Important highlights:

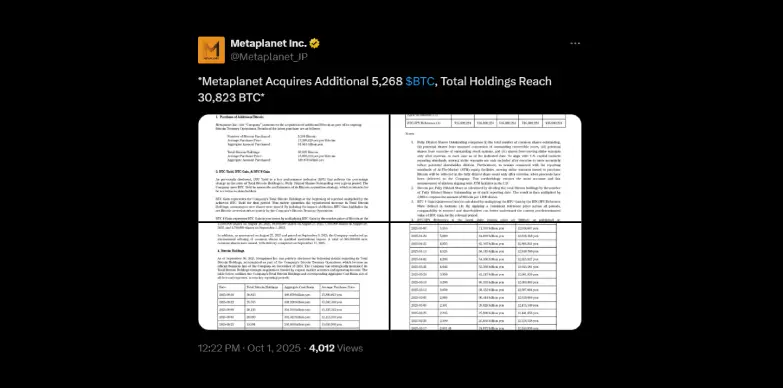

- Metaplanet acquired an additional 5,268 BTC on September 30, 2025, increasing its total holding to 30,823 BTC.

- Third quarter revenue reached July 2,438 billion.

- The operating profit forecast for fiscal year 2025 increased 88% to 4.7 billion yen.

Metaplanet Inc., a registered company in Tokyo, has acquired more Bitcoin to add to the BTC Ministry of Finance. The company acquired 5,268 BTC to the reserve yesterday, bringing a total of 30,823 BTC as of September 30, 2025. In addition to this acquisition, the company reported outstanding performance in its Bitcoin revenue generation business in the third quarter of 2025. This surge shows the increased value of Bitcoin’s position and the potential for revenue from Bitcoin-driven operations.

Metaplanet accelerates Bitcoin accumulation and moves towards its 2027 financial goals

The company’s goal is to hold 210,000 BTC by 2027. As mentioned above, due to the recent accumulation of 5,268 BTC, the company currently owns 30,823 BTC as of September 30, 2025. This number is approximately 15% of the 2027 target. From this information, it can be estimated that almost 179,177 BTC is required to achieve the set goals for the company.

Recently, last week, the company had acquired 5,419 BTC at an average price of around $116,724 per Bitcoin BTC at the time. This shows that the company is slowly and steadily accumulating bitcoin

Recent changes in stakeholders have also increased governance and support for these strategic investments. Such a move by the government will further boost confidence in Bitcoin’s growth plan.

This pace of acquisitions has made Metaplanet one of the top five Bitcoin holders worldwide, establishing himself as one of the leading corporate players in the Bitcoin market.

Strong Q3 Revenue Growth and Business Model

In the third quarter of fiscal year 2025, Metaplanet reported revenue of 2.438 billion yen from Bitcoin’s revenue generation business, showing an impressive 115.7% increase compared to the previous quarter. This growth demonstrates the increased efficiency and scale of the company’s Bitcoin financial operations.

Metaplanet’s business model has two main goals: The first of them is to generate stable revenue from Bitcoin price movements by steadily accumulating Bitcoin over the long term and selling options.

In order for the company to achieve this goal safely, the company divides its capital into two parts. Some are stored in cold storage for long term holdings. This cold storage ensures that your assets are secure, the other is used for aggressive transactions to generate revenue, the company’s second goal. This approach will allow the company to increase Bitcoin’s Treasury Department and earn consistent revenue.

Capital allocation and strategic strengthening

As of September 10, 2025, Metaplanet had allocated 2041.2 billion yen to Bitcoin’s revenue generation business. This capital is separate from the long-term Bitcoin Holdings. It also manages the flexibility to adapt to changing market conditions.

The company is also said to have added strategic partners to support growth. Future plans include plans such as issuing permanent preferred shares.

Management focuses on using capital wisely and effectively implementing it to generate shareholder value, with Bitcoin Treasury operations as a major driver of the company’s growth.

Revised full year revenue forecast

Metaplanet has doubled its 2025 revenue forecast to 6.8 billion yen, according to revised details shared by the company today. Operating profit was also increased to 4.7 billion yen. This is the result of the company’s Bitcoin revenue generation business. Segment revenue is currently forecast at 6.3 billion yen, an operating profit of 6.2 billion yen has increased from previous forecasts.

The CEO highlights strategic growth and Bitcoin leadership

CEO Simon Gerovich said the company’s main focus is building a scalable Bitcoin Treasury and revenue business. Recent revenue growth shows that their current strategy is in favour of the company. The company plans to expand its team and infrastructure using initiatives such as permanent preferred stocks to increase shareholder value. Metaplanet’s leadership in Bitcoin financial management positions it for continued growth in a rapidly changing market.

Also Read: SEC opens doors for state trust as a custodian of crypto