Keynote

- Sol has experienced five consecutive losses since September 21st, showing his worst performance in over three weeks.

- Derivative data shows an extreme bullish surrender of $45 million in long liquidation.

- Technical indicators including the RSI of 37.47 and BBP of -35.47 BBP had previously continued continued bearish momentum.

Solana

Sol

$196.5

24-hour volatility:

3.8%

Market Cap:

$106.84 b

Vol. 24H:

$11.29 b

Price plunged below $200 on Thursday, September 25th, trading at a 23-day low of $197.65 on Coinbase. The 6.1% price downtrend on Thursday has set Solana prices firmly on the course for a five-day free fall after booking the number of consecutive days since September 21st.

Solana Price is below $200 during its $45 million settlement

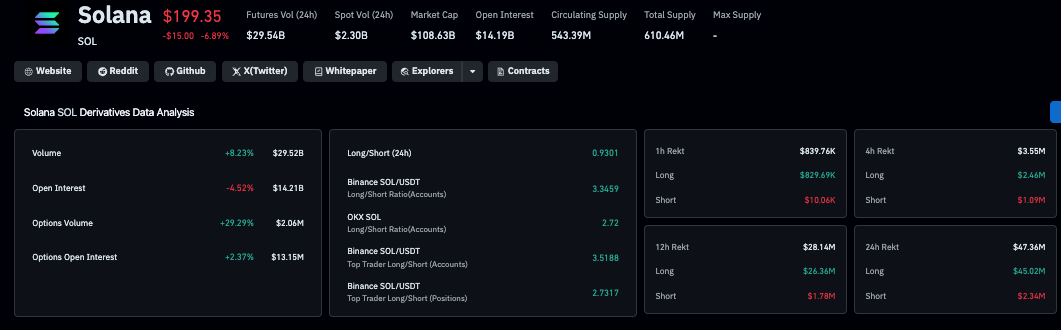

Coinglass data reveals clear indications of panic sales among bullish traders. Solana Open Integ fell 4.52% to $14.2 billion, but intraday trading volume rose 8.2% to $29.5 billion. This tests a bearish overreaction as a 6.1% drop in Solspot prices exceeded the contraction of the futures market.

Solana Derivatives Market Analysis | Source: Coinglass

Additionally, the Solana Derivatives market has liquidated a longer position of over $45 million compared to a short position of just $2 million. This imbalance underscored how bulls contracted Thursday after a long day’s loss, leading to rapid breakdowns below the $200 price level.

Solana’s weak market performance is consistent with Ethereum and top crypto assets

ETH

$3 942

24-hour volatility:

1.8%

Market Cap:

$476.00 b

Vol. 24H:

$57.41 b

Also, 6% retreated for the first time in September at under $4,000, and XRP

XRP

$2.77

24-hour volatility:

3.0%

Market Cap:

$165.53 b

Vol. 24H:

$8.57 b

They also reversed 5.7% to settle at multiple weekly lows close to $2.78. Meanwhile, Bitcoin

BTC

$109 524

24-hour volatility:

2.0%

Market Cap:

$2.18 t

Vol. 24H:

$69.10 b

Price was able to rebound from $110,650, supported by news of a fresh influx of companies from Europe.

Solana Price Prediction: Can support of $197 prevent a deeper collapse?

The Solana Price is covered in volatile near the $197.65 support. This decisive closure below key level could lead to Sol Price becoming even more slump towards the $189.81 zone.

The relative strength index (RSI) slips to 37.47, suggesting that it slips firmly in bearish territory, suggesting that momentum remains leaning against the bull. Meanwhile, the BBP indicator is located at –35.47, reinforcing the participation of weak buyers and dominance of bearish emotions. The Chande Kroll Stop also sits high at $209.11, confirming a significant resistance cluster overhead.

Solana (Sol) Price Prediction | TradingView

For the Bulls, reclaiming a $210 resistance cluster is the first signal of a bullish inversion. Beyond that, if broader emotions improve, a rebound to $254.72 could be on the card. Conversely, failing to hold $197 opens the door for a sharper retracement towards the $189 zone before the buyer attempts to recover.

Solana’s recent price outlook is relatively vulnerable. The early bounce from $197 remains unlikely, without significantly boosting spot trading volume and wider market sentiment.

Given the weight of recent liquidation, it appears that buyers are not trying to defend their position within current macroeconomic conditions.

Next

Disclaimer: Coinspeaker is committed to providing fair and transparent reporting. This article is intended to provide accurate and timely information, but should not be considered financial or investment advice. Market conditions can change quickly, so we recommend that you review your information yourself and consult with an expert before making a decision based on this content.

Ibrahim Ajibade is a veteran research analyst with a background in supporting a variety of Web3 startups and financial organizations. He holds a bachelor’s degree in economics and currently holds a master’s degree in blockchain and distributes ledger technology at the University of Malta.

Ibrahim Ajibade on LinkedIn