- Ethereum outperformed Bitcoin in the third quarter with a 75% rally, but it slowed down in September.

- Demand for the system increased sharply, and circulating ether supply decreased, but retail participation remained weak.

- Futures trading data shows historical changes, with Ethereum’s derivatives activity reaching new highs.

- Major on-chain levels, such as $4,580, are crucial for a sustained bullish reversal.

- Conservative retail sales signal potential challenges, but changing retail flows can accelerate profits.

Ethereum (ETH) saw a noticeable 75% increase against Bitcoin (BTC) in the third quarter of 2023. Despite recent slowing price momentum, many traders remain optimistic about ETH reaching $5,000 over the next two years as on-chain indicators continue to highlight strong demand and trading activity. Cryptocurrency resilience highlights its evolving role within the resilience of the broader blockchain ecosystem and the Defi and NFT sectors, which rely heavily on Ethereum’s network.

Data from GlassNode shows that futures traders continue to support the ether, with their open profits reaching 43.3%, the fourth-highest record. Meanwhile, Bitcoin’s advantage remains at 56.7%. In particular, Ethereum’s persistent futures volume reaches an all-time high of 67%, reflecting a significant change amidst high in high volatility and dynamic market sentiment, reflecting a significant change in trading activity to ETH.

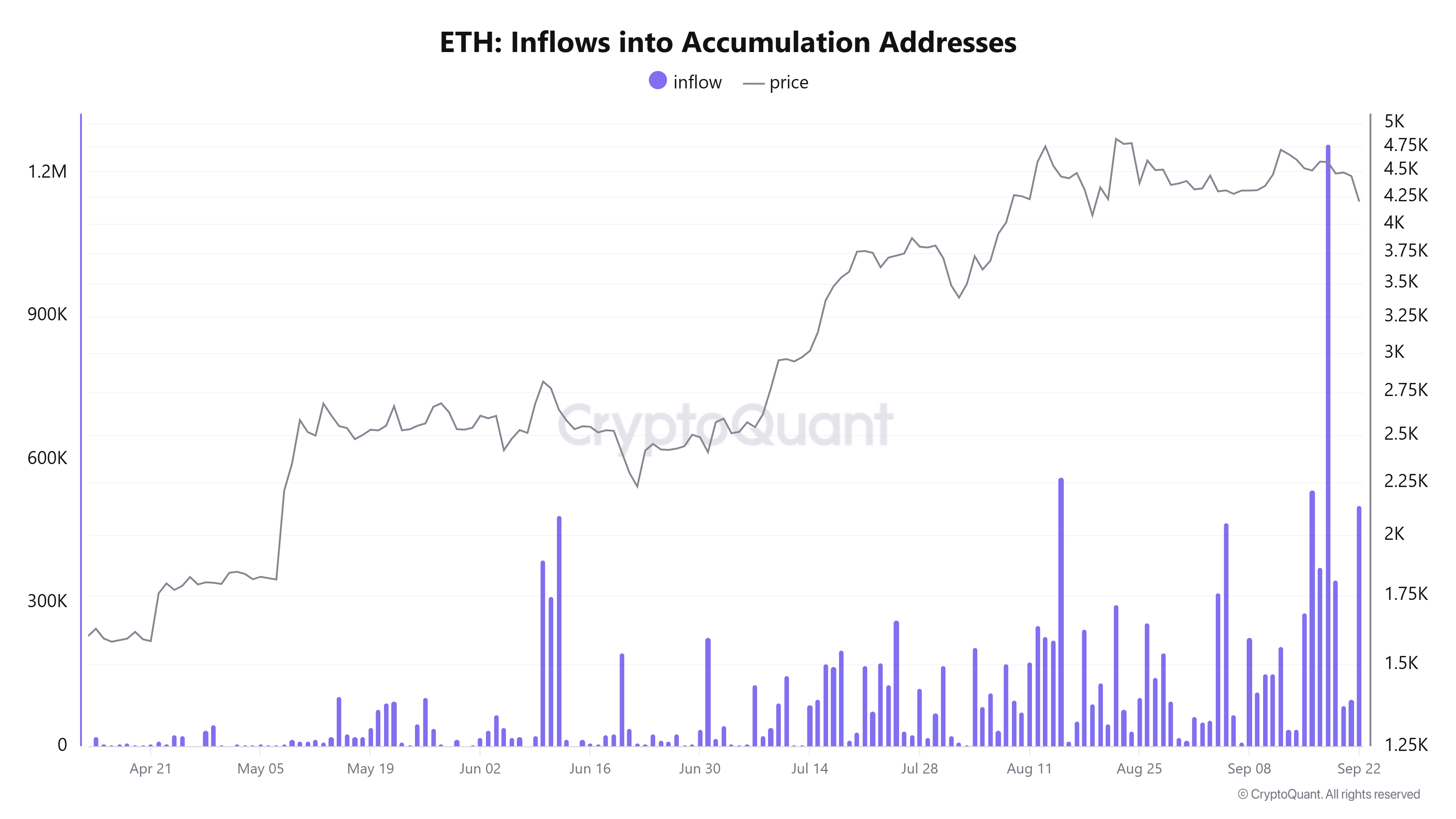

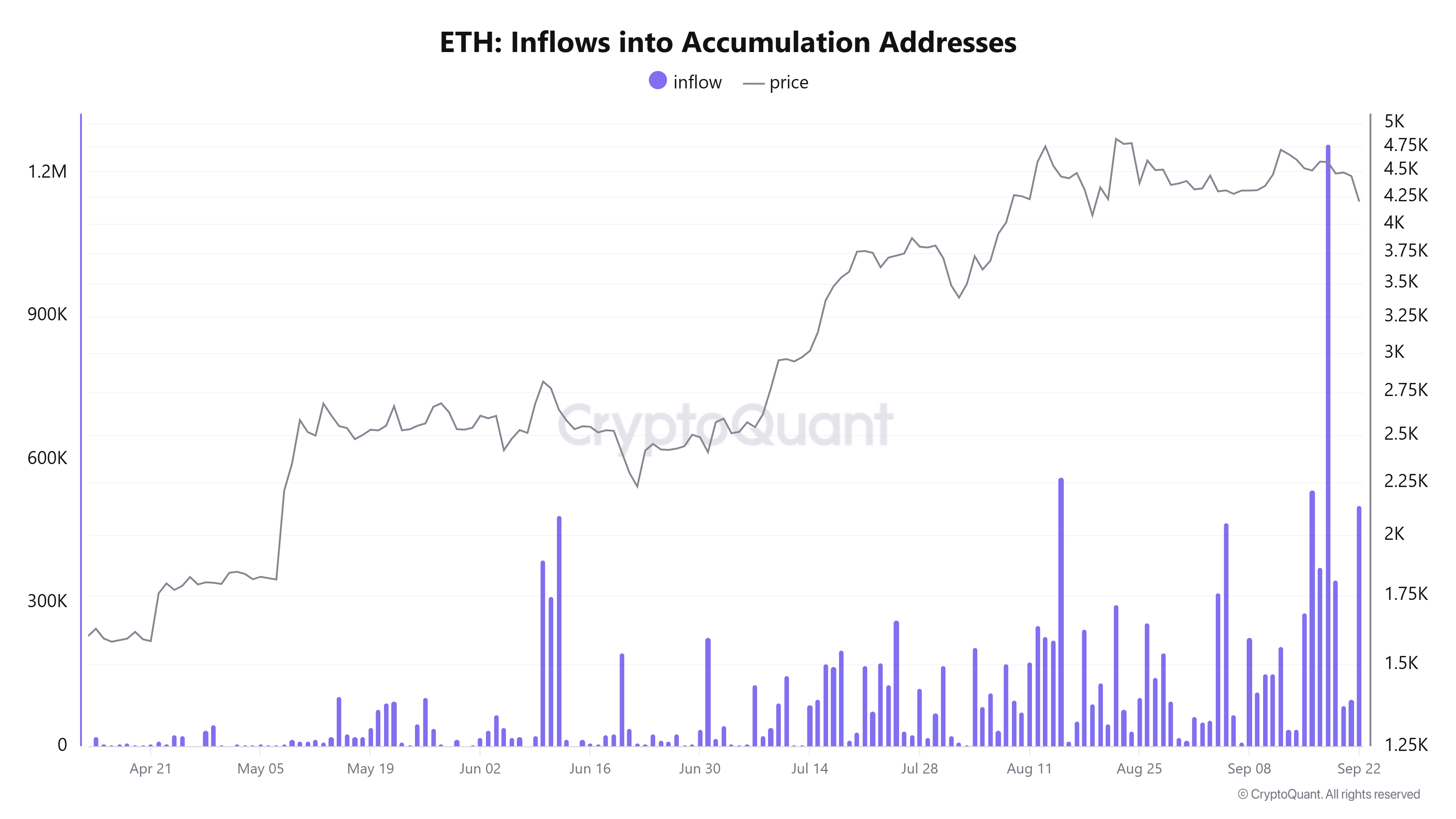

CryptoQuant analyst CrazzyBlock emphasized the importance of Ethereum regaining its $4,580 threshold. This is related to exchanging the runoff cost base and the accumulation level. Recent movements show that over 1.28 million ETH, worth more than $5.3 billion, have been moved to long-term holding addresses. Currently, ETH finds support of around $4,100, correlates with the average cost base of highly active addresses, suggesting the basis for upward movements in the future.

