Please participate telegram A channel that stays up to date to break news coverage

Strategy co-founders Michael Saylor and Fundstrat CIO Tom Lee are among the heavyweights of codes meeting us today with lawmakers in the industry that expedites strategic Bitcoin reserve plans.

Eighteen crypto industry leaders, including Mara CEO Fred Thiel and Bitdia Harris Bass, will be taking part in a roundtable hosted by Digital Chambers and its affiliate, Digital Power Network.

The conference will focus on Senator Cynthia Ramis’ advances in the Bitcoin Act. It is designed to establish a strategic Bitcoin reserve in the United States and set rules for the acquisition and management of government-held Bitcoin.

After President Donald Trump proposed it during last year’s election campaign, it was hyped as a potential game-changer, and strategic Bitcoin Reserve initiatives slowed down, disappointing parts of the crypto industry.

The strategic Bitcoin Reserve represents a strategy for US digital hegemony in the 21st century. This presentation explains why Bitcoin is important for our country’s prosperity and how America becomes a global Bitcoin superpower. pic.twitter.com/5e6ppxsgzm

– Michael Saylor (@saylor) March 12, 2025

It will also be a meeting CleanSpark executives Matt Schultz and Margeaux are Plaisted and Mara’s Jayson Browder. Crypto-focused venture capital firm executives will also be present at Chain Capital and Reserve 1 executives.

Executives in the traditional financial space include David Fraguele of Western Alliance Bank and Jay Brusteen of Blue Square Wealth.

Bitcoin acts to set strategic Bitcoin reserve rules

The Bitcoin Act aims to formally establish a US strategic Bitcoin reserve for Bitcoin, and seeks to set rules for how Bitcoin is acquired, stored and managed.

As part of the law, the US will acquire 1 million bitcoins over five years, all of which will remain under the program for at least 20 years, except under special circumstances.

The law requires that Bitcoin be acquired in a budget-neutral manner. That means it should not be an additional cost for US taxpayers. Some of the funding strategies mentioned so far are the Treasury Gold Certificate and reassessment of tariff revenue.

.@secscottbessent Correct: The budget-neutral path to building an SBR is the way. Buying more Bitcoin won’t save our country from $37T in debt, but we can revalue gold reserves to today’s prices and transfer the increase in value to build an SBR.

The US needs the Bitcoin Act.

– Senator Cynthia Ramis (@senlummis) August 14, 2025

The Bitcoin Act is based on Trump’s March 6 executive order on “the establishment of strategic Bitcoin reserves and US digital asset stockpile.”

Under the president’s order, the US government will build strategic BTC preparations using Bitcoin held by the Treasury, which has been confiscated via criminal or civil assets.

The US government owns over 198k BTC

Data from Bitbo The US government suggests that as of December 15th last year, it holds approximately 198,012 BTC, primarily from law enforcement seizures.

The biggest seizures include Bitfinex Hack’s, Ilya Lichtenstein and Heather Morgan, whose 94,643 BTC was seized from the orchestrator of the Hack.

Another 69,370 BTC was seized from the Silk Road Marketplace and 15,085 BTC was seized from other Bitfinex hacks.

There is also 9,800 BTC seized from Jameszon. This was also related to the Silk Road.

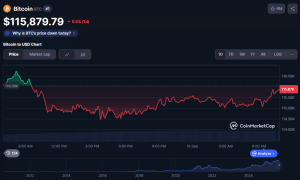

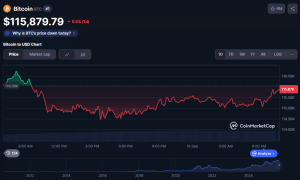

Bitcoin included trading As of 1:42am on EST, it was $115,879.79, with an estimated government holdings valued at over $22.93 billion.

BTC price chart (source: coinmarketcap))

The government’s Bitcoin holdings are estimated as there was no official disclosure of how much they actually held. According to Bitbo, some BTCs are either still sealed cases, either still in transit or not fully considered.

Related Articles:

Best Wallets – Diversify your crypto portfolio

- Easy to use, functionally driven crypto wallet

- Get early access to future token ICOs

- Multi-chain, Multi-wallet, Non-Antiquity

- Currently, the App Store and Google Play

- Stakes to earn Native Tokens

- Over 250,000 monthly active users

Please participate telegram A channel that stays up to date to break news coverage