Below is a rewritten article with an added introduction, SEO optimization, and HTML structure preserved.

Recent high-profile exploits against decentralized exchange balancers have revealed highly coordinated attackers utilizing sophisticated on-chain tactics. With an estimated $116 million in assets compromised, experts suggest the attack involved months of extensive pre-planning, highlighting the increasing complexity and skill level behind recent cryptocurrency exploits. This incident highlighted the importance of advanced security measures in the evolving landscape of blockchain and DeFi security.

- The $116 million Balancer hack represents a well-planned attack that may have been carried out over several months.

- On-chain analysis revealed that the attacker used small ETH deposits to avoid detection and funded the account through Tornado Cash.

- Security experts have classified this breach as one of the most sophisticated DeFi exploits of 2025, exposing gaps in current security protocols.

- North Korea’s Lazarus Group had suspended its illegal activities before the recent $1.4 billion Bybit hack, signaling a shift in strategy.

- Experts emphasize the need for continuous real-time monitoring to detect and prevent advanced blockchain attacks.

Recent balancer exploits targeting decentralized exchanges (DEXs) and automated market makers (AMMs) exposed vulnerabilities in DeFi protocols and demonstrated the evolving sophistication of cryptocurrency attackers. The breach resulted in the theft of approximately $116 million worth of digital assets, and on-chain data revealed a carefully coordinated attack that may have taken place over several months.

Blockchain data shows that the attackers discreetly funded the account using a small 0.1 ETH deposit from privacy-focused mixer Tornado Cash, with the aim of obfuscating their tracking. Coinbase director Conor Grogan noted that the attackers had at least 100 ETH stored in the Tornado Cash smart contract, suggesting a link to previous hacking efforts. “The hacker appears to have experience: 1. Seed account with deposits of 100 ETH and 0.1 Tornado Cash. No operational security breaches.” Grogan said in a social media post. “There were no recent 100 ETH Tornado deposits, so the funds may have come from a previous exploit.”

In response, Balancer offered a 20% white hat bounty and urged the attackers to return all stolen funds, minus the reward, by Wednesday. The project also assured the community that ongoing research is underway. Security audit of Balancer’s protocol is under scrutiny following incident.

“Our team is working with leading security researchers to understand this issue, and we plan to share additional findings and a full postmortem as soon as possible,” Balancer said in an update. This incident highlights the growing need for proactive security on DeFi platforms to counter advanced threat actors.

Balancer exploits were the most sophisticated attacks of 2025: Cyvers

According to Deddy Lavid, CEO of blockchain security company Cybers, the Balancer breach is one of the most complex attacks to occur this year.

“The attacker bypassed the access control layer and directly manipulated asset balances, creating a critical flaw in operational governance rather than core protocol logic.”

Lavid emphasized that static code auditing alone is no longer sufficient to protect against these threats. Instead, continuous real-time monitoring is essential to identify suspicious activity before funds are depleted, highlighting the need for advanced security measures in DeFi protocols.