Institutional demand reduces the supply of ether, but the decline in retail raises doubts

Institutional buyers have played a key role in reducing Ethereum distribution supply. The US Spot ETH ETF swelled to around $27.48 billion in September, exceeding $10 billion in June. The inflow totaled over $17 billion in July and August, highlighting substantial institutional trust and investment in ETH, along with strategic reserves managed by companies such as Bitmine and Sharplink. These reserves have grown by 121%, with ETH of over 12 million (currently valued at around $46 billion), demonstrating a long-term bullish attitude among professional investors.

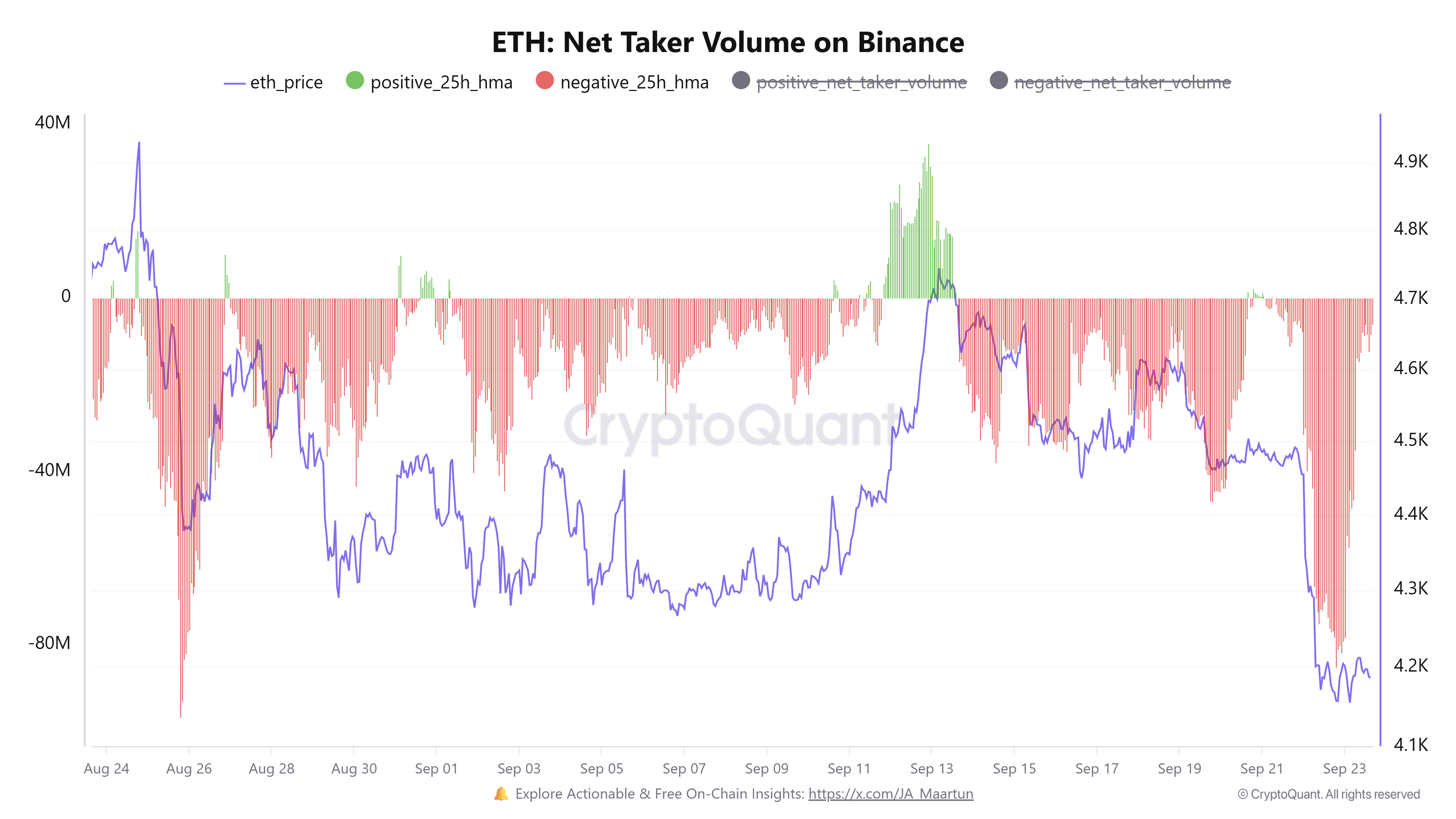

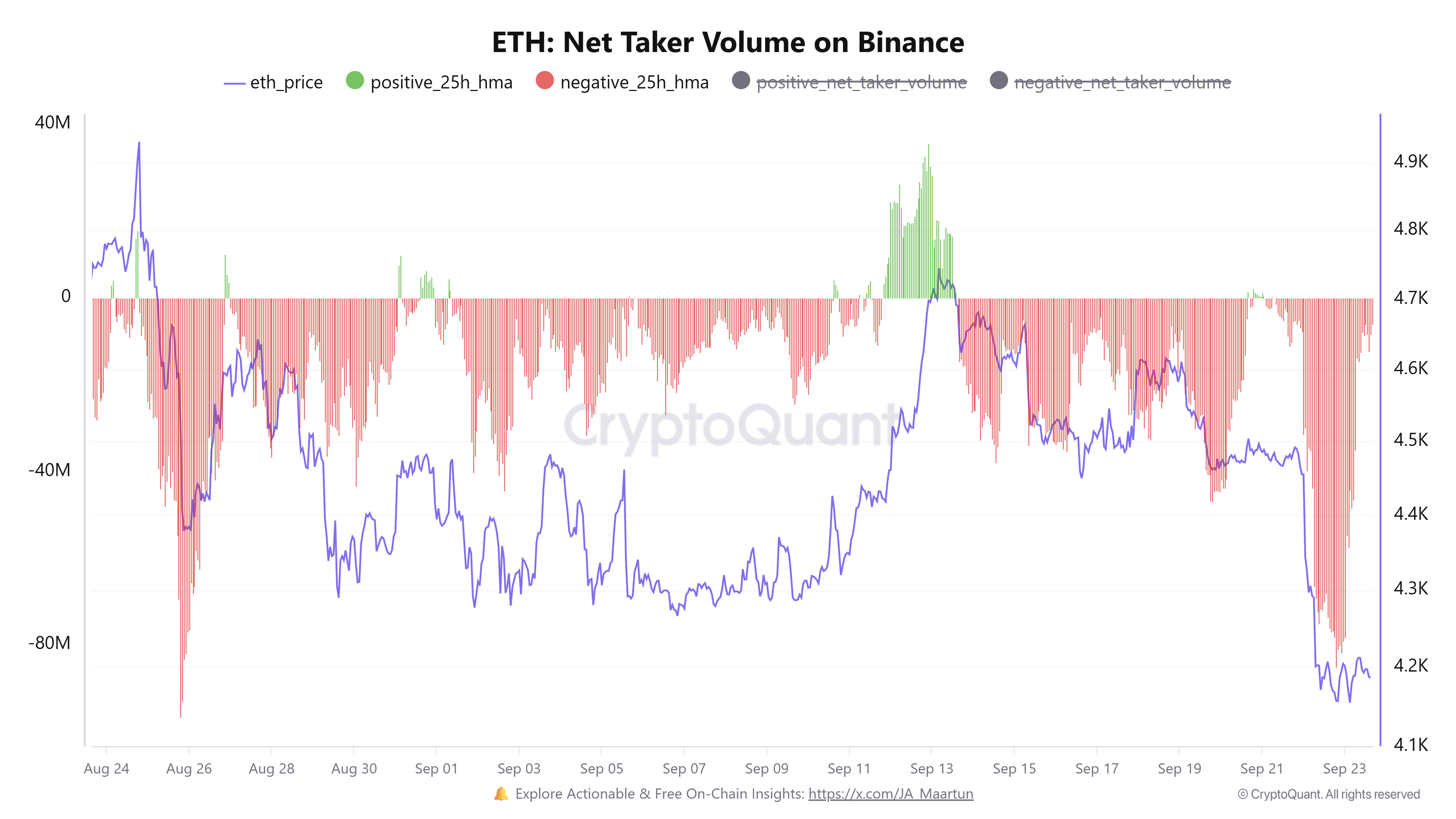

In contrast, retail participation shows signs of fatigue. The nettaker volume of Vinanence peaked in late September and remains negative for nearly a month, indicating sustained sell-side pressure from retailers despite strong institutional activities. Spot Taker CVD, which tracks volume sales over 90 days, suggests that sales have been dominant since late July, indicating that retailers are net sellers of ETH.

However, if retail flows shift to positive territory and CVD dominates shopping, Ethereum could experience retail-led gatherings and potentially drive momentum across the market. In addition to the ongoing institutional profit and chain support levels, note the reversal of retail sales trends as a key indicator of sustained upward mobility in ETH prices.

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are risky and readers need to do their own research before making transaction decisions.