As the global economy faces increasing uncertainty, cryptocurrencies such as Ethereum have seen significant price fluctuations, reflecting cautious investor sentiment. Despite the potential for an Ethereum update, market confidence appears to be stagnant due to broader macroeconomic concerns, weak derivatives activity, and declining on-chain engagement.

-

Ethereum’s recent price decline indicates cautious trader sentiment and low confidence in a bullish rebound.

-

The futures market is showing minimal bullishness, and the 4% premium indicates that ETH’s risk-taking appetite is subdued.

-

Rising macroeconomic risks and the ongoing US government shutdown are contributing to lower investor optimism in the crypto market.

-

Ethereum’s decentralized finance (DeFi) activity continues to decline, with Total Value Locked (TVL) dropping to its lowest level since July.

-

There is some hope for Ethereum’s upcoming upgrade in December, but overall short-term momentum remains limited.

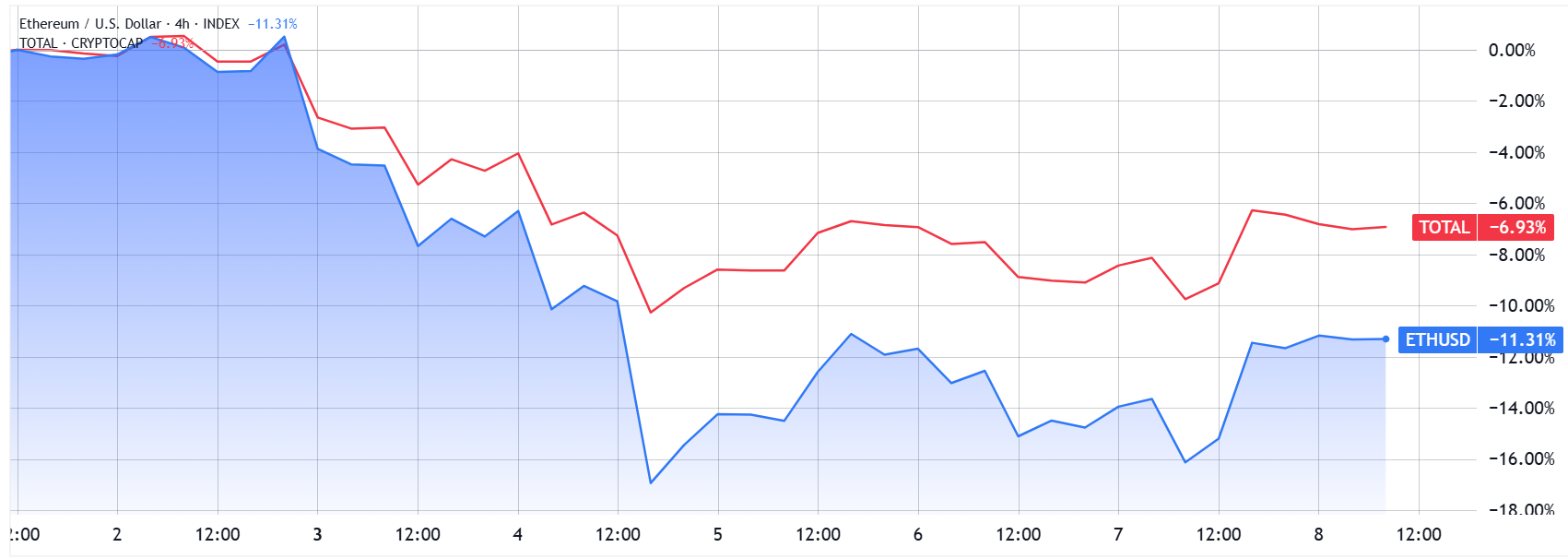

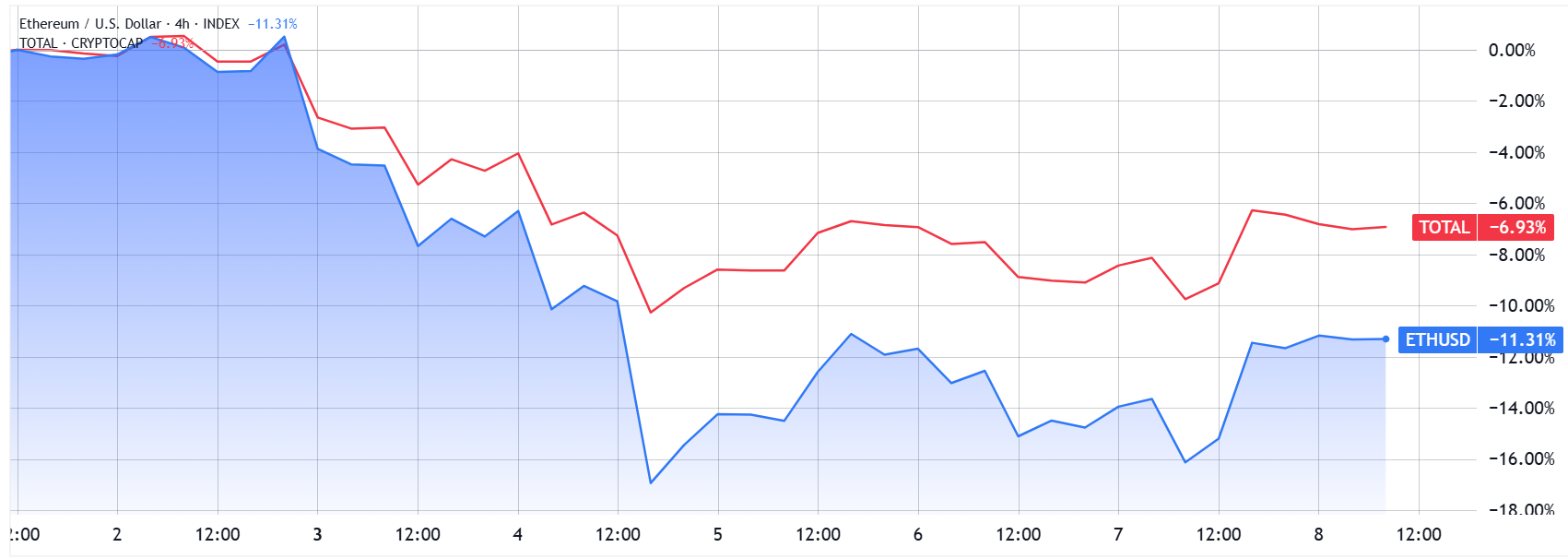

Ethereum (ETH) has experienced an 11% decline over the past week, despite reaching the $3,400 level last Saturday. This correction coincided with a 4% decline in the Nasdaq index, erasing recent gains and casting doubt on ETH’s ability to recover to the $3,900 level. Concerns about global economic growth, driven by weak earnings reports from consumer-focused companies and renewed scrutiny of high valuations within the artificial intelligence sector, are contributing to the cautious sentiment. Meanwhile, the prolonged US government shutdown continues to weigh on economic stability. \n

