40 minutes. This is all Hedera, which is scheduled to ship the latest mainnet upgrades, hit the window at 17:00 UTC on September 24th. The network marked the work perfectly without lingering incidents and turned it into a testnet cutover the next day.

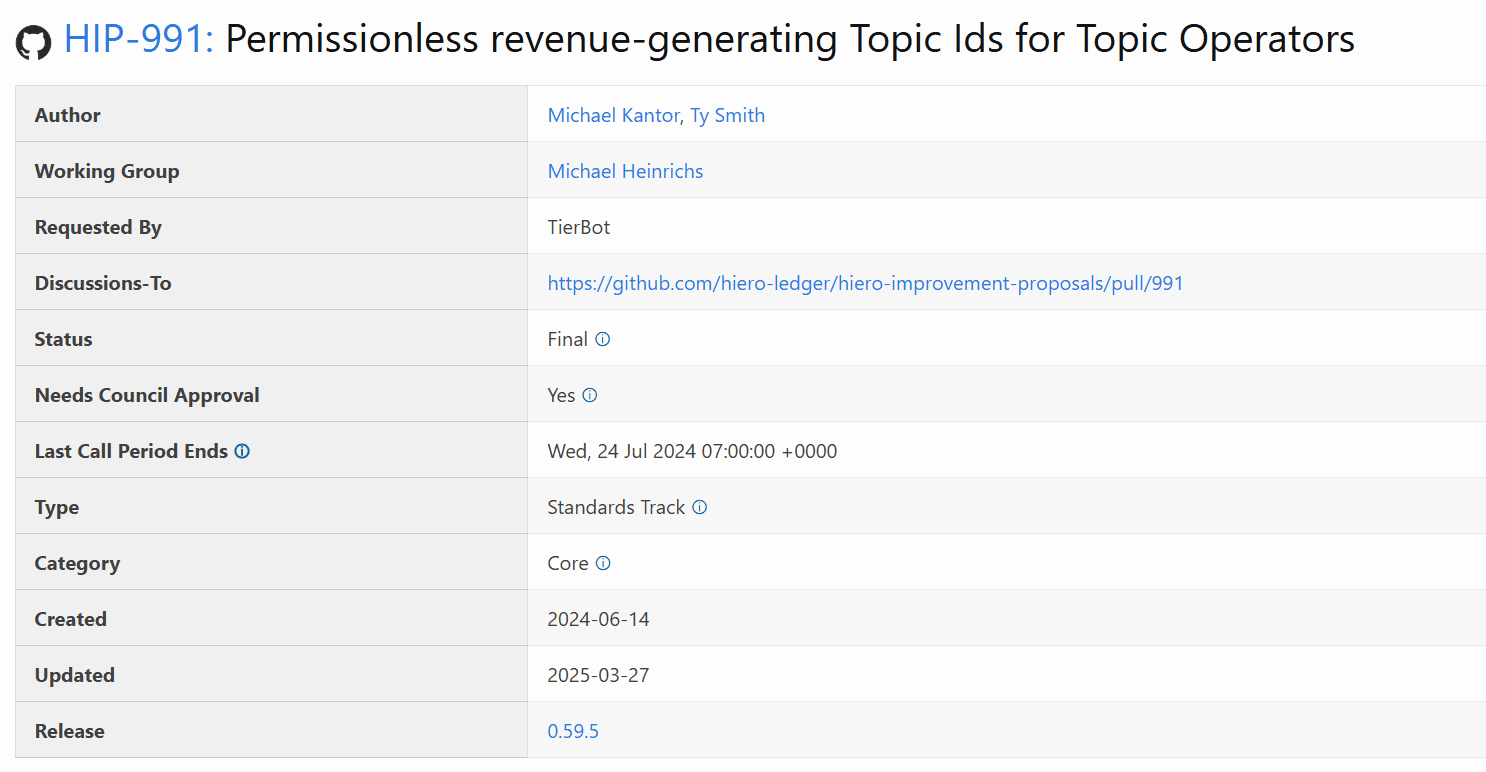

Mainnet V0.65: Short window, clean cutover

Hedera set up a maintenance window for the V0.65 MainNet upgrade on Wednesday, September 24th, approximately 40 minutes. The status page flagged possible service destruction with nodes restarted and applied.

