Reasons to trust

Strict editing policy focusing on accuracy, relevance and fairness

Created by industry experts and meticulously reviewed

The highest standard for reporting and publishing

Strict editing policy focusing on accuracy, relevance and fairness

Morbi Pretium leo et nisl aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque Nec, ullamcorper eu odio.

Español.

Bitcoin continues to try to violate the $95,000 barrier as it seeks metrics that investors may actually do so. Digital money has failed to violate this level of resistance since last Friday, market data reveals.

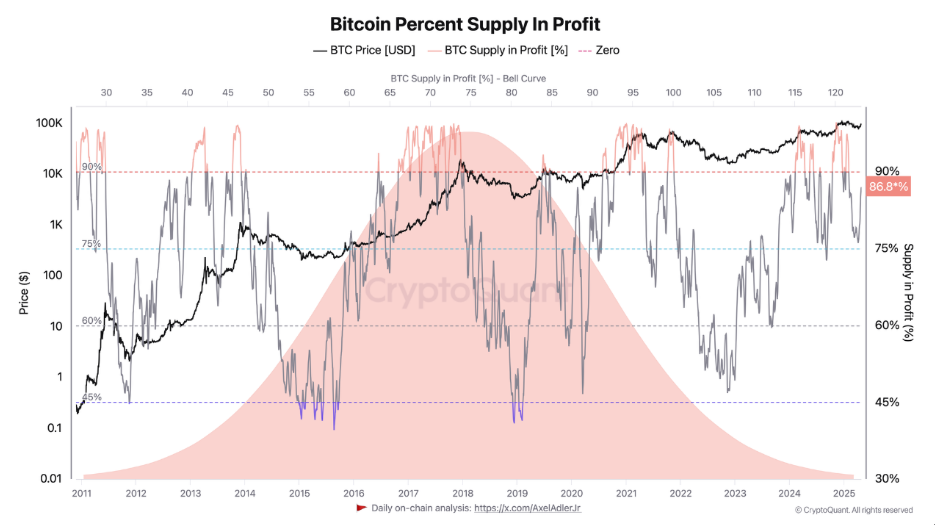

Yet despite this tension, a very impressive 91% of the total Bitcoin supply is included in black, reflecting what market strategists call the “happiness stage” of market activity.

Related readings

Profits will skyrocket as the market recovers

The majority of profitable Bitcoin holdings are currently undergoing a recent market recovery, according to data from analytics firm Cryptoquant. Tech expert DarkFost points out that when profitable Bitcoin supply exceeds 90%, it generally represents the last stage of a bull market.

During this phase, a large price increases normally before any modifications are made. During the recent price decline, profit supply has fallen almost to 75%. This is believed to have a potential to cause widespread sales if analysts violate it.

Market pressure on holders will be eased

The current context provides room to breathe for the Bitcoin holder. As the majority of their holdings are profitable, investors are not forced to offload coins during times of market uncertainty.

This drop in pressure could help maintain the price stability of Bitcoin near the $95,000 level and earn steam for future upside potential. According to various experts, this period of decline in sales pressure tends to lead to important price actions in the cryptocurrency market.

Analysts project $250,000 in Bitcoin whenever possible

Some institutions have made price predictions for some well-known Bitcoin. Standard Chartered predicts cryptocurrency will reach $120,000 by the second quarter of 2025.

Other market analysts are forecasting higher prices in the $200,000-$250,000 by the end of the year. These are some of the hard-to-break predictions just below the psychological $95,000 mark of $95,000, as Bitcoin is trading at $94,900.

History shows attention that follows happiness

Although the market mood today is positive, encryption warns that history shows patterns of revision after these periods of happiness.

Historical data from past Bitcoin Bull cycles suggest that after such a high profitability period, a corresponding large price drop usually occurs.

Related readings

In previous cycles, the percentage of Bitcoin supply in profits fell to about 50% at the time of these revisions. This is a characteristic of the Bear Market situation.

The euphoric phase is not permanent. Ki Yun, the encrypted CEO, usually lasts from three to 12 months when the correction action begins.

The ongoing Bitcoin cycle has witnessed consistent growth over the past few months, driving profitable percentages of holdings to a level that shows both opportunity and attention.

As investors observe resistance levels of $95,000, many ask whether history will repeat itself with another epic price surge before the final revision.

With 91% of Bitcoin currently profitable, the market is at a key point in challenging both bullish forecasts and historical trends over the coming months.

Gemini Images, TradingView charts