The 2025 Lender Price Prediction story is heating up quickly as the Lender Network tests key win-loss support zones. The project continues on Solana after migrating from ETH, and on-chain activity is very strong. This month’s market structure shows early signs of a possible breakout that could fuel a big rally in late 2025 and early 2026.

Unprecedented transfer momentum accelerates with lender’s Solana expansion

Render Network’s migration to Solana continues to inject strength into the RENDER crypto. This migration is designed to benefit from Solana’s speed and lower cost of execution, and we’ve seen a significant acceleration in network usage this month.

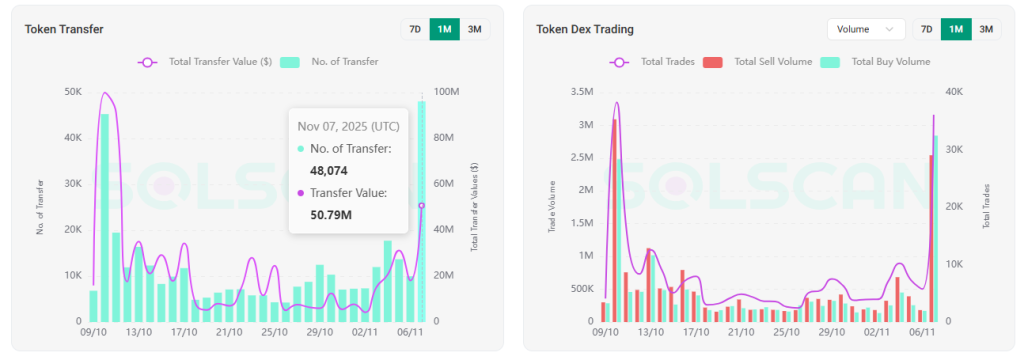

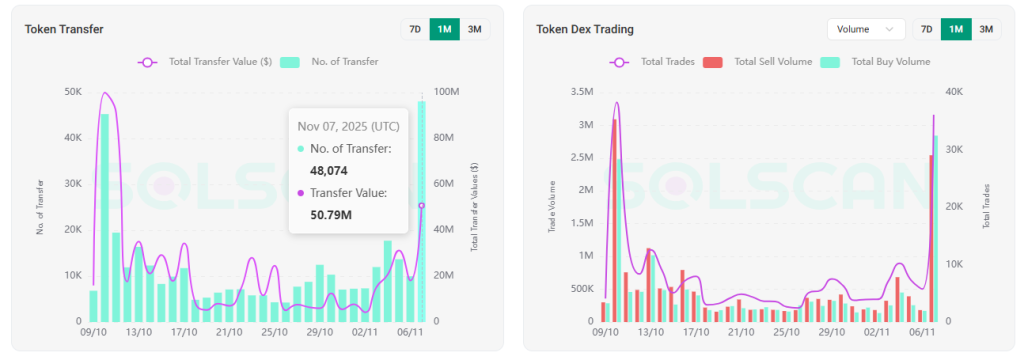

According to SOLSCAN, RENDER token transfers jumped from 7,339 transfers (valued at $4.25 million) on November 2 to 48,074 transfers (valued at $50.79 million) at the time of writing. This spike represents a strong expansion in network activity and confirms growing engagement with the Solana-based RENDER token.

Similarly, DEX trading volumes are also increasing aggressively. The total number of trades jumped from this week’s low of 3,948 to 36,132, with buying volume outstripping selling volume. At the time of writing, SOLSCAN showed buy volume of $2.84 million and sell volume of $2.54 million.

This change suggests that the bears are starting to lose control and a short squeeze could occur if buyers monopolize order flow.

