In the fast-paced cryptocurrency world, it depends on understanding the movements of large traders ahead of the market. These key players can cause major price fluctuations in the instant, making early detection important for traders who aim to leverage or hedge market volatility. Advances in artificial intelligence now provide sophisticated tools to analyse on-chain data, detect whale activity, interpret behavioral patterns, give traders better insights and potentially provide a strategic edge.

-

AI enables instant processing of on-chain data to identify high-value cryptocurrency transactions in real time.

-

Connecting the blockchain API allows traders to continuously monitor whale activity and create personalized alert feeds.

-

Advanced clustering algorithms reveal behavior patterns and relationships between whales’ wallets and show strategic movements.

-

From transaction filtering to automated responses, a step-by-step AI approach can give traders systematic benefits in volatile markets.

Traders in the crypto market are constantly looking for ways to predict big moves from large wallet holders. In August 2025, one Bitcoin Zilla sold 24,000 BTC (approximately $2.7 billion), causing a rapid market decline, liquidating leveraged bets of over $500 million within minutes. If traders had foreseen such activities, they could have hedged their positions or used the recession to turn chaos into opportunities.

Today, artificial intelligence provides robust tools for analyzing blockchain transaction data, flagging unusual wallet activities, and identifying whale strategies. These AI-driven insights go beyond traditional technical analysis and provide a deeper, real-time understanding of on-chain movements.

On-chain data analysis of cryptographic whales using AI

The easiest application of AI in whale detection involves filtering. AI models can be trained to recognize transactions above a certain threshold (e.g. ETH of $1 million or more) by connecting directly to the blockchain API. These APIs provide a continuous stream of transactional data, allowing AI scripts to automatically flag large or suspicious transfers.

To implement this method:

Step 1: Sign up for blockchain API providers like Alchemy, Infura, QuickNode and more.

Step 2: Generate API keys and craft scripts to retrieve real-time transaction data.

Step 3: Apply a query filter to target specific transactions such as high value transfers or specific wallet addresses.

Step 4: Continuously monitor new blocks of transactions that meet your criteria and trigger alerts when they are detected.

Step 5: Save and review flagged transactions through a dashboard or database for further analysis.

This analytic layer transforms raw transactional data into actionable insights, shifting traders from reactive strategies from aggressive strategies, and observing that they form the price of actual on-chain activities beyond mere market sentiment and chart patterns.

Analyzing behavior of cryptographic whales using AI

Large wallets often work to refined strategies, namely trade, multiple wallets, or gradually blur the intentions. AI machine learning techniques such as clustering and graph analysis identify interconnected wallets and reveal the complete network behind whale activity.

Graph analysis of connection mapping

By treating wallets as links and nodes and transactions, AI can map complex networks and reveal groups of wallets on which a single entity operates.

Clustering behavioral patterns

Once connected, AI can group wallets with long-term accumulation, market distribution, or exchange-inflow similar behavior.

The AI then labels these clusters, converts raw data into clear signals, telling whether the whales are accumulating, distributing or leaving their defi positions, and providing intelligence to traders to predict market changes.

Advanced Metrics and On-Chain Signal Stack

To deepen market insights, traders incorporate broader on-chain metrics such as SOPR (used output profit margin) and NUPL (net unrealized profit/loss). Variations in these indicators often show trend reversals, especially when combined with flow metrics such as inflow, outflow, and exchange ratios.

By integrating these signals into an on-chain analysis stack, AI can generate predictive models that evaluate the overall whale activity rather than simply isolated large transactions. This multilayered analysis allows traders to increase their confidence and accuracy and identify early signs of market movement.

Did you know? AI is also essential for blockchain security. You can protect assets in addition to analyzing market activity before smart contract vulnerabilities and potential exploits are exploited.

Deployment Guide to AI Whale Tracking Tool

Step 1: Data Collection

Connect to blockchain APIs such as dune, nansen, glassnode, or cryptoquant for real-time and historical data filtered by transaction size.

Step 2: Model Training

Train machine learning models on clean datasets and identify whales’ wallets and behavior patterns using classification or clustering.

Step 3: Emotional analysis

It incorporates social media and news sentiment analysis to contextualize whale movements and market mood shifts.

