Key takeout

-

Analysts are divided into short-term bounces and long-term breakout scenarios for SHIB Price

-

A descending triangle signals pressure build-up towards decisive movement

-

Larry’s predictions depended on speculation rather than basics.

Shiba Inu Coin, Shib has been falling since it reached its monthly high on September 13th. Memecoin has dropped by more than 21% from its recent high on September 25th, putting pressure on Shib’s fragile structure.

The token hovered near the $0.00001180 zone and struggled to attract buyers. However, Memecoin began in an aggressive location on September 26th, but it remains to be seen whether the Bulls will convert Spikes into a rally. Despite their weaknesses, traders remained very optimistic about the future of tokens. Marketwatchers argued that repeated defenses of lower support suggested pressure to get involved. The discussion has changed whether Shiv’s boring behavior could lead to breakouts similar to past meetings.

Analysts share Shiv’s wild predictions

Social media analysts have highlighted the latest post-integrated Shiv structure, relying on speculation that tokens could repeat past meetings. This post framed the current range as both risk and opportunity, depending on how prices responded to the resistance barrier.

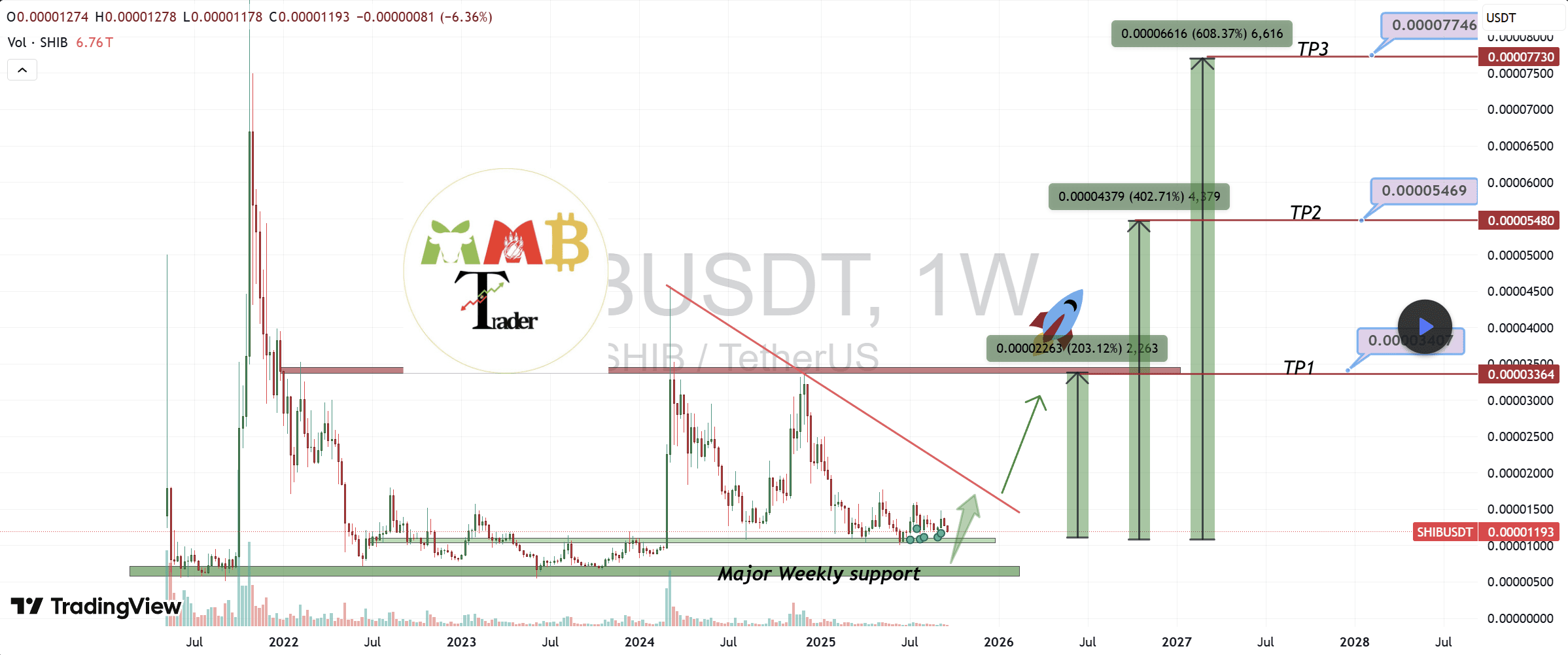

MMBTTRADER highlighted Shiv’s position on what he described as his major weekly support.

Analyst MMBTTRADER’s chart outlined three different upside targets. These were associated with 200%, 400%, and 600% potential gatherings, respectively. The projection reflects the price range that was last seen during the 2021 surge, comparing the “periods.”Dead Market“It suddenly flipped into a panic-driven pump. A post from Mmbtrader highlighted that the initial barrier near 0.00003364 remained a key trigger for wider advancements.

However, based on historical interests, such targets are often attributed to hopium-fueled optimism rather than technical clues. This is very similar to how PI network fans are hoping to reach $314,159, or even $1 in the current market.

