World Chain has turned on the cross-chain rails on the chain link today. Canton, the institution’s blockchain, has also promoted Chain Link to a “super validator.” Together, they will expand the reach of chain links across consumers and regulatory networks within two days.

World Chain adds CCIP and CCT to WLD

WorldChain adopted ChainLink’s Cross-Chain Interoperability Protocol and WorldCoin’s WLD’s Cross-Chain Token Standard. The launch allows native transfers between the world chain and Ethereum while standardizing the way tokens cross the chain. ChainLink said the data stream was also published to provide market data.

The CCT standard is important as it allows teams to convert existing ERC-20 tokens into cross-chain native assets under the CCIP security model. This approach reduces the work and operational risks of bespoke bridges for developers who want a single audit pattern for network-wide movement. It also streamlines user flow between L2 and Ethereum.

World Chain and Chain Link have amplified social channel updates and called for the status of WLD as a CCT-enabled asset. The post was a production-based data stream that was placed side by side with CCIPs in the same stack, not pilots.

Canton Name Chain Link Super Validator

Canton Network has launched a strategic partnership with ChainLink and integrated data streams, “SmartData” services such as Proof of Reserve, Navlink, and CCIP. The network also participated in the ChainLink scale program. This offset Oracle costs during early growth. The goal is for tokenization and payments in regulated settings.

Under this agreement, ChainLink Labs will become a super validator who will participate in Canton’s global synchronizer ordering cross-domain transactions. Its role is located near the network’s core time order and final layer, supporting multi-use workflows across permitted domains. Canton and ChainLink highlighted these responsibilities in their coordinated posts.

Trade and market infrastructure outlets have presented partnerships as a way to speed up bank and asset manager pilots on rails that provide privacy. A scale that covers some of the data service costs allows agencies to test proof of reservations without feeding, cross-chain messaging, and severe initial overhead.

The backup proof will be published for ETP collateral

Deutsche Börse Group’s Crypto Finance has turned on NXTAssets’ physically backed Bitcoin and Ethereum ETP chain link spare proof. Preliminary data adjusted by the ChainLink runtime environment is published on Arbitrum for public verification. The companies described this as a live development that allows for independent checks of backing versus debt.

Industry coverage highlighted that models are writing proofs on the chain and will publish them for investors, auditors and counterparties. Arbitrum’s post amplifies that reserves will be visible via a certification on the ChainLink spare page, improving the auditability of listed products. The focus remains on transparency rather than secondary market trading.

Additional summary recorded collaboration details (Issuer nxtassets, Custodian Crypto Finance, Chainlink Oracles) and deployed within a wider movement to standardize the proof of tokenized equipment. This update will add capital market use cases this week along with consumer and enterprise chain news.

Why is it important now?

With today’s global chain launch, CCT operates in large user environments, turning WLD into a natively transferable cross-chain token. Package CCIP and data streams into the same deployment, reducing the fragmentation of apps that require both token movement and market data.

Yesterday’s Canton Deal will embed chain links within permitted networks targeting regulated finance. The economics of super validator roles and scales aim to reduce barriers for pilots requiring standardized data, cross-domain messaging, and auditable reserves.

Meanwhile, preliminary evidence from crypto finance and NXTASSETS brings on-chain verification to traditional wrappers. Once the preparatory data is published to Arbitrum, the move extends ChainLink’s footprint from consumer L2 to ETPS listed as institutional infrastructure, not touching token prices.

Analysts flag link weekly triangle breakout passes

Crypto analyst Ali says a pull back to $16 on ChainLink will be a “gift”, claiming the link remains in the big weekly triangle pointing to a breakout scenario. In his post, he mapped the measured movements that project into $100 if momentum is carried beyond the top of the pattern.

His charts permanently track Binance Link-USDT in a weekly time frame, where the 2022 trendlines converge the triangle-forming trendlines. He plotted the dotted path leading after a clean break above the upper boundary, as there are provisional reference zones around 0.786 and 1.0 Fibonacci levels before the 1.272 extension of nearly $100.

Setup means two technical checkpoints. It’s about holding an upward trend line that crosses near $16 and closing beyond a downward resistance near $20. This illustration frames $16 as potential support within the structure and displays rising milestones that match previous reaction areas on the weekly chart.

