Chainlink’s 2025 price prediction is gaining attention as the $100 per LINK mark is currently being talked about on social media and it is no surprise that many are interested in the factors that cause such a prediction.

Chainlink’s transition from an oracle pioneer to a major player in institutional fintech reflects the company’s strong business model and commitment to meaningful innovation. The current price may seem conservative despite various strong fundamental indicators and factors, but also with global capital market consolidation and reduced supply on exchanges. This clearly suggests future growth potential. Chainlink price USD seems to be approaching a key moment.

From DeFi oracles to global capital markets

Originally built just to serve defi, it has come a long way. By evolving into a modular backbone of services that enhances institutional-grade data, interoperability, and seamless connectivity with legacy systems. For example, Chainlink’s DataLink platform allows companies to distribute regulated market data across over 40 blockchains.

Furthermore, according to Sergey Nazarov, Chainlink crypto’s continued evolution and vision of interoperability shows it to be an important bridge. It connects traditional institutions and decentralized systems through secure and verified data exchange.

More precisely, it aims to establish a standardized framework that seamlessly integrates blockchain with existing financial infrastructure.

Greater integration and institutional partnerships strengthen prospects

Increasing the number of integrations is also a key factor that will help Chainlink evolve. Also, recent weeks have shown that growth is accelerating. Between October 27th and November 2nd alone, 62 integrations of Chainlink standards took place across 24 blockchains. This cross-chain adoption continues to strengthen Chainlink’s position as the industry-leading oracle solution.

Similarly, one of the most important updates in FTSE Russell’s collaboration with Chainlink was a huge hit today with the ability to publish major global indices on-chain via DataLink. These include the Russell 1000, 2000, and 3000 indexes, FTSE 100, WMR FX benchmark, and FTSE DAR digital asset prices. This integration will connect over $18 trillion of benchmark assets to on-chain infrastructure through Chainlink’s secure data distribution system.

This sets the stage for a unified data framework that will enhance Chainlink’s price predictions and highlight its growing importance across capital markets.

On-chain accumulation and technical setup show growing confidence

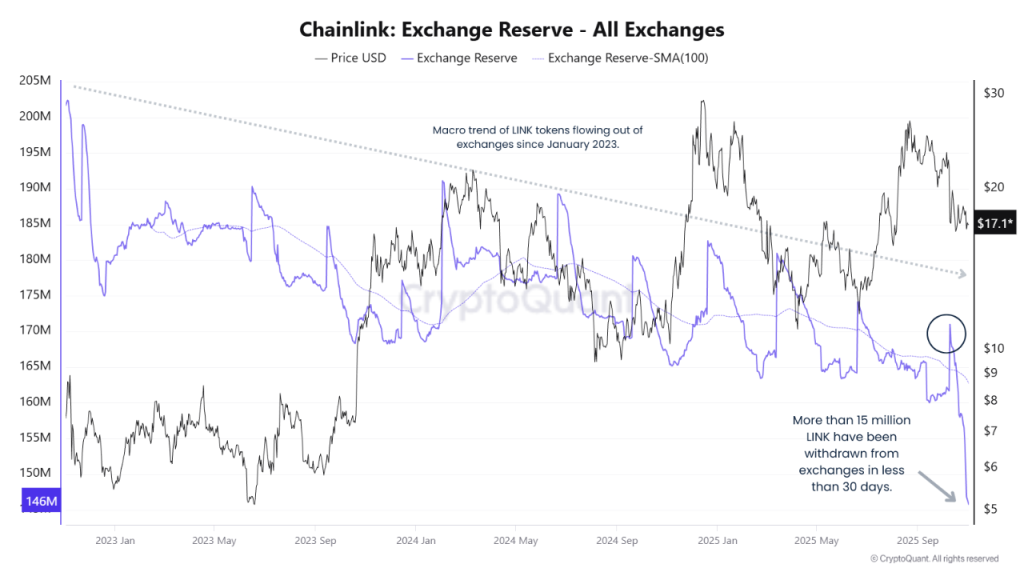

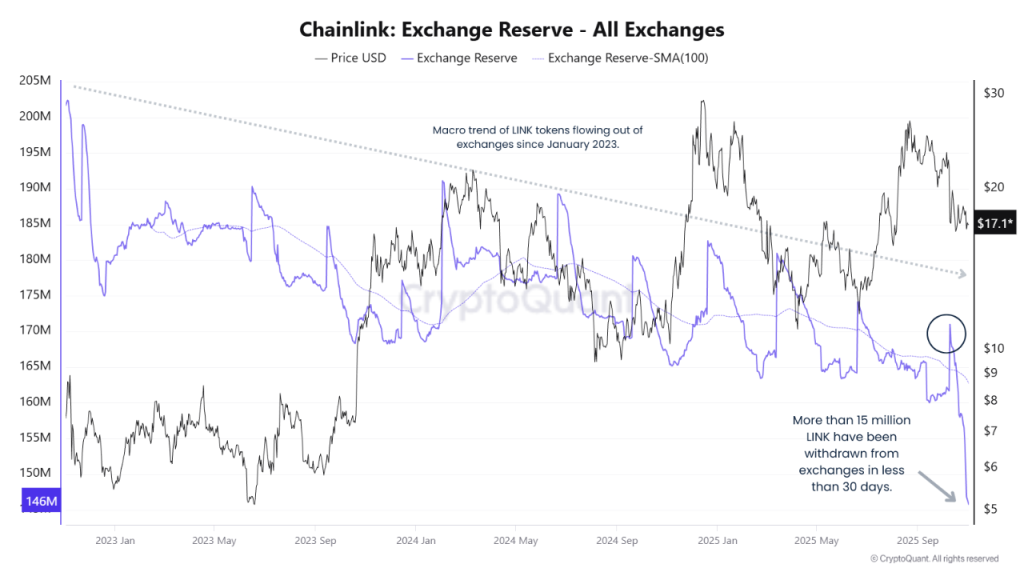

Additionally, on-chain data shows growing confidence among investors. Over 15 million LINKs were withdrawn from the exchange within 30 days. This reduced total reserves from 180 million LINK to 146 million LINK. This reflects long-term holding behavior.

This pattern suggests that supply will be tight going forward due to high bullish accumulation. Although the current Chainlink price may still face a volatile situation, the decreasing supply suggests strong conviction among holders.

Technically, Chainlink’s price chart shows a symmetrical triangle formation, with predictions indicating a possible drop to $15. However, this is considered an important accumulation zone for the rally towards the $100 level.

Such a setup supports a long-term bullish setup above Chainlink Price Forecast’s November 2025 short-term target.

Trust CoinPedia:

CoinPedia has been providing accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by an expert panel of analysts and journalists following strict editorial guidelines based on EEAT (Experience, Expertise, Authority, and Trustworthiness). All articles are fact-checked against trusted sources to ensure accuracy, transparency, and authenticity. Our review policy ensures unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely and up-to-date information on everything cryptocurrencies and blockchain, from startups to industry giants.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making any investment decisions. Neither the author nor the publication is responsible for your financial choices.

Sponsors and advertising:

Sponsored content and affiliate links may appear on our site. Ads are clearly marked and our editorial content is completely independent of our advertising partners.