Link prices are under pressure until September, sliding into the bear market, temporarily touching on the lowest point since August.

However, signs of turnaround appear. With cup and handle patterns formed, link strategic bookings expand and institutional momentum built up firmly, Link Crypto may be preparing for a critical rebound.

Link prices supported by strategic reserves

An important development that cushions link prices is the strategic link reserve. Since early August, it has accumulated over 371,000 link coins, worth around $8 million with an average cost of $22.49.

These reserves are created by redirecting on-chain and off-chain fees directly to the purchase of linked tokens.

This strategy is important. This is because the demand for Link Crypto is closely linked to adoption. As ChainLink’s network increases, fees are expected to rise, which increases the accumulation of reserves.

Stable accumulation not only supports the link price prediction narrative, but also shows solid trust in long-term value creation.

ETF predictions add fuel to the story

As AltCoin ETF speculation intensifies, the Link Price Chart may also be in line with momentum. The Grayscale and Bitwise Link ETF proposals are under review by regulators. This is a development that will attract US investors and further institutionalize the demand for ChainLink Crypto.

Recent data confirms the growing interest in Altcoin ETFs as products such as Ethereum, XRP, Solana and Dogecoin have already experienced a strong influx.

If Link Price USD receives similar regulatory traction, it could unlock new stages of market participation. This is in line with the broader expectations of increased demand for actual asset tokenization, the area where ChainLink places itself as a leader.

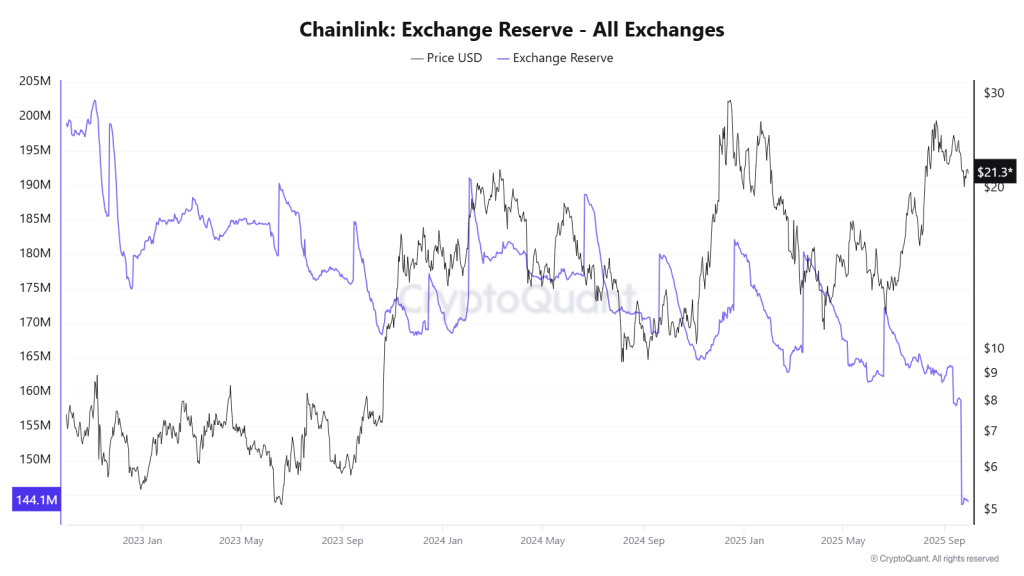

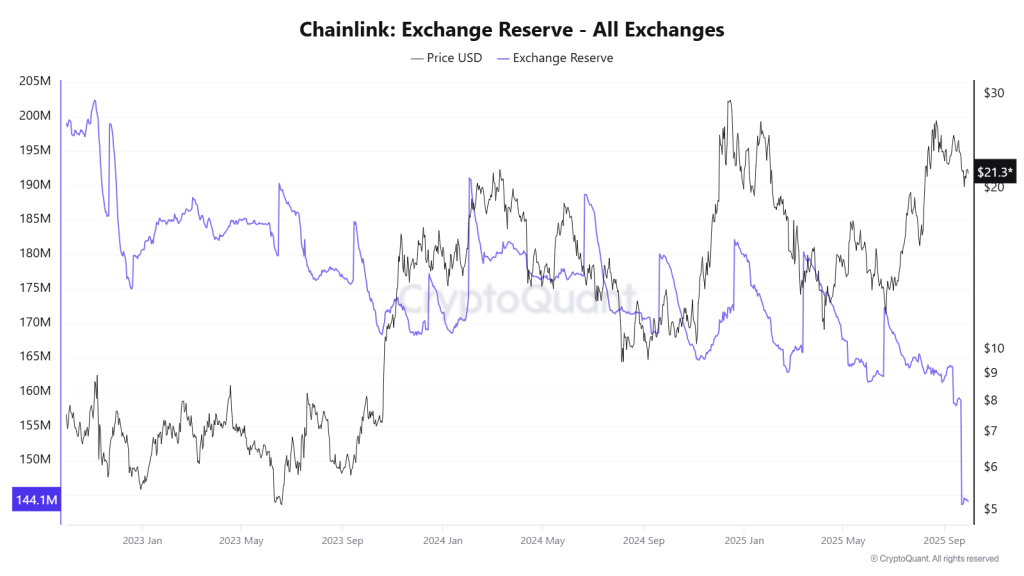

Supply shock and investor accumulation

Another factor that could potentially drive link price forecasts is the rapid decline in exchange reserves. In just 30 days, investors’ wallets absorbed 20 million linked tokens.

Such structural changes, often seen as a precursor to supply shocks, indicate increased confidence from larger players.

The decline in available supply coincides with broader institutional headlines. This convergence suggests that today’s link prices could enter a period in which demand significantly outweighs immediate supply and creates conditions favorable for upward movements.

Swift Ledger and Institutional Partnerships

Similarly, another optimistic news built up the momentum of Link Crypto, strengthened at the SIBOS 2025 conference when Swift announced plans for a blockchain-based shared ledger built with more than 30 major banks, including Consensy and JPMorgan and HSBC.

The announcement was a very bold move and quickly rekindled interest in chain links given its role in filling blockchain infrastructure.

Even ChainLink itself highlighted the corporate action initiative on X, which confirmed the news that it actually expanded to 24 global financial institutions, including Swift, ANZ, Schroders and Zürcher Kantonalbank. These partnerships add reliability linking price forecast expectations by demonstrating real-world adoption and institutional trust.

Technical Outlook: Link Price Forecast

Technically, Link Price formed a cup and handle pattern. This is a structure that is often associated with bullish reversals.

If the $20 floor remains held, the next potential target is around $28, indicating midrange resistance.

Beyond that, the broader rising channels established since 2023 still constitute a long-term trend.

Under this structure, if momentum continues, USD’s link price could be extended towards a resistance of nearly $47, suggesting room for significant profits in the coming months.