altcoinsbitcoin

The fresh data from Alphractal highlights that Bitcoin, Litecoin, and Dogecoin continue to experience significant changes in lost coin metrics.

Lost coins represent assets tied to wallets that have never been moved in chains. Many belong to early adopters accumulated during the childhood of each network.

Prices tend to move dormant funds to long-term holders, but overall metrics rarely reach zero. This is because some of the wallets are permanently inaccessible, so they lock the coins forever.

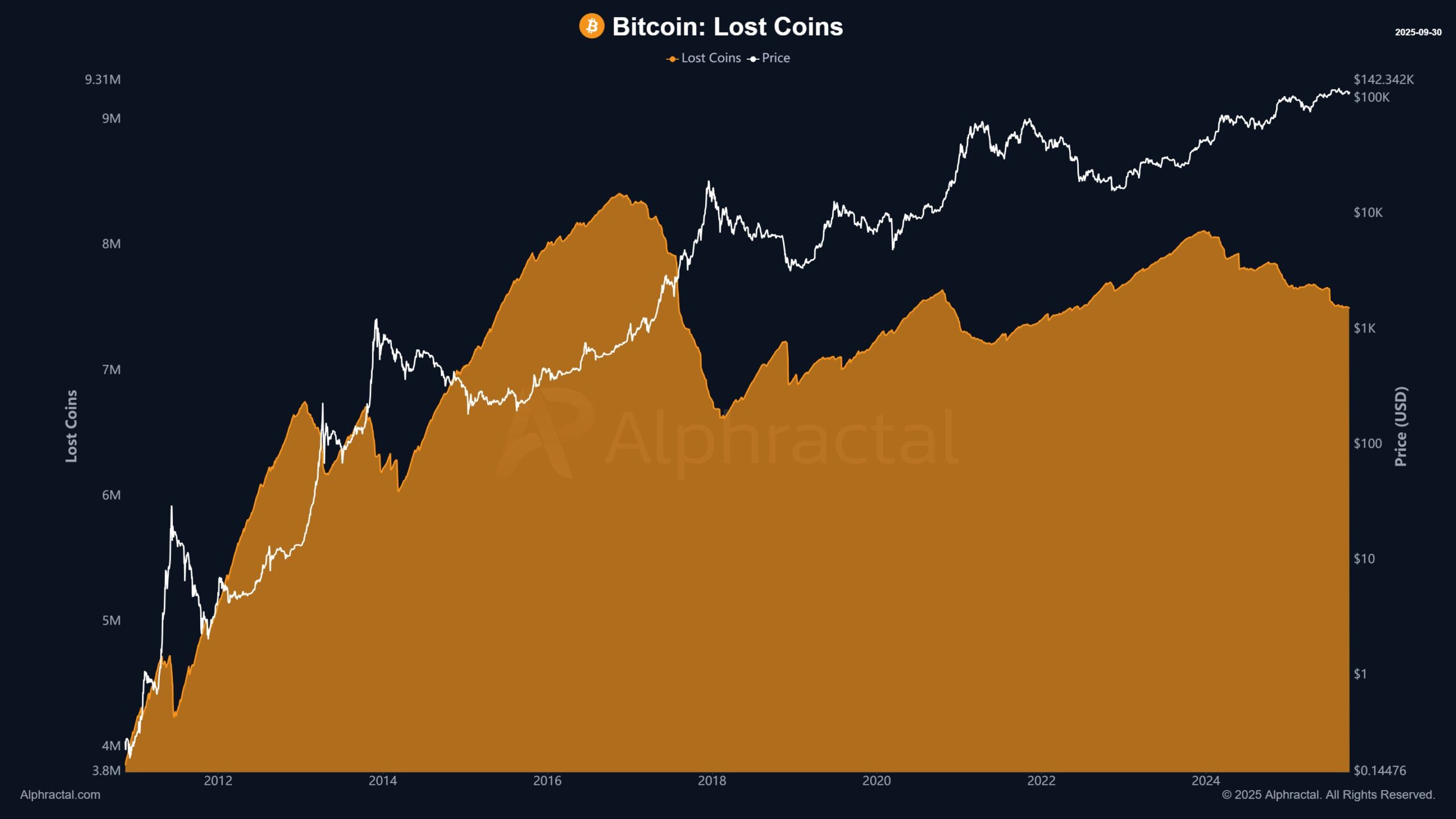

Bitcoin Lost Coin Plateau

In the case of Bitcoin, the chart reveals a steady rise in coins lost throughout childhood, as millions of BTC are locked forever. In more recent cycles, the metrics are flattened, suggesting that most recoverable dormant coins are already activated. This trend reflects a more mature market, and no longer causes prices that, as seen in previous years, have dramatically reduced the dramatic decline in lost coins.

Litecoin shows another picture, with lost coins steadily increasing throughout its history. Despite strong gatherings, the metric rarely drops significantly, indicating that many early wallets are not touched.

This increase in dormant supply is consistent with the hovering of LTC prices in the integrated range, suggesting that sales pressure from long-term holders has settled.

