Updated (October 29, 2:07 PM UTC): This article has been updated with comment from SharpLink.

SharpLink Gaming plans to deploy $200 million worth of Ether (ETH) from its treasury to ConsenSys’ Linea network.

The company said the multi-year effort will use Linea’s zkEVM Layer 2 infrastructure to generate on-chain revenue and increase the efficiency of ETH holdings. According to Tuesday’s press release, the strategy aims to earn “competitive, differentiated, and risk-adjusted returns in ETH.”

SharpLink plans to generate revenue from staking, restaking rewards earned by helping secure EigenCloud’s Decentralized Validation Service (AVS), and incentives from Linea and ether.fi (decentralized liquid staking and restaking protocols).

Staking refers to locking up cryptocurrencies to secure a blockchain network in exchange for a reward. Restaking builds on that idea by allowing users to reuse or “restake” staked assets to support additional decentralized services and earn additional rewards.

The $200 million implementation will be managed under institutional safeguards through SharpLink’s authorized administrator, Anchorage Digital Bank.

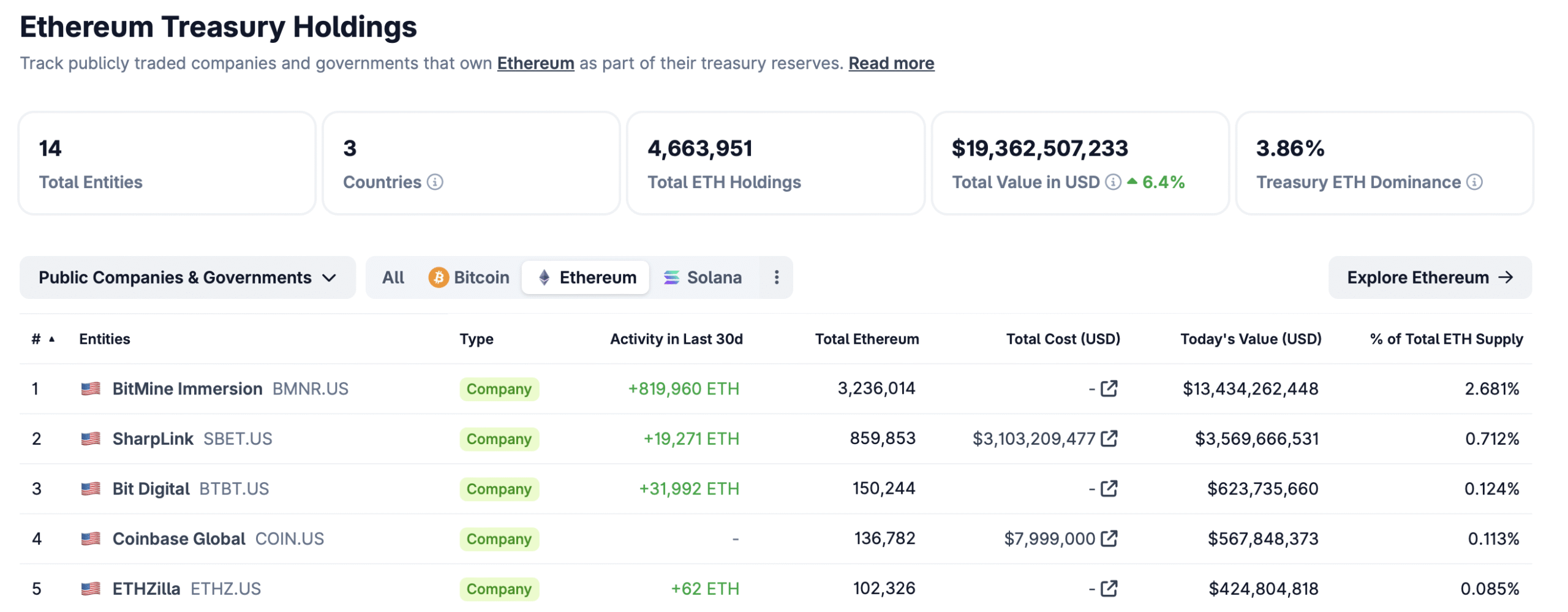

According to CoinGecko data, SharpLink is currently the second largest corporate holder of ETH, holding 859,853 ETH worth approximately $3.57 billion, representing 0.71% of the total supply. The planned deployment represents approximately 5.6% of the Treasury.

A Sharplink spokesperson told Cointelegraph: “If our strategy performs as expected and delivers consistent yields while maintaining the highest standards of custody and compliance, we will consider expanding the program over time in the best interest of our shareholders.”

Related: Regulated crypto yields win as institutions demand substance

DeFi profit strategy

SharpLink is not the only company turning to decentralized finance to boost on-chain revenue.

On September 2nd, ETHZilla (ETHZ) announced that it will deploy $100 million of ETH to ether.fi to increase the yield on its government bond holdings. ETHZilla is currently the fifth largest Ethereum digital asset treasury (DAT), holding 102,326 ETH at the time of writing.

In February, the Ethereum Foundation, the nonprofit organization that supports Ethereum’s core development and ecosystem, deployed 45,000 ETH to DeFi protocols including Spark and Compound. The foundation’s financial policy from June reveals plans to move beyond passive holdings by staking and deploying ETH across DeFi protocols.

Centralized exchanges are also starting to integrate DeFi yield strategies. In September, Coinbase partnered with DeFi lending protocol Morpho to allow users to earn up to 10.8% yield by lending USDC (USDC) stablecoin.

Less than a month later, Crypto.com announced plans to integrate Morpho into its Khronos blockchain, allowing users to deposit wrapped ETH and other assets to earn stablecoin yield through a new lending vault, expected later this year.

magazine: Hayes ‘Up Only’ Tips on Cryptocurrency, ETH Staking Exit Queue Concerns: Hodler’s Digest, September 14-20