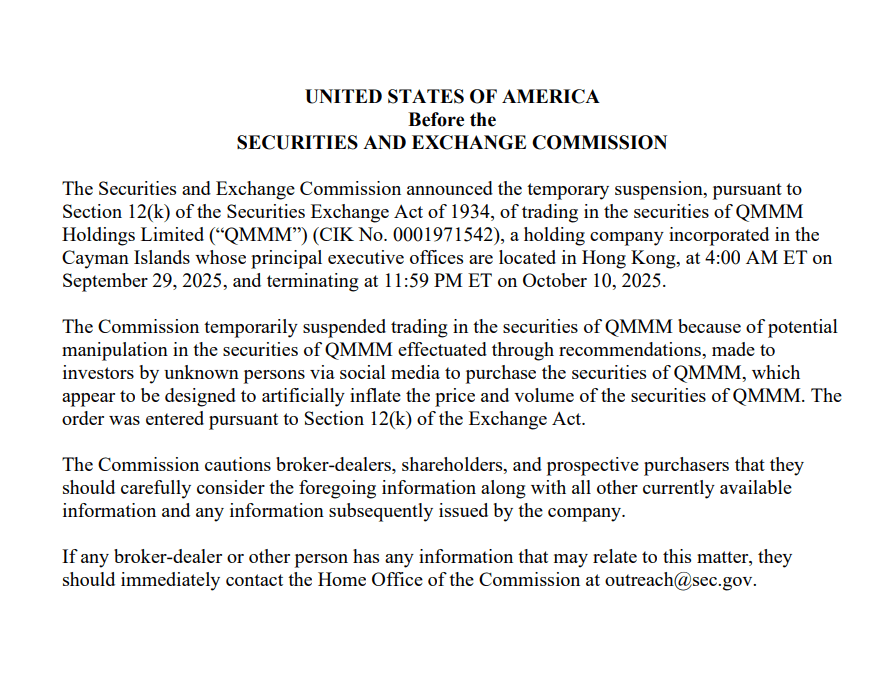

The suspension of SEC trading at QMMM begins on Monday and runs for 10 days until October 13th. The agency cited potential stock operations as a reason for the suspension of trading. He said the act includes promotions to stocks on social media.

In the notice, the SEC said it is recommending unknown people to purchase QMMM shares online. He said these messages seemed designed to increase prices and volume. SEC trading blocks new transactions while regulators review their activities.

Trade suspension applies only to QMMM. Do not cancel previous transactions. This allows the SEC to examine the flow, timing and communications of the order, and also maintains a clear window of probes ongoing.

QMMM Crypto Treasury Plan: Bitcoin, Ether, Solana, $100 million

Before SEC transactions ceased, QMMM announced plans for the Ministry of Cryptocurrency on September 9th. He said he would buy and hold Bitcoin, Ether and Solana. It also disclosed the initial $100 million allocation for purchases.

QMMM moved sharply after the Crypto Treasury update. The stock jumped from around $11 to a high of nearly $207 in a single session. The profit for the month exceeded 1,700% before the trading halt.

By Friday, QMMM had closed at $119.40. The rally was before the halt of SEC trading and the inventory manipulation probe. The company also flagged plans for its cryptographic analytics platform, along with the Cryptocurrency narrative.

Analyst quotes about SEC trading suspension and Tradfi rules

The market index Carl Capolingua is a rare occurrence called such a trading halt. He said they are rare because management’s interests are high.

“If the SEC can link to employees “unknown people” who are responsible for encouraging the company’s shares to be returned to employees, or even worse, penalties that include large fines and prison hours can be severe. ”

He said.

Capolingua said the Cryptocurrency angle may have attracted investors. However, he said the main issue was allegedly illegal stock promotion. His comments were focused on the SEC’s trading halt and stock manipulation probes.

Tony Sycamore of IG Australia has addressed investors’ actions regarding crypto exposure. He said

“These types of Hale Mary plays are not a way to go about it.”

His remarks put a trading halt within the Tradfi rules. They highlighted how SEC Action focuses on promotions, disclosures and market integrity.

SEC and FINRA investigation into the Ministry of Cryptocurrency’s equity and selective disclosures

The suspension of SEC trading followed a report by the Wall Street Journal. The outlet said the SEC and FINRA had contacted companies pursuing cryptocurrency strategies. It cited the extraordinary volume and price rise before public news.

Selective disclosure rules are bars that lean investors in private updates. The SEC will assess whether information has been leaked prior to the announcement. FINRA lenses include broker-dealer activity and communication.

Over 200 companies have announced cryptocurrency plans in recent months. Some stocks have risen. Others didn’t. SEC and FINRA enquiries are considering timing, volume, and messaging around those movements.

Timeline and Key Number: 10 trading days until October 13th

The SEC trading halt begins on Monday and lasts for 10 days. The current end date is October 13th. Regulators may extend or terminate the suspension based on the findings of the investigation.

The key QMMM figure secures the case. The shares closed at $119.40 on Friday. It reached an intraday high of nearly $207 after the September 9th Crypto Treasury Update. The company allocated $100 million to Bitcoin, Ether and Solana.

Both SEC and QMMM did not immediately comment. SEC notifications remain the primary source of scope and timing. Further updates may address stock manipulation probes and next steps.

For QMMM shareholders, SEC trading is suspended

A trade halt prevents new orders at QMMM in the window. Store a clean period for reviewing price and volume patterns. It also separates the impact of social media stock promotions.

Stopping does not change past stuffing. It simply freezes current transactions. The SEC can request tied records to order flows, messages, and promotions.

If the probe links promotions to insiders, the penalty can be serious. That risk was highlighted by the market index Carl Capolingua. The SEC tests these links based on Tradfi rules and disclosure criteria.