Liquidity cluster points to rapid upward path

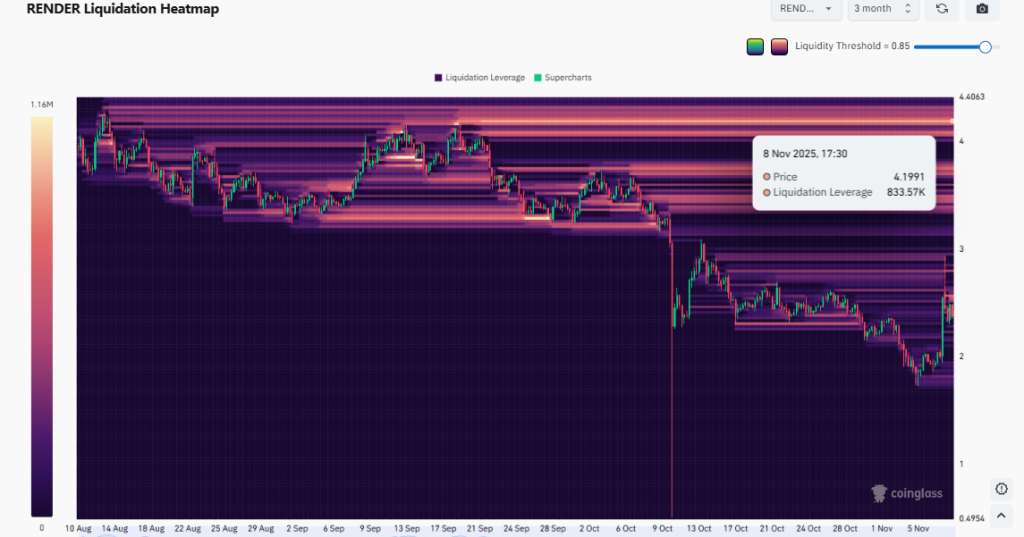

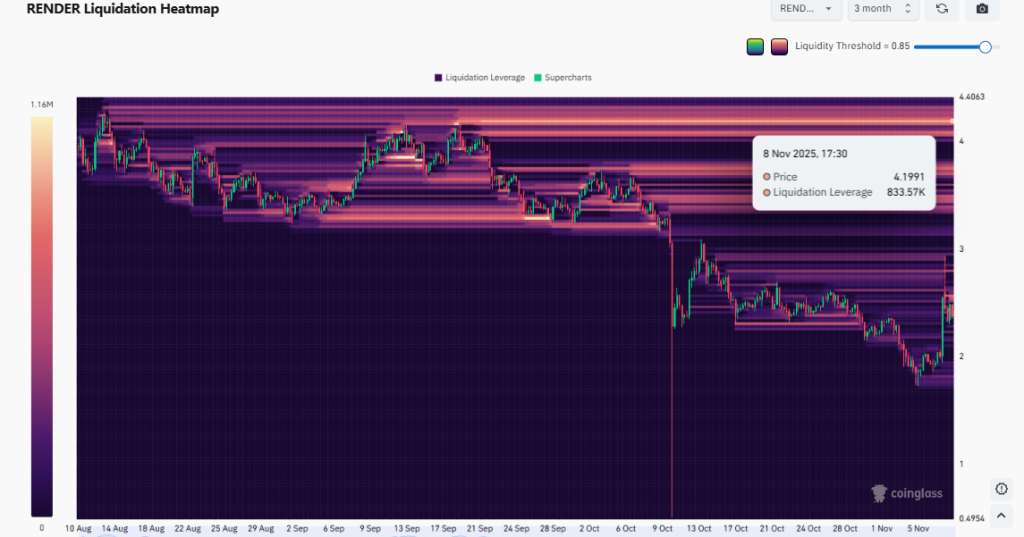

Additionally, the Coinglass liquidity heatmap chart shows two major liquidity clusters that could act as magnets ahead of RENDER/USD.

The first one is $3.75 with a liquidation leverage of 680.32,000 and the second one is $4.19 with a liquidation leverage of 833,57,000.

When bullish demand intensifies, price often moves towards these liquidity pools, accelerating upward movement.

RENDER’s price chart is consistent with this outlook. The weekly pattern shows a broad downward wedge price action from 2024 onwards, with current support around $2.00-$2.50, considered a historically valuable zone.

If momentum reverses at $4.19, lenders could target $9 by year-end, with a revisit to $13.75 in early 2026, reflecting a measured wedge breakout move.

Technical indicators point to early gains despite mixed momentum

Moreover, its technical indicators still suggest a cooling phase for the lender price USD, as the RSI of 36.63 indicates that the oversold situation may deepen further towards 30.

MACD and AO remain silent, suggesting consolidation is underway. However, the Chaikin Money Flow (CMF) of 0.09 indicates increasing positive inflows, indicating an accumulation below the surface.

This situation often precedes a sharp rise in demand as supply falls and demand spikes.

As market volumes expand and Lender maintains significant support, Lender Price Forecast’s 2025 outlook indicates a continued strong rally is increasingly likely.

Trust CoinPedia:

CoinPedia has been providing accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by an expert panel of analysts and journalists following strict editorial guidelines based on EEAT (Experience, Expertise, Authority, and Trustworthiness). All articles are fact-checked against trusted sources to ensure accuracy, transparency, and authenticity. Our review policy ensures unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely and up-to-date information on everything cryptocurrencies and blockchain, from startups to industry giants.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making any investment decisions. Neither the author nor the publication is responsible for your financial choices.

Sponsors and advertising:

Sponsored content and affiliate links may appear on our site. Ads are clearly marked and our editorial content is completely independent of our advertising partners.