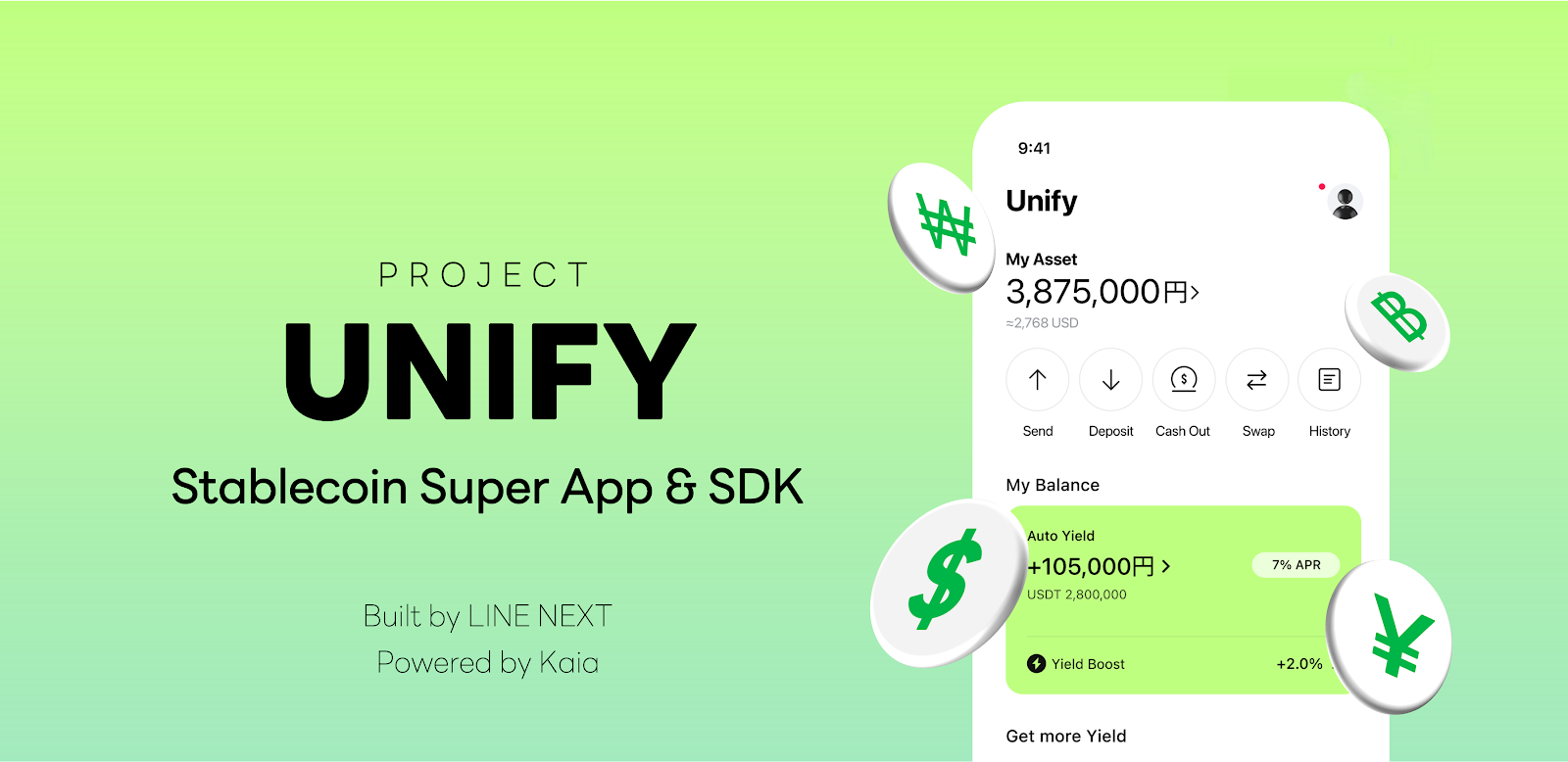

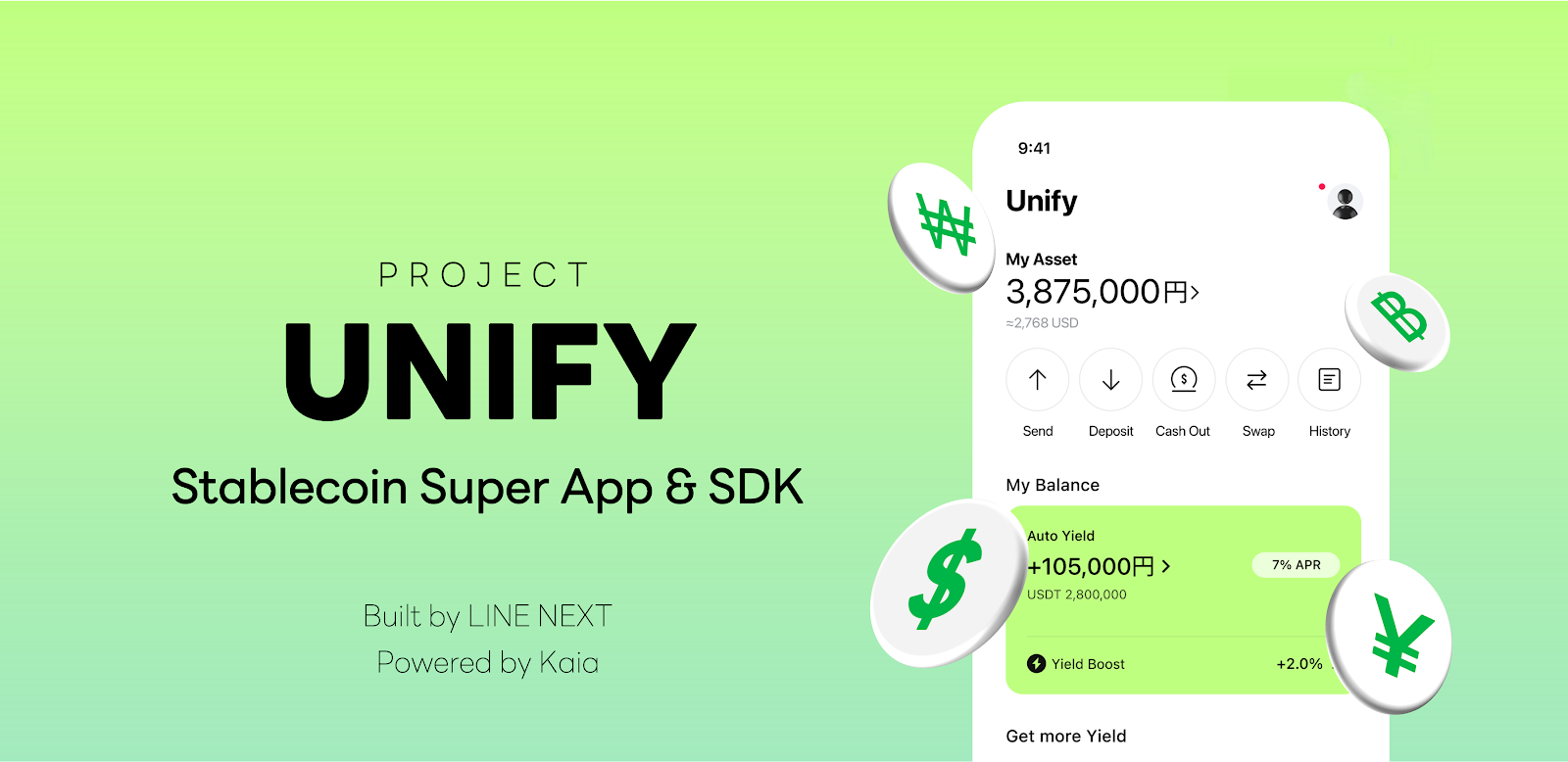

Project Unify is one of the most complete approaches to adopting Stablecoin in the Asian market. Our analysis reveals a thoughtfully designed ecosystem that prioritizes user experience while addressing real payment friction points.

Core Features Overview

Multicurrency Stablecoin Support. Project Unify’s support for eight major Asian currencies (USD, JPY, KRW, THB, IDR, PHP, MYR, SGD) addresses key issues in local commercial transactions. Users can hold, transfer and convert these stupid drugs without leaving the application. This is an impressive improvement over the current multi-platform workflow.

Integrated yield generation. The platform uses the Defi protocol to provide real-time yield opportunities for Stablecoin deposits, while abstracting technical complexity from end users. This feature is competitively unified over traditional savings products, particularly in low interest rate environments across Asia.

A simple on/off lamp experience. One of Unify’s most powerful propositions is the simplified Fiat to Crypto conversion process. Integration with existing banking infrastructure across multiple Asian markets promises to eliminate friction that is currently blocking mainstream adoption.

Social Payments Integration. The ability to transfer funds through messaging interfaces represents the natural evolution of the already popular social commerce trends in Asia. This feature is based on familiar user behavior, while introducing the benefits of blockchain.

Check out this tweet on Twitter

Benefits of the user experience. Project Unify offers single app solutions for multiple financial services, reducing the need to switch between different platforms. The familiar interface design uses messaging app rules that Asian users already understand intuitively. The progressive disclosure of Web3 features helps mainstream users gradually explore advanced features without overwhelming their initial experience. The wide range of merchant networks cover both online and offline transactions, creating practical utilities for everyday spending.