After the window, the Hedera status feed confirmed V0.65.1 completion. The update was closed without notice after an upgrade of an incident regarding public history. Operation cadence remained stable throughout the week.

The release sequence focused on reliability rather than market features. Hedera highlighted predictable execution and record hygiene, and set stages of subsequent network iteration. Hedera

Something strange under the hood

Version 0.65 introduces a virtual megamap to streamline state management. The documents also highlight blockstream improvements that integrate records and improve future compatibility. These changes target the cleaner data flow in nodes and explorer.

Seriously, an upgrade is forced max_custom_fee Limitations tied to HIP-991. That protection allows users to limit custom fees on supported transactions. If the transaction exceeds CAP, it will fail with the correct error.

Together, these items reduce operational surprises for the DAPP team. It also coordinates fee behaviors between scheduled transactions and services that rely on topic interactions.

TestNet V0.66 will land on September 25th

The day after work on the mainnet, Hedera scheduled a testnet upgrade to V0.66 on Thursday, September 25th at 17:00 UTC. Like MainNet, the window was called for about 40 minutes, warning of intermittent confusion.

Hedera later marked changes to the testnet as completed in public history. Quick Follow-On maintains an environment and test environment that is consistent with the newly implemented rules.

For developers, continuous cadence shortens the gap between production capabilities and test cycles. Teams can verify touring and record processing with V0.66, and MainNet runs V0.65.

Does hbar form near the key structure?

According to Cryptopulse, HBAR is narrowing its well-defined support zones and trendlines. The chart shows a series of lower highs that were pushed into previous demand blocks of momentum that had been accelerating before. Therefore, liquidity concentrates in this region as orders from previous trading clusters at the same level.

Furthermore, the structure is similar to the late aperture: the candle contracts for support, while the guide on the downward resistance line lowers supply. This setup often forces decisions as the buyer defends the zone and the seller tests it. As a result, a quick rejection on a short sweep under the box or trendline is not uncommon before the direction is resolved.

Analysts add that low frame patterns are important now. Traders usually monitor disruption and retest actions, momentum gains, or failures to confirm bias. However, invalidation is right next to the demand box, and acceptance below will shift focus to the next historical support and delay attempts at recovery.

HBAR volatility is compressed near the lower bollinger band

HBAR/USD is currently trading along the lower Bollinger band, with a slight decline in SMA over the 20-day period. That position means that the price is located near two standard deviations of the recent below average. The bandwidth is about 21.7% ((0.26–0.21)/0.23) of the medium price, so volatility increases, but not extreme. When the candle “rides” into the lower strip, the seller controls momentum. However, the band also frames where the average return often begins.

This is what it means. If the candle expands back onto the central band (20-day SMA), the movement indicates a shift from defense to stabilization. The first objective is to maintain the SMA in retest. Closures on maintained closures often move prices towards the upper band. Conversely, fresh closes below the lower band with the continued risk of heavier volume marks. In that case, traders are looking for quick reclamation inside the band. Otherwise, the downswing will usually be extended until the base is formed.

Next thing to monitor. Note the volatility cue: further band tightening usually precedes a sudden expansion movement, but band expansion confirms already ongoing movement. Track the volume of any band break. An expansion without volumes often returns to SMA. Finally, before assuming trend changes before looking for a check of momentum in lower time frames, such as low time, bullish, or failed failures near the band edge.