Some analysts looking at a shorter field of view

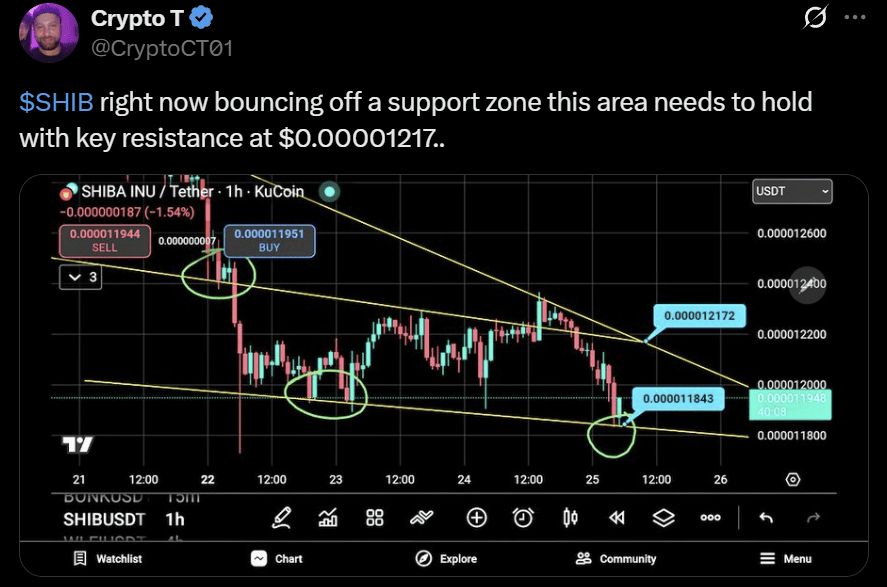

Other posts have drawn attention to a shorter perspective. Crypto T marked repeated tests of Shib’s low yellow support line. Analysts noted how the token bouncing off the area. T emphasized immediate resistance near 0.00001217.

Analyst Crypto T’s chart suggested that replaying zones could allow for the unlock of short bursts of momentum, but the obstacles were at risk for further integration. As Dogecoin has acquired its own ETF, market interest in Doge’s rivals could be reduced. This is despite the team’s efforts to establish Shiba Inu as an ecosystem-like project.

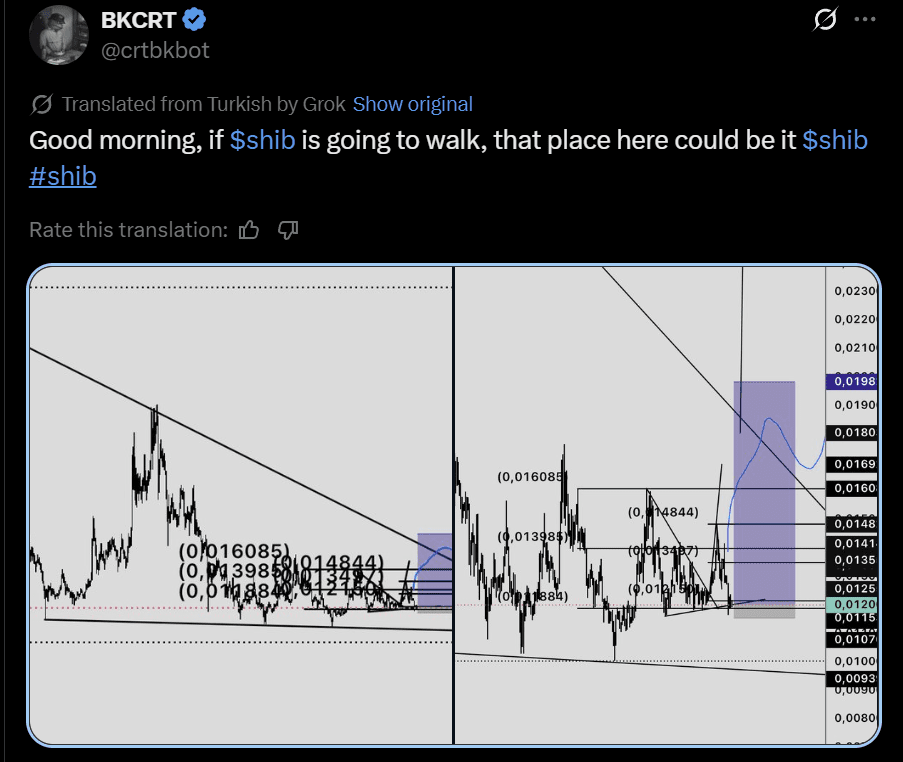

With a higher time frame, independent analyst BKCRT mapped a broader descending trendline that had determined price action over several weeks. His post says how Shiv “I walked the line“Shredded under an oblique barrier while wrapping within the tightening range.

The attached chart projected a potential breakout window and placed a purple target box near 0.0198. That scenario implies a sudden extension from current prices. This is said to be possible for SHIB to turn trendlines upside down first. The analysis highlighted the gap between the battle of tactical resistance and the larger structural trigger.

The Downward Triangle raises doubts about Shiv’s next move

Meanwhile, the SHIB USD pair formed a bearish technology setup called the Downward Triangle Pattern. This pattern consisted of a flat base and a lower maximum value that was pushing resistance. It reflected a gradual tightening of price action, with sellers consistently forcing a low peak, and buyers repeatedly defending certain support floors. Such formations often weaken momentum and foresee sharp breakage when pressure is resolved.

For Shiba Inu Coin, in the breakout you’ll see bulls running around to check the downtrend with support near $0.00001046. Support is psychologically important as it prevents Shiv from adding another zero to the price label. Violation of immediate support could potentially send Shib Price Spiraling to the last seen level of $0.0000886 in January 2024.

The theoretical price target for the triangle is $0.000008, down 31% from the current level.

The immediate resistance of the pattern was near the $0.0000131 ceiling marking the upper limit of the downward structure. Inverting this resistance disables the bearish setup and instead creates a structure inversion condition. When you break into the top of the bearish setup, Shiba Inu Coin’s resistance is nearly 0.0000142.

Disclaimer: The above analysis reflects the author’s personal views and is provided by informational purposes only. It should not be considered financial advice. Readers should conduct their own research before making investment decisions. Any losses incurred by acting on this analysis are not the responsibility of the author or the coin chapter.

What’s going on with ChainLink? Check it out next.