Please join us telegram Channels where you can get the latest information on breaking news

Jim Chenos confirmed that his investment firm, Kynikos Associates, has exited a short position in Michael Saylor’s strategy, but one analyst said the move could signal the end of the bear market for Bitcoin Treasury firms.

Chanos, the best veteran investment manager He, who is known for shorting Enron before its collapse in 2001, said the move comes after Strategy’s stock price has fallen 50% from its peak and its market net asset value (mNAV) has now been compressed to 1.23 times.

We have received several inquiries, so we would like to confirm that they have been cancelled. $MSTR/Bitcoin hedge trading as of yesterday’s open. pic.twitter.com/lgrWNy35H8

— James Kanos (@RealJimChanos) November 8, 2025

Strategic premiums are expected to compress further

The implied premium, which is MSTR’s enterprise value minus the value of its 641,205 BTC reserves, has decreased from about $70 billion in July to $15 billion now.

In a screenshot of a memo sent to investors shared on X, Chanos said the company expects Strategy’s premium to further compress as the Bitcoin treasury company “continues to issue common stock.”

However, he recommended “letting other traders chase the final leg of the trade as MSTR inevitably moves towards 1.0x mNAV.”

Analyst says Bitcoin Treasury bear market is nearing an end

Pierre Rochard, CEO of Bitcoin Bond Company, responded to Chanos’ post: said “Bitcoin treasury company bear market is gradually coming to an end.”

“We expect continued volatility, but we hope this signals a reversal,” he added.

I don’t think that’s a sign that the bear market is over. It was a spread trade. A loss in strategy premium is a bearish signal. Perhaps the next one indicates that there is a discount.

— Peter Schiff (@PeterSchiff) November 9, 2025

However, Bitcoin Perpetual Bear Peter Schiff disputed Rochard’s post, saying it does not signal the end of the bear market.

company dHe said the fall in premiums is “a bearish signal,” adding that it “likely signals that discounting is next.”

Rochard immediately fired back.

“With all due respect to Mr. Schiff, please forgive me for putting you in the opposite signal bucket with Mr. Cramer given your track record of being bearish on Bitcoin since 2011,” he said.

Saylor suggests buying with a different strategy despite MSTR downtrend

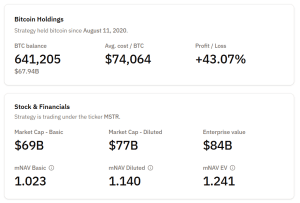

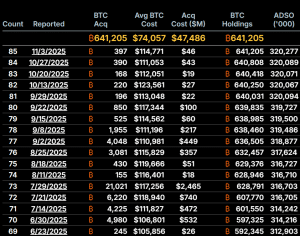

Strategy began purchasing Bitcoin in 2020 as part of its corporate financial planning and is now the world’s largest digital asset treasury (DAT) company, with its BTC holdings valued at more than $67 billion, according to the Bitcoin Treasury.

Strategy BTC holdings (Source: Bitcoin government bonds)

The company has unrealized profits of over 43%.

Strategy to double your Bitcoin

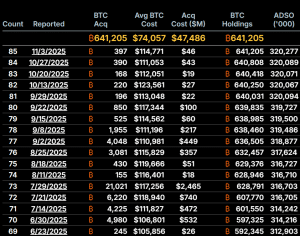

Despite stock prices plummeting, Strategy has continued to add to its Bitcoin reserves in recent weeks, albeit at a slower pace than at the beginning of the year.

Recent strategies for BTC to buy (Source: strategy)

in post Yesterday, Strategy founder Michael Saylor posted a screenshot of a SaylorTracker chart with an X and the caption “₿est Continue.” SSimilar posts by Saylor are always followed by new BTC purchase announcements.

Related articles:

Best Wallets – Diversify your crypto portfolio

- Easy-to-use, feature-oriented crypto wallet

- Get early access to upcoming token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now available on App Store and Google Play

- Stake and Earn Native Tokens $BEST

- 250,000+ monthly active users

Please join us telegram Channels where you can get the latest information on breaking news