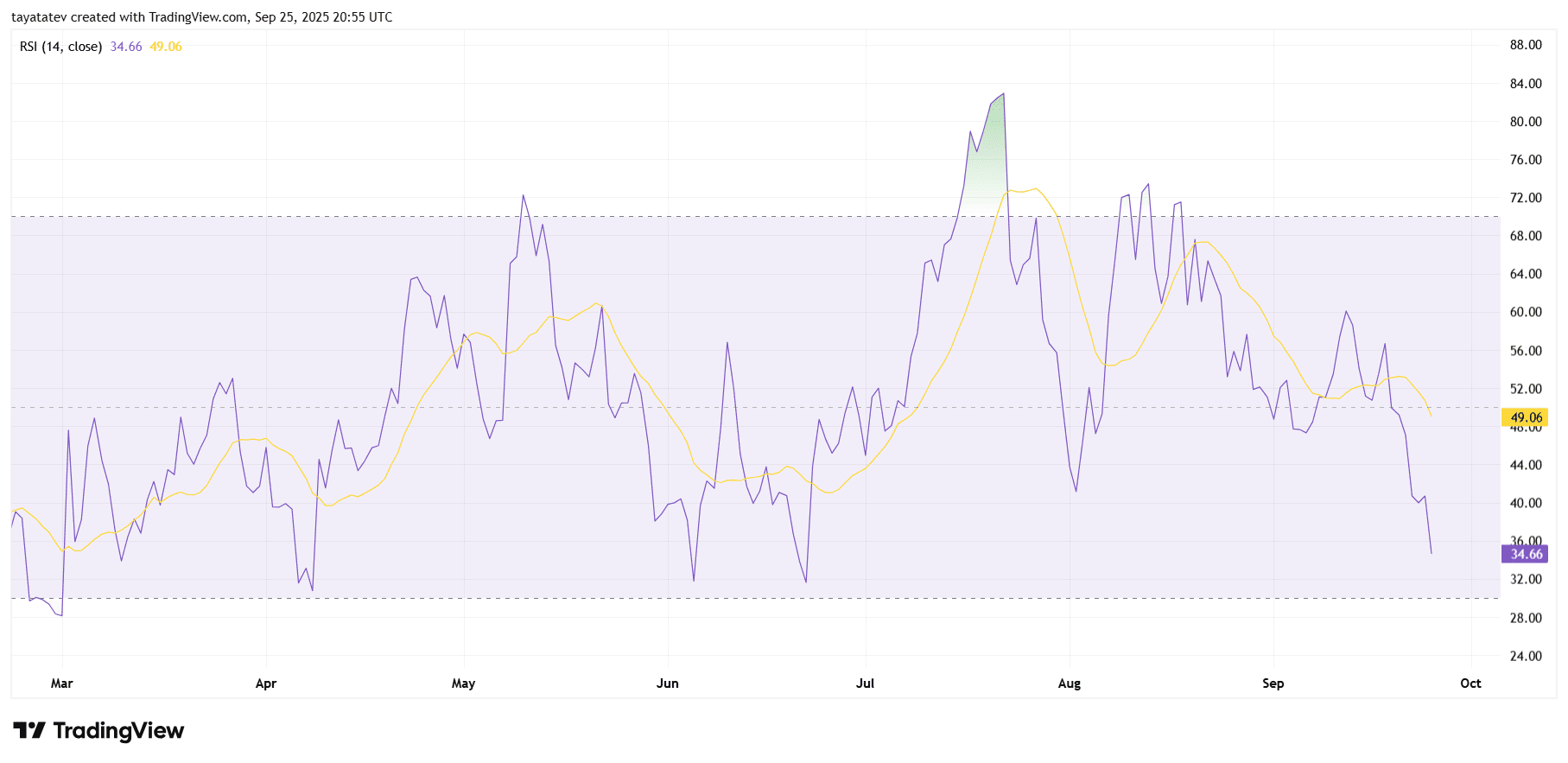

Link Daily RSI shows you get too close and lose momentum

The 14-day RSI is close to 34.7, with an average signal below 49.1. This confirms bearish momentum in the daily time frame. The RSI fell below the signal in early September and has since expanded the gap and has shown sustained underside pressure.

At the beginning of August, RSI pushed over 70 for a short time, then rolled over, marking a shift from over-acquired to a steady downswing. Since then, momentum has dropped highs and price action has cooled down, strengthening momentum downtrends rather than a single shocking move.

As the RSI approaches a threshold of 30, the condition is moving towards potential fatigue, but it must be stabilised or returned to above the signal line for confirmation. Until that happened, the setup continued to pay attention to momentum, monitoring basic behavior near low 30s bands.