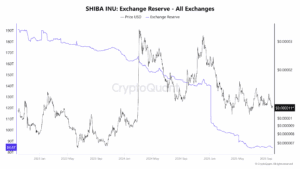

Shiba Inu (Shib) Exchange Holdings has fallen to its lowest level since 2023, referring to investor accumulation. With fewer tokens on the exchange, the question now is whether this setup will lead to meetings in the coming days. Let’s look into it.

Lowest exchange reserve in 2 years

Cryptoquant data shows that Shib Exchange Remerves has dropped sharply. At the beginning of 2025, the reserve was close to 140 trillion tokens. In other words, exchange ownership has dropped by almost 40% in less than a year.

Exchange Reserves tracks the number of tokens available on trading platforms. A fall in reserve usually means that the holder is moving their tokens to the platform rather than moving them to a private wallet or staking platform. This shift often reduces the immediate supply available for sales. Historically, similar declines in reserves precede the period of accumulation.

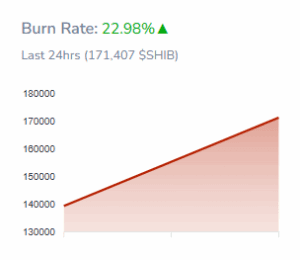

At the same time, Shiba Inu’s burn mechanism continues to cut down on supply. Shibburn data shows that over 171,000 Shiv tokens have been burned in the last 24 hours, increasing daily burn rates by 22.98%.

The amount burned is small compared to Shiv’s large-scale circular supply of over 584 trillion tokens, but consistent reductions play a broader theme of tightening supply.

The combination of lower exchange reserves and continuous token burns suggests that fewer siv tokens are available for immediate trading.

Shiv faces strong resistance

Despite these positive signals on the supply side, Shiv’s prices remain trapped in downtrends. The daily chart shows the downward resistance line closing the rally from early 2023. Currently, Shib is testing support for nearly 0.000011, a level that has been held multiple times in recent months.

Currently, SHIB is testing support of nearly $0.000011. This is a level that has been held multiple times in recent months. The relative strength index (RSI) is around 38 years old, indicating that the seller is dominated, but also suggests that buyers will retreat soon. At the same time, the 50-day and 200-day exponential moving averages (EMA) outweighs prices and keeps the overall trend under pressure. For the Bulls, a move of more than $0.00001364 is required to see the inversion.

Can a low reserve trigger an “Uptober” rally?

Analysts believe that a decrease in Shiv’s exchange supply will put tokens in the accumulation zone. With fewer tokens available on the exchange, even a slight increase in demand could lead to higher price fuel. Some traders see October (often called “up-to-bar” in crypto circles) as a potential turning point if Shiv prices succeed in breaking out of the downtrend line.

However, the risk remains. If SHIB cannot hold $0.000011 of support, then the downside could also open towards the 0.000010 level.