RSI currently being sold too much, traders are looking at potential bounces.

summary

- Solana Price has dropped from a resistance level of $260 to a support area of $200.

- 0.618 Fibonacci Retracement aligns with sold RSI conditions and produces a powerful technical confluence.

- If $200 in support is retained, Solana could potentially return to the $230-$260 range.

The Solana Price Action shifted quickly after just over $260. The higher and higher low sequences established bullish structures until resistance suppressed advancement. The refusal caused an aggressive sale, sweeping through the points of control (POC) and value area (VAH) before finding footing in the $200 region.

This zone coincides with the height of the 0.618 Fibonacci retracement, the area that Solana historically reacted with a strong inversion. In addition to the story, Kazakhstan has introduced stubcoins backed by Solana, Mastercard and major local banks.

Solana Price Key Technical Points

- Support Test: Price crashes into the $200 region and works with the 0.618 Fibonacci Confluence.

- rsi excess: The indicator has a signal below 30, highlighting the fatigue of sales pressure.

- Potential rotation: Historical patterns suggest that Solana often bounces back from the 0.618 level towards previous highs.

The recent spread of bearishness has been sharp and offensive, reflecting previous moves by Solana that respected the 0.618 Fibonacci retracement as a key turning point. This high-time frame support offers a technically important level that can attract buyers looking for value after sale.

From a structural standpoint, the $200 support has more weight than Fibonacci alignment. It also reflects the psychological round number level where liquidity pools tend to form. The bounce here allows us to reestablish Solana’s bullish trajectory by reverting the price action to a neutral volume level, such as a VAH, and ultimately retesting the $260 resistance mark.

Momentum indicators further support this story. Currently below the 30 threshold, RSIs show terms of sale that are rarely lasting for a long time. In past cycles, this level of violation has consistently resulted in relief gatherings.

Volume analysis is important to review this scenario. If demand inflows return with these drops, they can mark the fatigue of the current bearish leg and set the stage for another bullish impulse. However, if you don’t follow $200, the next support is below, so if you can’t defend $200, you could reveal a deeper level of liquidity.

In addition to the wider ecosystem, PancakesWap now supports Solana with cross-chain swap, allowing users to exchange tokens across the blockchain in a single transaction.

What to expect from future price action

In the short term, Solana’s unsold RSI and strong $200 support support support for a rebound scenario. If this zone is successfully defended, it could trigger a rotation towards $230-260.