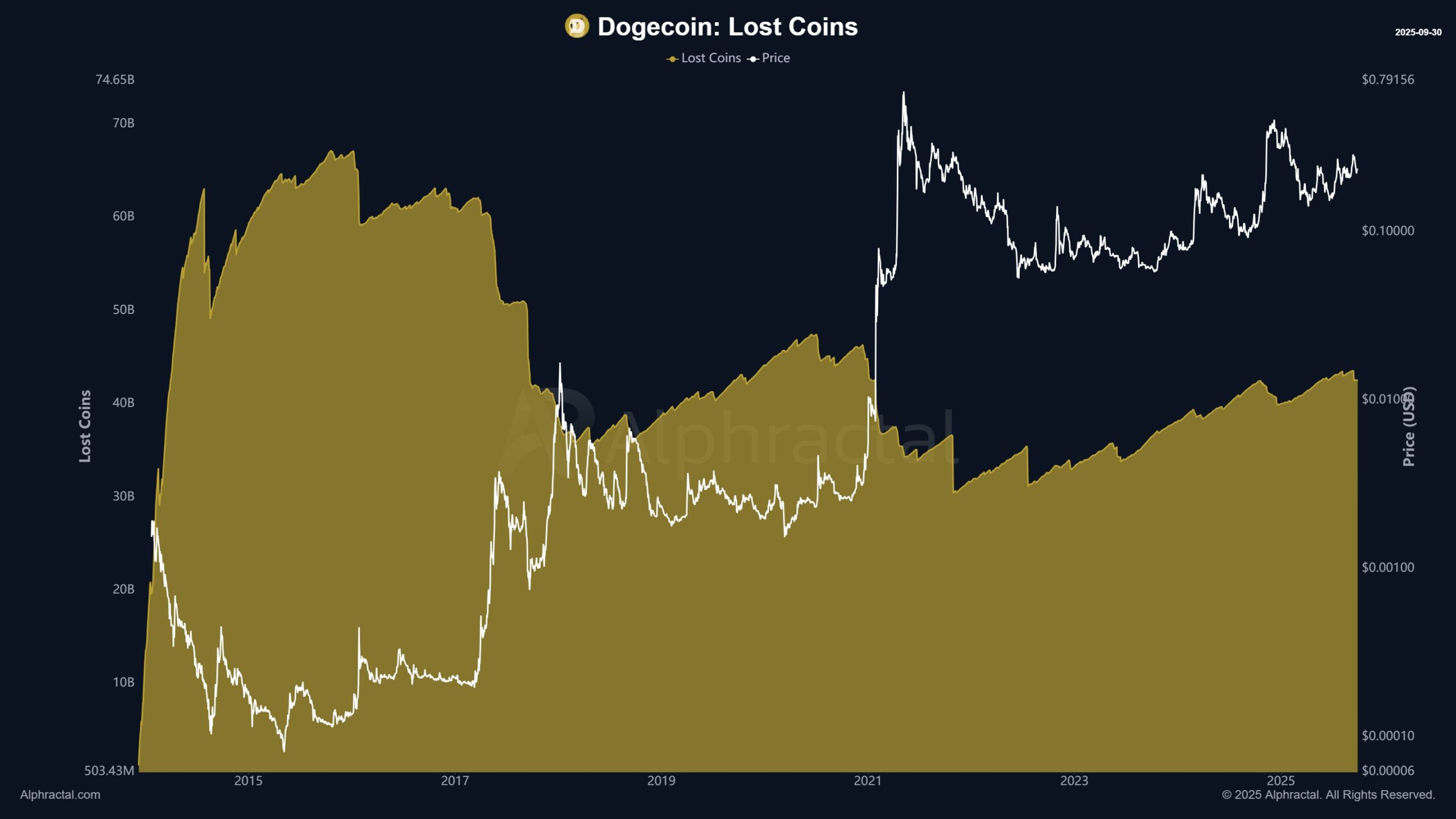

Dogecoin volatility is reflected in lost coins

Dogecoin presents the most unstable patterns. Memecoin’s lost coins surged early on, seeing a sharp decline with each change in price action into euphoria. However, the long-term trend is still upwards, meaning Doge’s share increase is idle. Given Dogecoin’s inflation supply model, permanently lost tokens serve as a subtle offset to new issuance.

Market signals from lost coins

Analysts often underestimate the role of lost coins in shaping supply dynamics. When the metric is rising, it usually indicates a lack of sales from the early wallet, often converting into sideways price action or even signs of the bear market situation. Conversely, during euphoric gatherings, some of these coins re-enter the circulation, adding liquidity and sometimes strengthening market volatility.

Alphractal’s data highlights how these hidden dynamics affect Bitcoin, Litecoin, and Dogecoin in a variety of ways. While Bitcoin appears to be stable at a dormant supply, Litecoin continues to accumulate untouched stocks, while Dogecoin swings more irregularly in response to price hype.

In short, the lost coin remains a quiet and powerful force in the market, shaping supply, emotions, and long-term price action.

The information provided in this article is for educational purposes only and does not constitute financial, investment or transaction advice. Coindoo.com does not recommend or recommend any specific investment strategies or cryptocurrencies. Always conduct your own research and consult with a licensed financial advisor before making an investment decision.