important notes

- Strategy increases STRC’s monthly dividend to 10.5% from 10.25% last week.

- Bitcoin treasury firm reduced market cap by $20 billion as BTC fell 8%.

- Despite the losses, total Bitcoin holdings by financial institutions increased by 3,970 BTC in October.

Michael Saylor’s Bitcoin specialist Strategy has announced a 10.5% monthly dividend on STRC stock, demonstrating confidence in the company’s Bitcoin-backed financial structure. The move follows a positive third-quarter report in which the company announced a profit of $3.9 billion, a significant improvement from the $432.6 million loss recorded in the third quarter of 2024.

$STRC Interest rates rose to 10.50%. For people who like money. pic.twitter.com/iJ486GoNXS

— Strategy (@Strategy) October 31, 2025

The 10.5% dividend is an increase of 0.5% from last month’s 10.25%. In an October interview with Mark Moss, CEO of Satsuma Technology, a UK-based cryptocurrency and decentralized AI company, Saylor explained that STRC, MicroStrategy’s perpetual preferred stock, is overcollateralized by past Bitcoin profits to eliminate downside volatility.

The rise in dividend yield indicates that funding for further BTC purchases is being more aggressively pursued. According to SaylorTracker.com, the strategy currently holds a total of 640,808 BTC, with unrealized gains of $23.2 billion.

Bitcoin price falls 8% in October, Bitcoin treasury firm cuts $20 billion

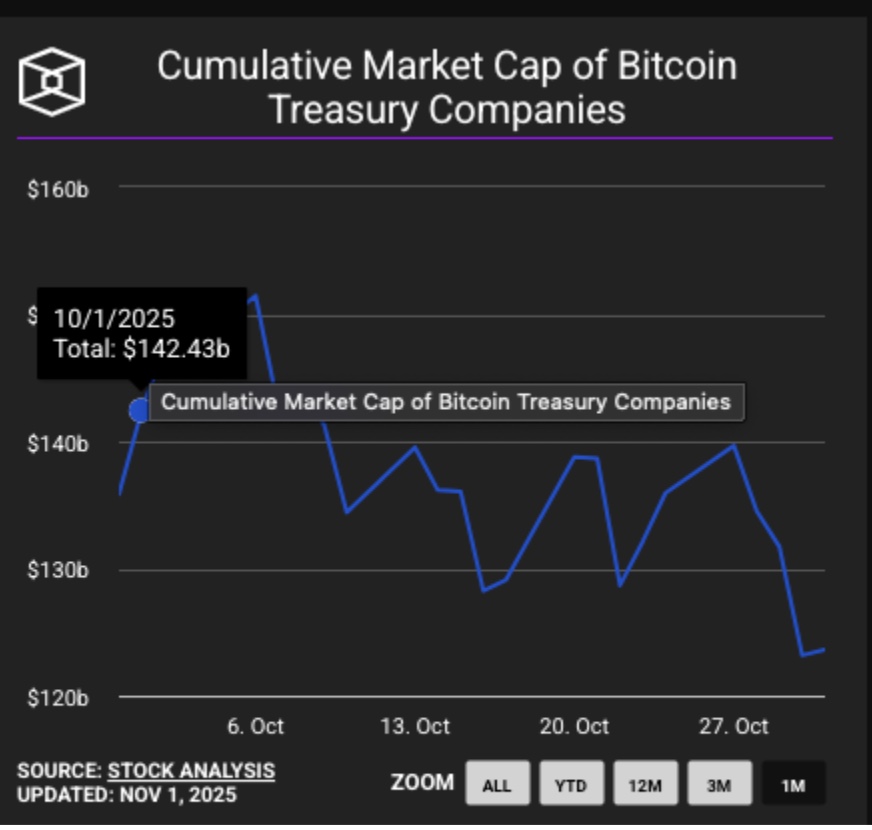

Bitcoin closed October at around $110,150, marking an 8% drop for the month and causing a sharp decline across Bitcoin treasuries. According to real-time data from The Block, the market capitalization of publicly traded Bitcoin government bonds fell from $142.4 billion on October 1 to $123.6 billion by October 31, a staggering $18.8 billion haircut, representing a 13% decline and nearly twice the price decline of Bitcoin itself.

