More than 12,000 financial experts are in Frankfurt this week. Hedera uses the bank to court using the floor at booth dism67. The team demonstrates tokenization, 24/7 Treasury Department, cross-border payments, digital identity, and AI use cases. The Exhibitors and Events page lists the booth and date: September 29th to October 2nd.

Additionally, SIBOS’ programs focus on digital assets and interoperability across over 250 sessions. This background places the pitch of Hedera’s payment and identity in front of payment networks, custodians, and market operators. Swift and Sibos hubs check themes and schedules.

Finally, Hedera discovers traffic from its own site, booking encounters in the stands, focusing on one-on-one enterprise conversations rather than broad announcements. Event Microsite also highlights onsite activations tied to the booth.

Meanwhile, the Africa Hackathon will hit the cutoff on September 30th

Today is the last day I will submit to Hedera Africa Hackathon and I have a window on the rules page at GMT from August 1st, September 30th, 23:45. The organizer will require the team to complete the Hedera certification before the deadline. The Hashgraph Association runs programs in exponential science.

Additionally, the prize pool started at $1 million during the campaign that launched in May, and then doubled to $2 million after a sponsored top-up. Posts from organizers and trade outlets track the increase in September.

So closing will push Hedera developers up the finance, operations, gaming/NFT, AI/Depin tracks. The program page describes the scope, hubs and target audiences across the continent. hashgraphonline.com

Additionally, Wyoming’s FRNT Pick is pinning public sector topics.

Earlier this month, Wyoming chose Hedera for FRNT and was billed as the first US issuance stable token under Wyoming’s stable token law. The announcement states that FRNT will be fully supported with cash and a short-term Treasury ministry and a 2% reserve.

Additionally, the PR filing and company posts are dates of choice until September 4th, enhancing the latest in policy and payment discussions at SIBOS. Authorities are assembled FRNT as a way to modernize public finance with faster, more transparent payments.

In summary, FRNT will provide Hedera with a concrete government case, along with Sibos floor settlement and identity demonstrations at this week’s meeting with banks and infrastructure providers.

Meanwhile, HBAR will retest the “life support” trendline

The 3-day chart shared by @Steph_Iscrypto shows HBARs pushing the yearly ascending trendline labeled “Life Support.” The price is located on its diagonal, with the Bullmarket Support Band (blend Emma on the chart) floating around the same area, creating a confluence of support. The setup frames today’s action as a structural test rather than a daily dip.

Additionally, recent candles track the lower highest in the series to the trend line and compress momentum. That aperture often precedes a directional break. Once the buyers defend the diagonal and regain the band, the market structure remains intact and the previous uptrends remain technically effective. Participation and follow-through are more important than the initial bounce.

However, clean breaks on both the trendline and support bands will turn the picture upside down. Sellers can then force a retest of the swing zone for the previous three days that appears left to the left on the chart, and the bullish structure becomes neutral. Diagonals and bands define the battlefield until the chart resolves.

