Please join us telegram Channels where you can get the latest information on breaking news

Italian banks say they support the European Central Bank’s (ECB) efforts to introduce a “digital euro” but want to spread the costs of the project over time.

“We are in favor of a digital euro because it embodies the concept of digital sovereignty,” Marco Elio Rottini, general manager of the Italian Banking Association (ABI), said at a press seminar in Florence.

“However, the cost of the project is very high given the capital expenditures that the bank has to sustain,” Rottini said, adding that these costs “may be spread out over time.”

ECB aims to strengthen European region’s monetary sovereignty

The ECB is working on a digital version of the euro to strengthen the EU’s monetary sovereignty.

With the proposed digital euro, the ECB seeks to ensure central bank funds remain accessible and relevant in an increasingly digital economy. At the same time, the ECB also wants to reduce its dependence on non-European payment service providers as a direct response to the rise of stablecoins.

A digital euro complements banknotes and extends the benefits of cash into the digital realm. This is important because euro cash unites us.

Europeans will be free to use the digital euro for all digital payments, online and offline, across the euro… pic.twitter.com/XzNZbl6mD8

— European Central Bank (@ecb) October 31, 2025

However, the legislative process for a proposed central bank digital currency (CBDC) has struggled to gain traction as some banks, particularly in Germany and France, oppose the idea.

They argue that a digital euro could lead to a massive liquidity drain of bank deposits as people start using the ECB’s online wallet for daily payments.

Recently, the ECB Executive Board decided to take the Digital Euro project to the next stage. This is the result of two years of preparation.

According to the report, launch is scheduled for 2029, following a test phase in 2027, but is subject to the adoption of EU legislation, expected in 2026.

Scaled-down version of CBDC proposed to accelerate deployment

The evaluation of the digital euro is being led by Fernando Navarrete, a member of the European Parliament from the Spanish People’s Party.

On October 28, he introduced a draft report promoting a scaled-down version of the system that would protect private payments initiatives such as Wero.

“We support a twin approach of a central bank digital currency and a commercial bank digital currency that could develop faster, because what Europe should not do is be reactive,” Rottini said.

US Federal Reserve chief says US policy needs to keep up with stablecoin growth

The ECB’s digital euro initiative comes amid a boom in the stablecoin market, ignited by President Donald Trump’s signing of the US GENIUS Act in July.

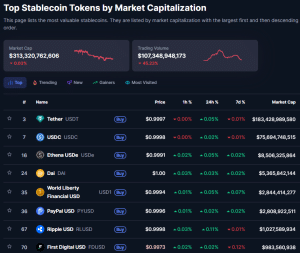

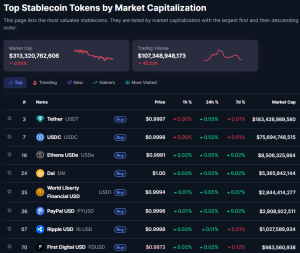

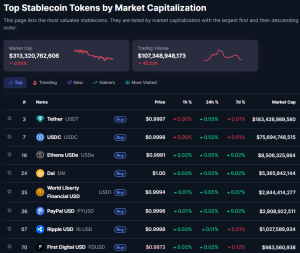

Stablecoin market overview (Source: coin market cap)

According to CoinMarketCap, the market capitalization of the stablecoin market has soared to $313 billion. Leading the market are tokens pegged to the US dollar, such as Tether’s USDT and Circle’s USDC.

Federal Reserve Governor Stephen Millan says widespread adoption of stablecoins will Policy-making needs to keep up with the rapid growth of the market.

Related articles:

Best Wallets – Diversify your crypto portfolio

- Easy-to-use, feature-oriented crypto wallet

- Get early access to upcoming token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now available on App Store and Google Play

- Stake and Earn Native Tokens $BEST

- 250,000+ monthly active users

Please join us telegram Channels where you can get the latest information on breaking news