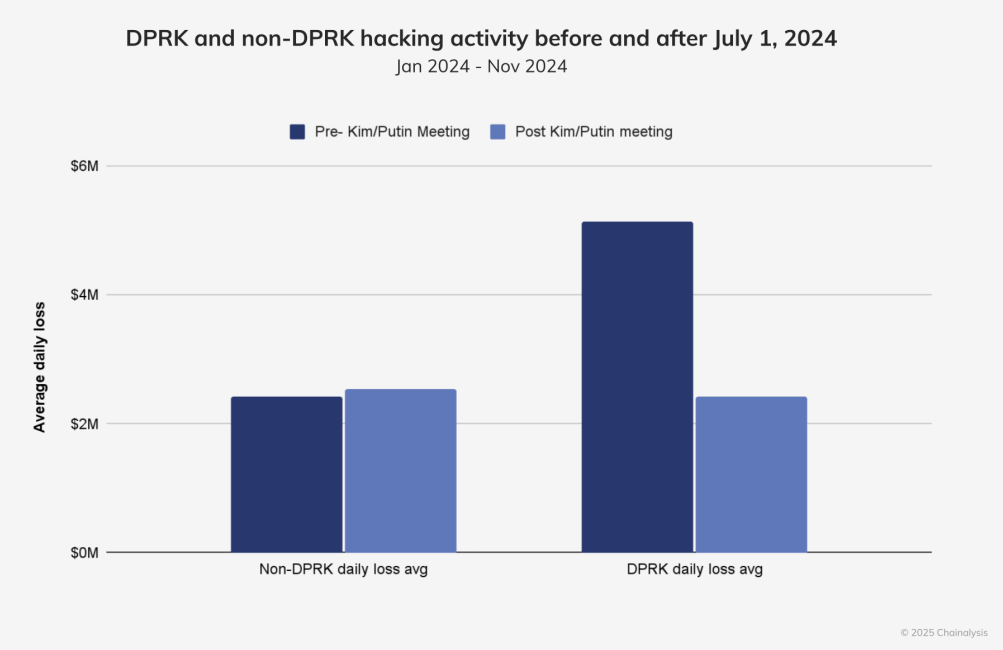

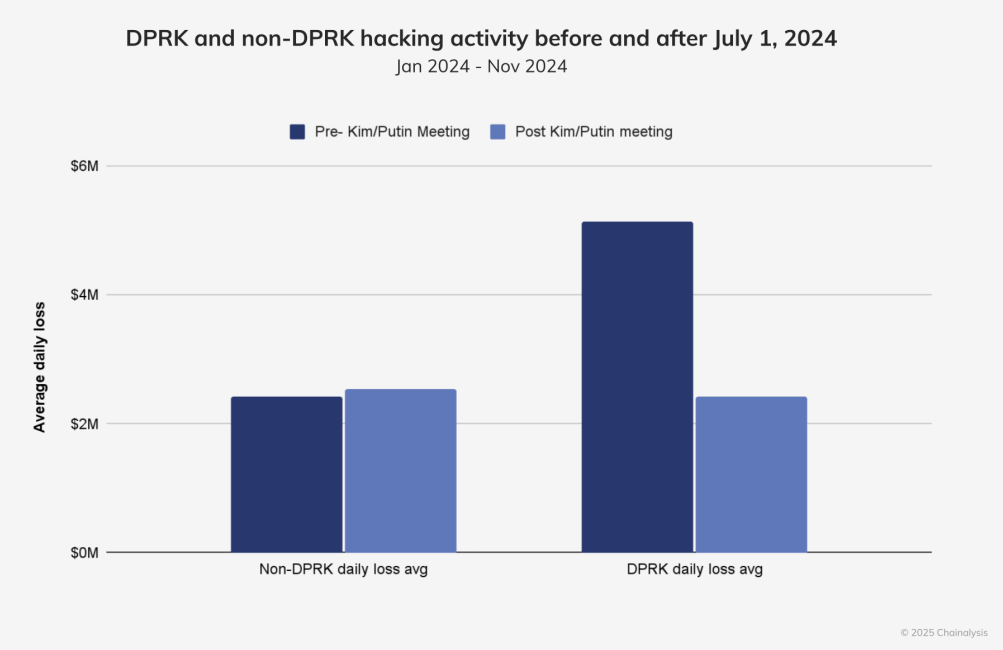

Lazarus Group suspends illegal activities ahead of Bybit hack

Lazarus Group, the notorious North Korean hacking group known for some of the biggest cryptocurrency exploits, reportedly paused its illegal operations for several months before carrying out a $1.4 billion attack on Bybit. Blockchain analysis firm Chainaracy observed a sharp decline in Lazarus-related activity starting July 1, 2024, following heavy attacks earlier that year.

Experts suggest the slowdown indicates groups are regrouping to target new plans or adjust infrastructure, perhaps influenced by geopolitical tensions. Lazarus Group is known for laundering stolen funds through decentralized cross-chain protocols such as THORChain, and the report said it took about 10 days to fully launder the proceeds from the Bybit hack.

As the cryptocurrency market becomes more profitable, heightened security awareness and vigilance remain essential to combat increasingly sophisticated threats from state-sponsored hacker groups, independent cybercriminals, and more.