Potential limitations. Regulatory compliance across various Asian markets can create variations in functionality across different regions. The platform’s reliance on existing Line Messenger adoption rates could limit growth in markets with low line penetration. Competition with established fintech solutions in mature markets presents an ongoing challenge for user acquisition and retention.

Market positioning. Project Unify is entering a competitive landscape, but it offers great advantages through Line’s existing user base and Kaia’s blockchain infrastructure. The 130 million users acquisition from the mini-dup launch in January 2025 shows a proven market verification.

Developer Ecosystem. The accompanying SDK positions can integrate projects as infrastructure rather than just an application, creating network effects through third-party integration. This B2B2C approach could accelerate adoption beyond direct consumer acquisition.

verdict

Project Unify demonstrates its promise as a complete solution for Asia’s Stablecoin adoption. Success depends heavily on the quality of execution, regulatory navigation, and the team’s ability to maintain the simplicity of user experience while expanding diverse markets.

The platform will launch in beta later this year, offering an opportunity to assess real-world performance against these ambitious forecasts.

About the review process

Coinrev conducts independent analysis of emerging cryptographic projects to assess technical benefits, market positioning and user experience design. Our reviews aim to provide a balanced perspective for both users and investors.

Official project documentation and updates are available at www.kaia.io.

Information published on Coinrevolution is for general knowledge only and should not be considered financial advice.

We aim to keep our content accurate and up-to-date, but there are no guarantees regarding its integrity, reliability or accuracy. Coinrevolution is not responsible for any losses, errors or decisions made based on the materials provided. Always do your own research and consult a qualified professional before making any financial choices. Please refer to our Terms of Use, Privacy Policy, and Disclaimer for more information.