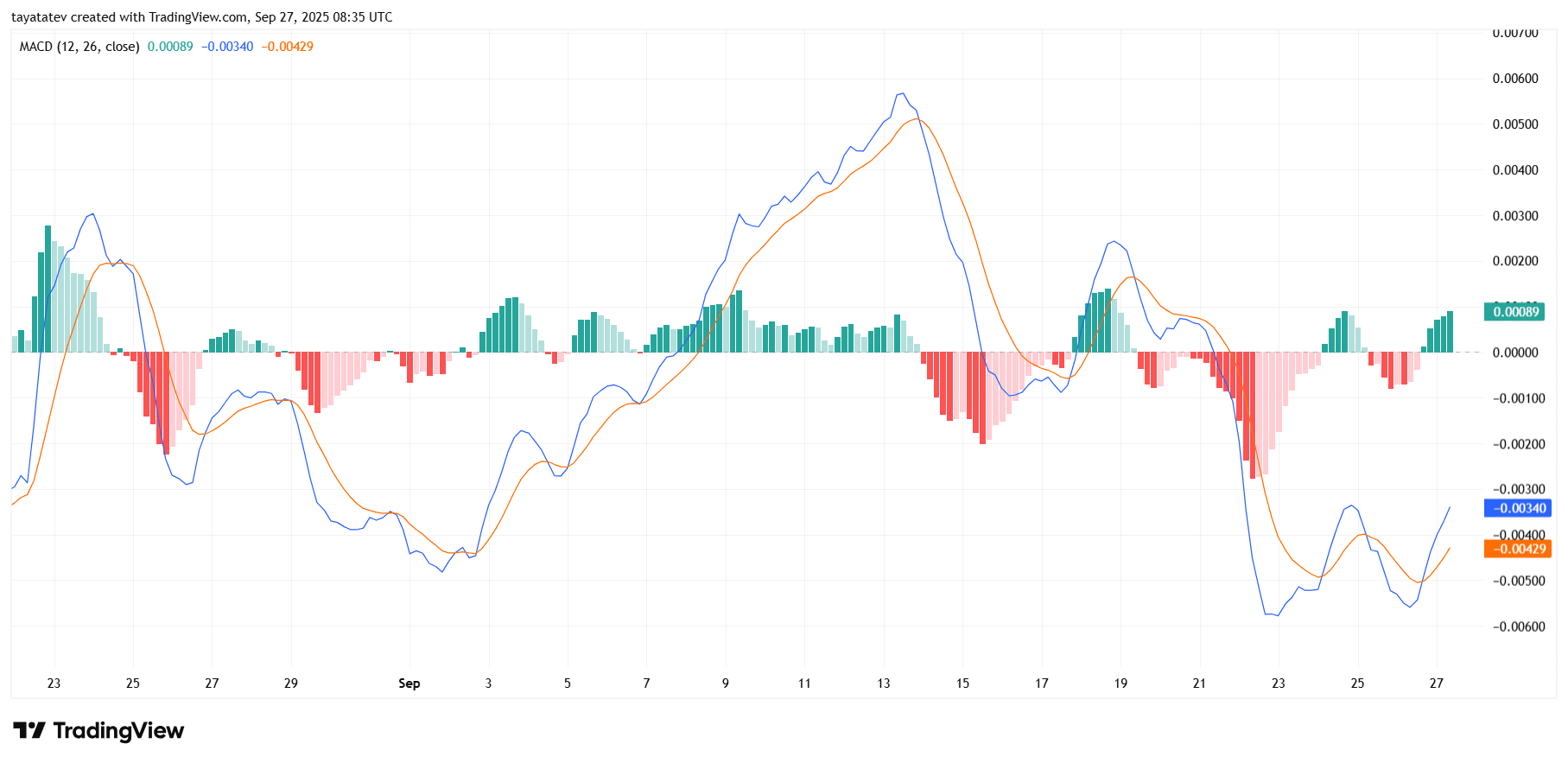

Will the HBAR MACD flip into a modest bullish cross?

MACDs (12,26,9) are both below zero across the signal line. The histogram tested positive (~0.00089), indicating that momentum improved after the sale in late September. However, since the cross occurred under the zero line, it reads as an early recovery signal rather than a confirmed uptrend.

Next, take a look at our follow-through. If the MACD continues to rise and the histogram expands, the price momentum is usually carried towards the zero-line test. A clean move above zero reinforces cases where the signal line is rounded behind it, causing the seller to lose control and a new upward direction could occur.

The risk still sits with the failed cross. If the histogram is stopped or negated and MACD rolls back under the signal line, the setup will be converted to a “bearish reset” under zero. In that case, momentum could retest recent lows before durable base foam.