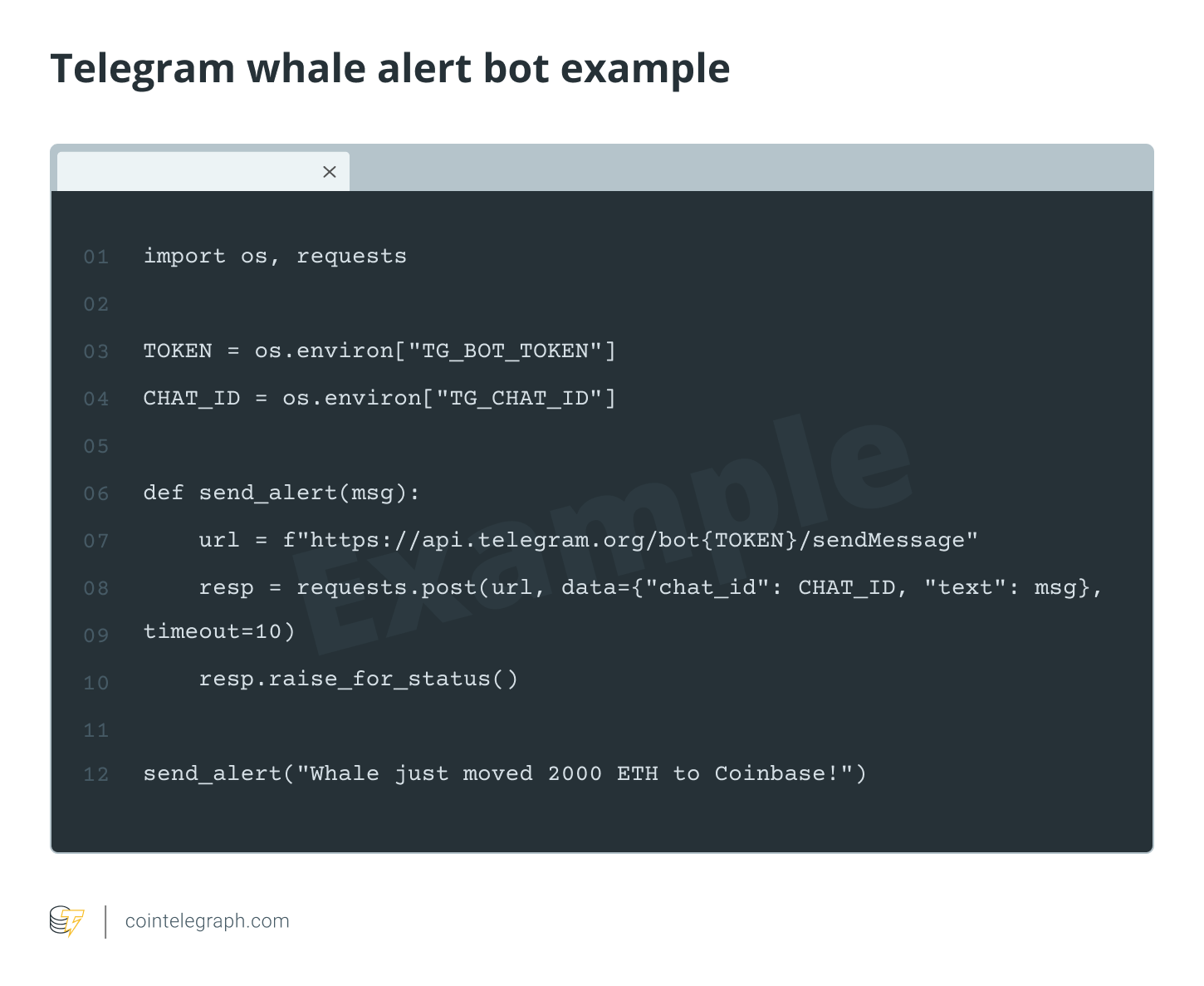

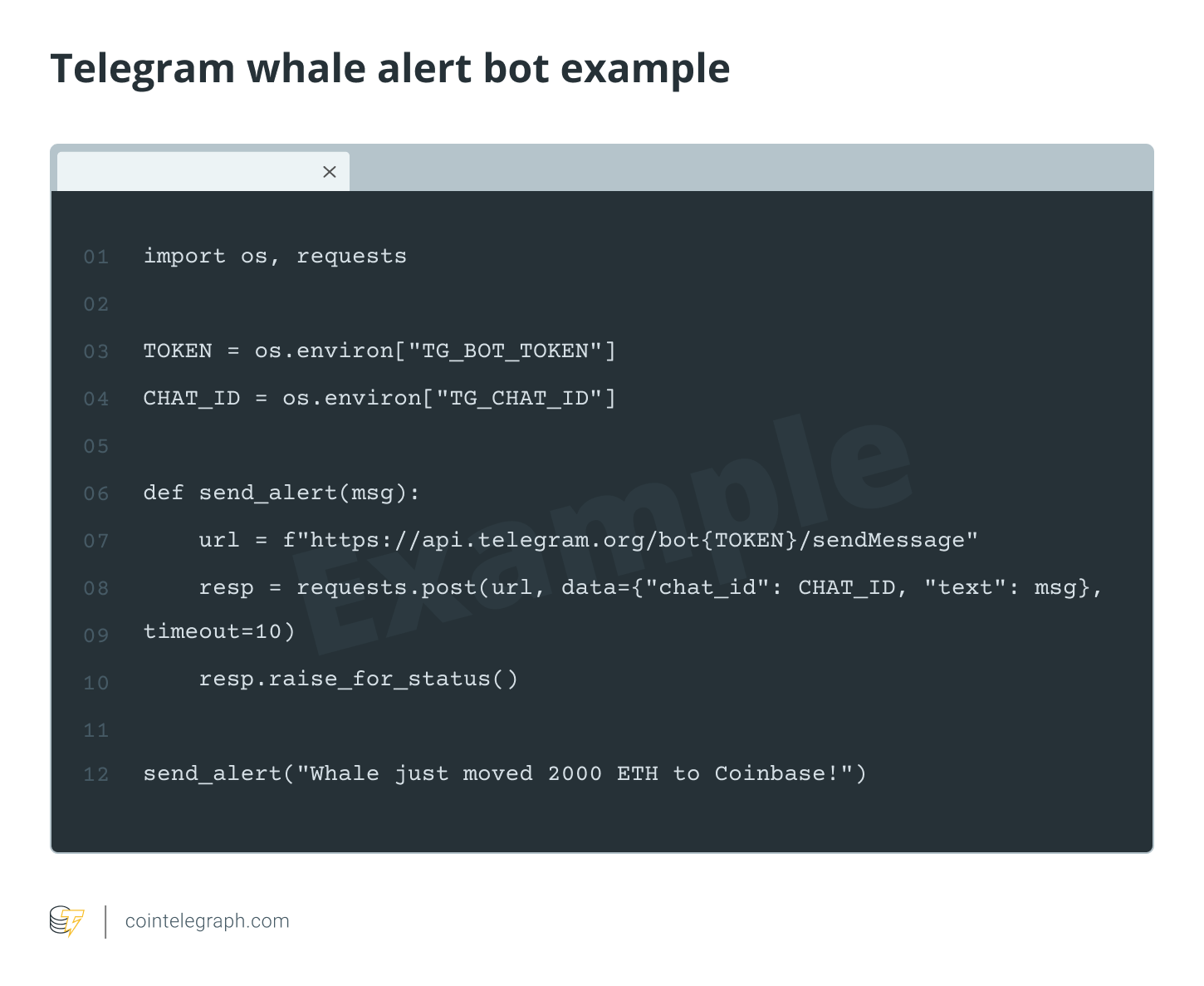

Step 4: Alerts and Automation

Set up real-time notifications through messaging platforms like Discord and Telegram, and integrate automated trading bots that respond to whale signals.

From basic monitoring to full automation, this step-by-step approach encrypts a structured way of predicting market changes driven by cryptographic activity and predicting that they will act proactively in a volatile crypto environment.

This article does not constitute investment advice. Cryptocurrency trading involves risk. Always carry out your own research before making any financial decisions.