Market capitalization of Bitcoin government bond companies decreased by $18.8 billion (13%) in October 2025 | Source: TheBlock

This shows that traditional investors are still sensitive to Bitcoin’s volatility. Cryptocurrency-exposed stocks such as Marathon Digital, Galaxy Digital, and Strategy all experienced double-digit share price declines in October.

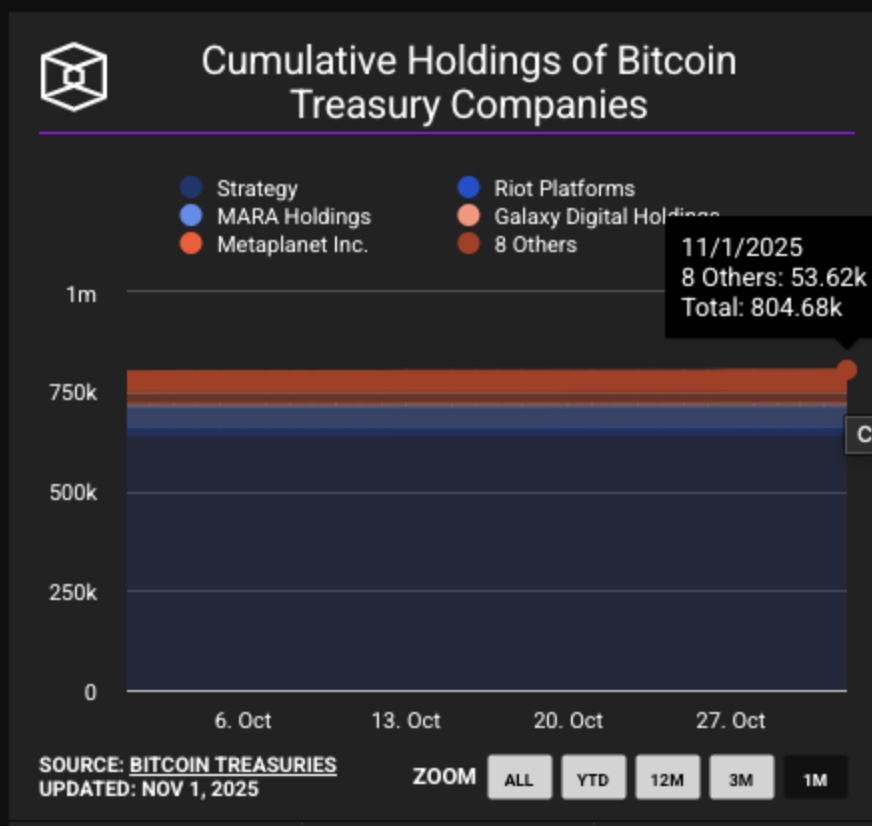

The total BTC held by Bitcoin Treasury increased by 3970 BTC ($437.8 million) in October 2025. Source: The Block

However, even the drop in stock prices did not stop the buying frenzy. The total amount of Bitcoin held by the Treasury increased from 800,710 BTC to 804,680 BTC, an increase of 3,970 BTC and was worth approximately $437.8 million at October’s closing price.

This countercyclical buying pattern reinforces the institution’s confidence in Bitcoin as a strategic financial asset, despite the Fed’s frugal policies and October’s disruption to the crypto derivatives market due to geopolitical factors.

Looking ahead, market leader Strategy’s aggressive intentions to increase liquidity for additional Bitcoin purchases could spur new entrants to sustain demand in November.

Early investors profit as Best Wallet presale approaches $17 million

Best Wallet (BEST) is a custodial crypto wallet designed to integrate multi-chain support and institutional-grade multi-signature protection.

With AI-powered features, the project aims to disrupt the $26 billion custodial wallet market.

best wallet pre sale

Best Wallet pre-sales are now over $16.8 million, marking one of the strongest early stage funding cycles of 2025. The token price is currently $0.026. Interested participants can access exclusive pre-sale bonuses through Best Wallet’s official website.

Next

Disclaimer: Coinspeaker is committed to providing fair and transparent reporting. This article is intended to provide accurate and timely information but should not be taken as financial or investment advice. Market conditions can change rapidly, so we recommend that you verify the information yourself and consult a professional before making any decisions based on this content.

Ibrahim Ajibade is an experienced research analyst with a background supporting various Web3 startups and financial institutions. He holds a Bachelor’s degree in Economics and is currently studying for a Master’s degree in Blockchain and Distributed Ledger Technology at the University of Malta.

Ibrahim Ajibade on LinkedIn