The cryptocurrency market continues to experience dynamic changes amidst investors’ sentiment and evolving institutional interests. Despite some recent optimism, ether (ETH) faces challenges to maintain key support levels, and if prices approach a significant threshold, there is a major liquidation risk looming. Meanwhile, institutional players have expanded their holdings of Ethereum, highlighting the continued relevance within the wider blockchain ecosystem, as demand for ETH-based investment products continues to exist.

-

If ETH reaches $4,350, it will be possible to settle short positions above $1 billion, indicating an increase in market sensitivity.

-

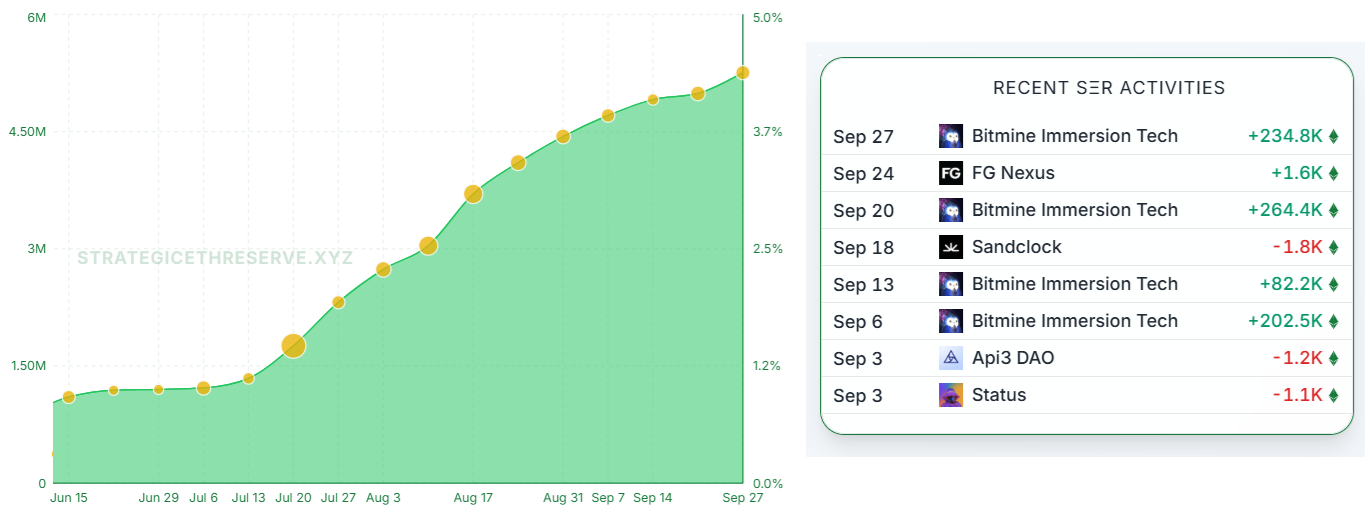

Bitmine Immersion aims to increase Ether Holdings to over $10.6 billion, ensuring 5% of its ETH supply.

-

The Ethereum ETF raised a net inflow of $547 million, highlighting institutional benefits despite declining Onchain activity.

Ether (ETH) struggled to exceed $4,200 on Tuesday. weaker activity on blockchain can weaken investors’ feelings. However, the company’s reserves continue to increase, showing long-term bullish outlook from institutional holders.

Traders are currently looking at the best to see if ETH can recapture its recent high of $4,800, the last touched on September 13th.

On Monday, Spot Ethereum Products recorded a robust $547 million of $547 million in net inflows, turning the decline last week into signaling investors’ confidence. Concerns about potential US government shutdowns and slowing down the AI sector have sparked concerns over the demand for digital assets. However, these fears have been alleviated as partial institutional closures are more manageable and government operations are likely to resume normal.

In parallel, after a new partnership between Openai, Nvidia and Oracle, enthusiasm for technology stocks increased and risk preferences increased. As investors became less risk averse, demand for cryptocurrency regained momentum, further supported by ETH’s strategic company acquisition.

In particular, Bitmine Immersion expanded its ether holdings by purchasing 234,800 ETH, and now has a total reserve of over $10.6 billion. The company’s chairman, Tomley, has reaffirmed its plans to acquire 5% of its total ETH supply as part of its long-term strategy. Additionally, the new partnership between Consensys and Swift aims to develop cross-border payment prototypes and improve interoperability of tokenized assets.

Ether faces downward pressure from reduced network activity

Despite accumulation by institutional investors, Ethereum’s on-chain metrics suggest that network prices and number of transactions have been declining over the past month. According to Nansen data, Ethereum fees fell by 12% and transaction volumes fell by 16%. Meanwhile, rival networks such as BNB chains and HypereVM have shown that fees are increasing significantly, and user activity and market interest are changing.

Ether Traders is looking at $1.6 billion payments from FTX Recovery Trust. Some expect recipients to reinvest in cryptocurrency, and they could provide a short-term boost. Payments scheduled for Tuesday may take days to make your bank account come true, but they remain an important catalyst for market sentiment.

Coinglass reports that the price of Ether, which approaches $4,350, could lead to nearly $1 billion in liquidation of short positions, highlighting the increasing sensitivity of the market. ETF holdings are worth more than $22.8 billion, futures are advantageous at $55.6 billion, and ETH remains the dominant institutional asset.

Essentially, ETH’s outlook remains strong, particularly amid ongoing accumulation of corporate reserves and increasing demand for ETFs. However, market momentum depends on external factors and broader economic conditions, maintaining an uncertain upcoming outlook for ETH’s price trajectory.

This article is for general informational purposes only and should not be considered legal or investment advice. The views expressed are those of the authors and do not necessarily reflect the opinions of third parties or industry standards.