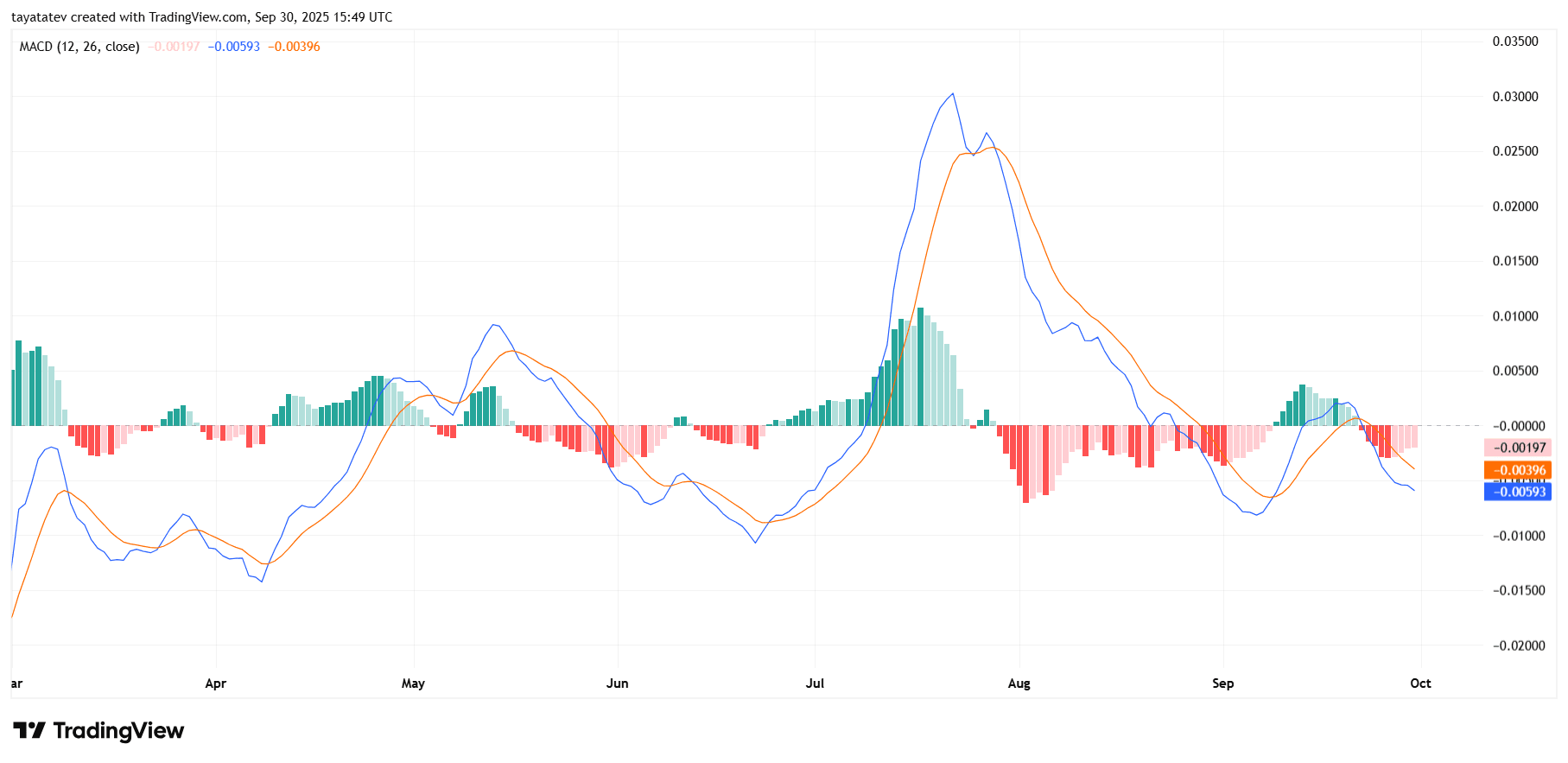

On the other hand, MACD is negative when the momentum cools

The HBAR’s MACD (12, 26, 9) is below the zero line, and the high speed line is across the signal line. The histogram flipped to red and hovered near the flat. This setup peaked in August and continues with a fade up rolling up until September.

Furthermore, the recent green burst in early September failed to drive a higher MACD high. When its low momentum is high and the subsequent negative side continues, it shows fatigue rather than growing trends. As a result, the seller will remain a slight edge while the indicator remains at zero.

However, small bars in the histogram signal compression rather than acceleration. Once the high-speed line curls up and regains the signal line, the first Tell will shrink the red bar towards neutral. Pushing over the zero line afterwards will confirm momentum reset. Otherwise, prolongation below zero means a decline in rotational risk at nearby resistance.