Ether futures are currently trading at a 4% premium to the spot market, unchanged from last week, indicating limited bullish enthusiasm among traders. Under normal conditions, this premium ranges from 5% to 10% and serves as a measure of market sentiment. The subdued premium suggests that traders are avoiding aggressive positions, indicating a sense of caution rather than outright panic. This reluctance is accentuated by declining U.S. consumer confidence, with expectations dropping to an all-time low, largely due to the ongoing government shutdown, according to a University of Michigan study.

Part of Ethereum investors’ frustration stems from ETH’s recent poor performance, which saw it record a weekly decline of 4% compared to the resilience of the broader cryptocurrency market. This lag signals potential macroeconomic risks, but also indicates other factors shaping trader sentiment, such as waning interest in the ETH Spot ETF. During November, the US-listed Ethereum ETF experienced over $500 million in net outflows, but no significant institutional buying activity was observed.

An important trigger going forward is Ethereum’s Fusaka upgrade scheduled for December. This upgrade is aimed at enhancing scalability and security, increasing network performance and investor confidence. Nevertheless, with derivatives markets still showing weakness and broader economic challenges continuing, ETH’s chances of spiking to $3,900 in the short term appear limited. Market participants continue to monitor the cryptocurrency ecosystem as it grapples with macroeconomic headwinds and an evolving regulatory landscape that continues to impact investor behavior and market stability.

This article is for informational purposes only and should not be taken as specific financial or legal advice. The opinions expressed are solely those of the author and do not necessarily reflect the views of the organization.