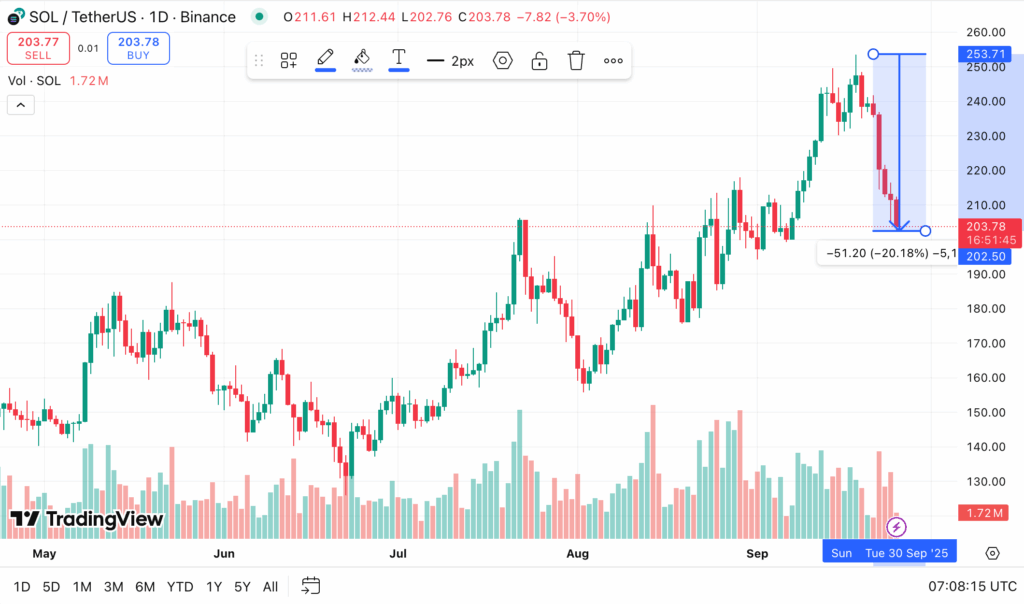

- Solana drops 20% in 7 days, and RSI hits oversold territory.

- Technical analysts identify channel support as key level in the $200 region.

- Previous overselling conditions led to the Sol Rally range from $155 to $250.

Solana has fallen 20% over the past week and is currently trading at $203.78 after falling from its recent high on September 18th. SharpSelloff sold out several technical indicators over various time frames.

Market analysts are assessing whether current price action offers opportunities for purchases or have moved further. Several technical indicators suggest that SOL may be approaching a historically preceded level of recovery.

The relative intensity indexes for the 4, 5 and 12-hour charts show excessive measurements that often coincide with price bouncing. One trader noted that similar sales terms on the 12-hour chart had previously triggered a rally between $155 and $250.

Technical level provides potential support

Channel support analysis revealed that SOL is touching on a critical level of technology for the current $200 region. Several analysts have identified this zone as important for determining the short-term orientation of the token.

“Tiered bids” from the $200 area have been found on the 12-hour chart, suggesting institutional interest at these levels. Sol is about $3 more than this potential support zone at current market prices.

However, daily and weekly time frame analysis offers a more careful outlook. The technical chart shows that Sol should recover $216 and resume its upward movement, while $172 represents a more conservative support target.

A weekly chart analysis suggests that retesting between $190 and $175 can provide the best entry setup for your long-term position. Many traders expect continuous price volatility before sustainable bottom form.

The recent decline coincides with intense sales pressure across multiple sessions. Despite the bearish price action, some market participants view oversold conditions as the reverse purchase signal.

Basic factors support the potential for recovery

On-chain data reveals a $315 million accumulation wave that helps to absorb recent sales pressures. The agency’s purchasing activities could provide a foundation for price stabilization and potential recovery.

The development of infrastructure and institutional adoption continues to support SoL’s long-term outlook. Recent Coingecko data shows that public companies have begun to add Solana to Treasury holdings along with Bitcoin.

The combination of excessive technical conditions and basic purchasing interests creates a mixed environment for salt traders. Historical patterns suggest that oversold RSI levels often precede recovery periods, but timing remains uncertain.

In the current market situation, risk levels must be carefully assessed before establishing positions, especially given the volatile nature of recent price movements.