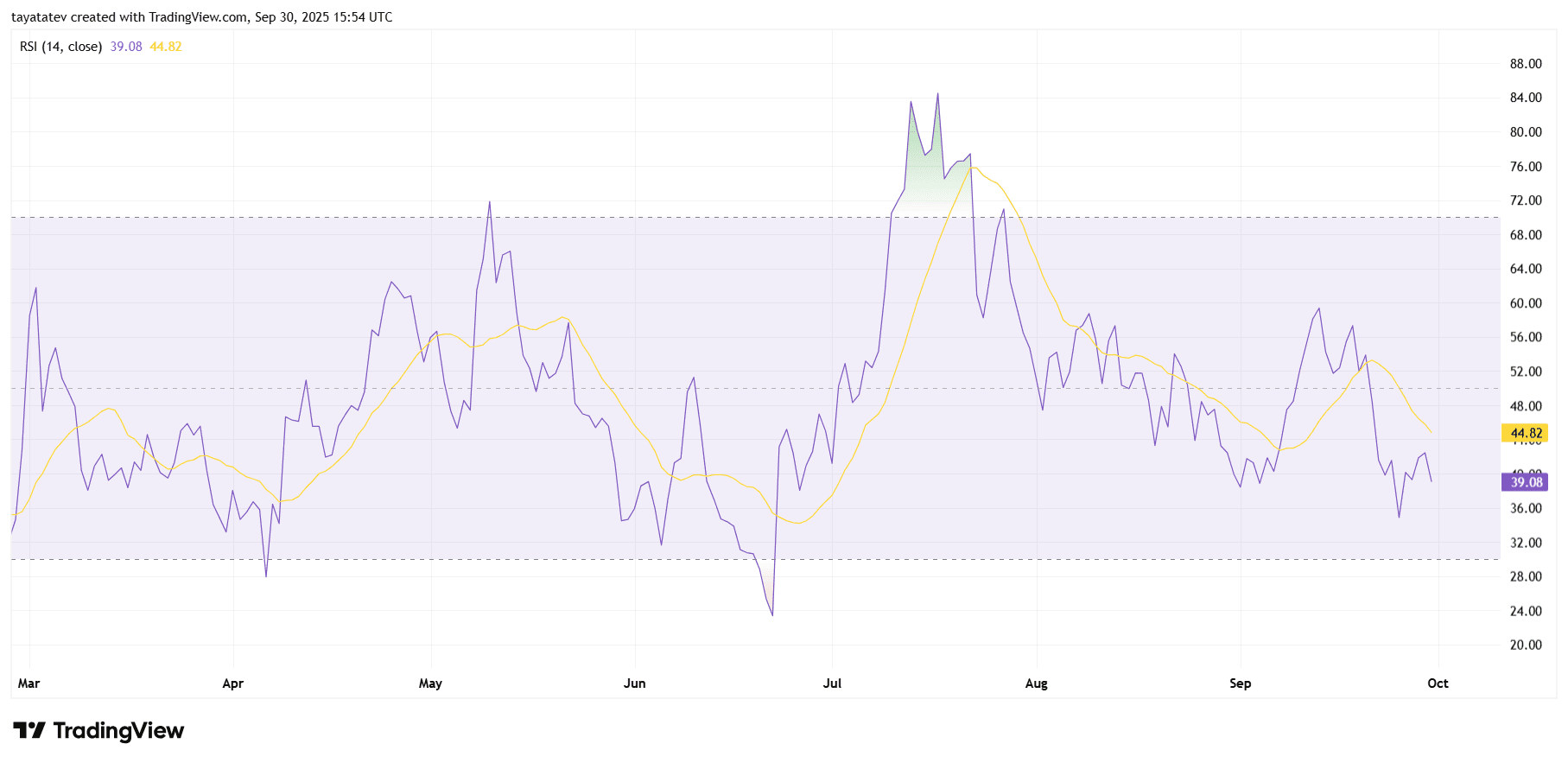

Meanwhile, when the buyer loses control, the RSI slides under the midline

HBAR’s 14-day RSI print is nearly 39, below the midline of 50, but the moving average for RSI is around 45th. This placement signal shows momentum in the short term. Additionally, the oscillator has declined since late August and has not held it above 50 in recent bounces.

Furthermore, the RSI has not hit classic sales (<30), so the downside room remains in front of the mechanical bouncing trigger. The gap between RSI and its moving average also widened through September, showing sustained pressure. However, a slight increase later in the series suggests stabilization rather than an immediate reversal.

Going forward, a clean RSI recovery of 50 will mark the initial momentum shift as it is paired with RSI crosses above the moving average. Until then, there is a risk of resistance coming nearer and stagnation. Conversely, if it decreases towards 30, the seller is in charge, increasing the chances of reflex bounce only after deeper stress.