Important points

Why is BTC a buying opportunity at current levels?

According to CryptoQuant CEO Ki Yong-joo, macro tailwinds and easing selling pressure could revive Bitcoin’s upward trend.

What are analysts’ predictions for BTC?

Beyond $100,000, accumulation and price ranges can increase. However, a return to $108,000 to $110,000 would be a bullish pivot.

Bitcoin [BTC] Recent losses have exceeded $100,000 and are poised to rise further towards $110,000 following a potential deal renewal to end the US government shutdown.

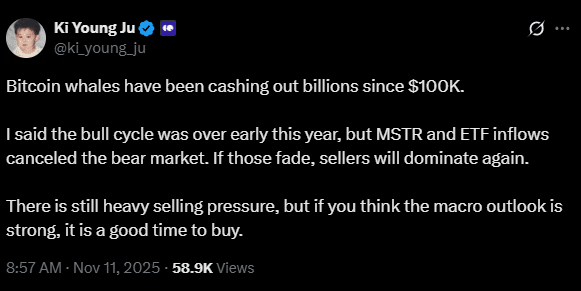

However, CryptoQuant CEO Ki Young Ju pointed out that the asset is still under strong selling pressure. he added,

“Selling pressure remains strong, but if you think the macro outlook is strong, now is a good time to buy.”

Source:X

What’s next for BTC: sideways or a bullish pivot?

On an average weekly basis, Bitcoin’s realized gains have been between $1 billion and $2 billion since late September. Selling by long-term holders accelerated in July, with weekly profit taking reaching more than $4 billion.

Source: Glassnode

Therefore, the selling pressure will be eased by half and an improvement in the macro front could trigger the necessary upside for the next bullish leg.

Macro factors being tracked include the end of the government shutdown and quantitative tightening (QT), a Fed rate cut, and the eventual replacement of Fed Chairman Jerome Powell with a more dovish candidate.

Overall, these factors are expected to inject more liquidity into the market and push risk assets, including BTC, higher.

ETF flows weaken as whales dominate

So far, overall selling pressure from whales has exceeded demand from ETFs and digital asset treasury (DAT) companies such as Strategy (formerly MicroStrategy) combined.

For example, ETFs posted net negative inflows throughout November, but outflows declined slightly.

Source: Glassnode

This further constrained and restrained BTC’s strong rebound, trading firm QCP Capital noted. company added,

“DAT activity remains subdued but critical. Unless legacy supply resolves, our base case remains rangebound in the near term with upside limited to around $118,000.”

Bitfinex Analyst share A similar sideways prediction points out that the bullish structure could only resume if BTC regains the STH cost base of $112.5K as support.

But for Swissbloc analysts, BTC bullish pivot This happens when the $108,000-$110,000 zone is recovered and defended as support.

“If it holds the structure and regains the $108,000-$110,000 pivot zone, it will start to gain momentum. Selling pressure has subsided and BTC$ is showing early signs of a bullish reversal.”

Source: Swissbloc

At the time of writing, BTC was trading at $105,200 after briefly declining at $107,500 and was on the verge of causing a bullish pivot.