The ongoing US federal closure continues to affect financial markets, with traditional, secure inventory assets gaining traction and prominent activity in the cryptocurrency market. Bitcoin rallied at two-week highs in investor attention, but the flow to Spot Bitcoin ETFs highlights the growing mainstream interest in digital assets as independent hedges. As the closure continues, traders are closely watching the short-term changes and long-term impacts on the evolving relationship between cryptocurrencies and traditional financial products.

- Rising risk aversion: The 10-year Treasury yields drop as investors seek security amidst government uncertainty.

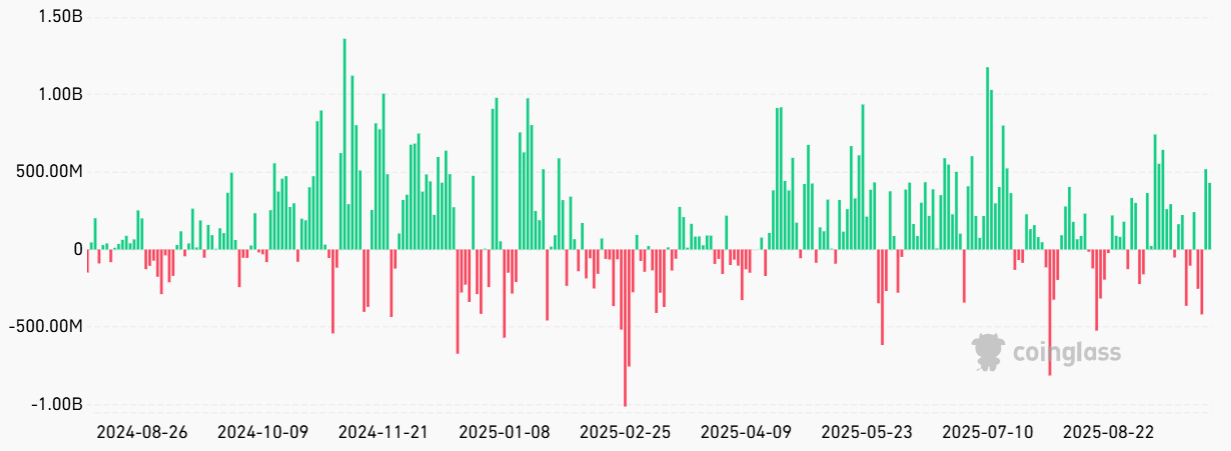

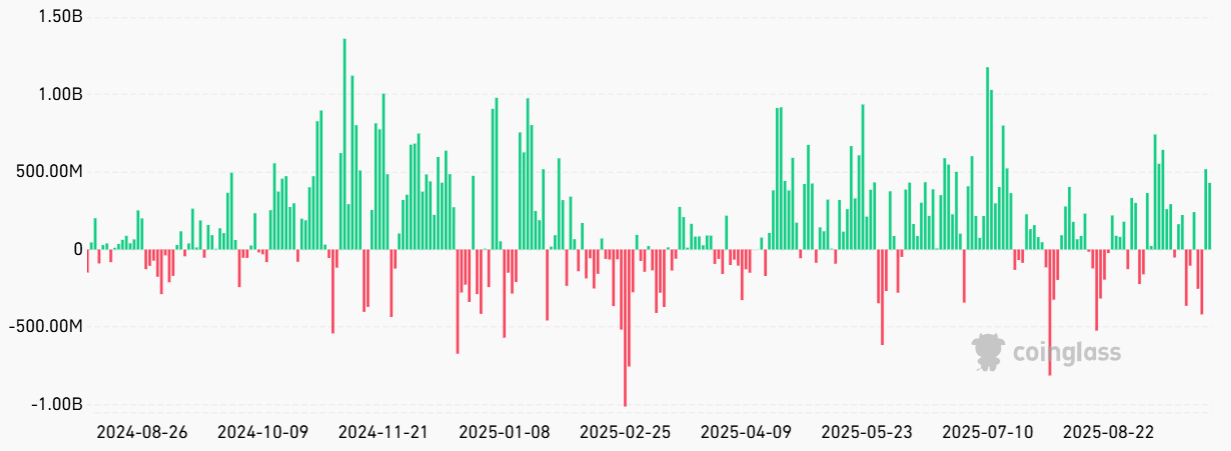

- Surge in cryptocurrency: The Spot Bitcoin ETF sees an influx of $430 million, indicating an increase in institutional profits and an increase in independence from stocks.

- Traditional assets are strengthened: Gold prices have reached record levels, reflecting the classic safe haven investment rally.

- Historical background: Previous closures have had different impacts on Bitcoin and the stock market, raising questions about future market reactions.

Bitcoin (BTC) surged to two-week highs on Wednesday, supported by an escalation of US federal government shutdowns. Unlike traditional stocks that showed minimal immediate response, the cryptocurrency market showed resilience, with inflows into Spot Bitcoin Exchange Trade Funds (ETFs) reaching $430 million. This suggests increased investors’ confidence in the role of Bitcoin as a hedge in an era of geopolitical and economic uncertainty.

Meanwhile, traders flock to traditional safe seafarer assets, pushing forward the Treasury yields for 10 years, showing preference for low-risk assets amid declining financial negotiations. Gold prices have skyrocketed to a record record of $3,895 per ounce, highlighting the strong demand for the preservation of traditional wealth amid economic turbulence. Apparent flights to safety highlight classic risk-off environments that affect both traditional markets and crypto assets in different ways.

Bitcoin’s past response to government closures

Bitcoin fell 9% in December 2018 during the last major government shutdown. However, this decline was relatively modest compared to the broader stock market correction, which began 10 days ago and was eventually revised around 12%. Despite Bitcoin’s temporary DIP, investors who held it throughout this period look at net profits and show their new role as an alternative asset class.

During that period, Bitcoin prices fell from about $3,900 to $3,550 amid rising regulatory concerns, particularly the implementation of stricter money laundering measures by the Financial Action Task Force (FATF). The development of these regulations has increased uncertainty and contributed to the unstable crypto market. This has since matured significantly, attracting institutional investors and further distanced themselves from purely speculative trading.

The current environment suggests that Bitcoin can continue to benefit next month as government uncertainty persists. The influx of institutional capital into Bitcoin ETFs and separation from stocks into potential long-term changes as digital assets pose a more independent role in the global financial ecosystem.

It has nearly $147 billion managed by Bitcoin ETFs, measured against traditional assets such as gold, which commands more than $460 billion in ETF assets. This is increasingly recognised the potential of cryptocurrency as a hedging asset. As debates over regulatory clarity continue and investors’ profits increase, it suggests that Bitcoin’s resilience during periods of economic or political stress remain a key asset for diversifying portfolios amid uncertainty.

The purpose of this overview is to provide a comprehensive understanding of recent market development, including cryptocurrencies and traditional finance. This does not constitute financial advice or support any particular investment measures. Readers should conduct their own research or consult with a financial advisor before making an investment decision.