In 2025, the crypto ecosystem continues to change amid market fluctuations and evolving investor priorities. Venture capital funding has slowed, with fewer large deals being closed compared to earlier this year. Nevertheless, strategic investments and innovation continue, especially in areas such as stablecoins, blockchain infrastructure, and decentralized finance (DeFi). Major projects such as Telcoin, Hercle, Momentum, and Temple Digital have secured funding to develop infrastructure aimed at driving mainstream adoption and fostering the growth of the digital asset economy.

- Cryptocurrency venture capital activity will continue to be weak in 2025, with funding rounds and deal volumes declining.

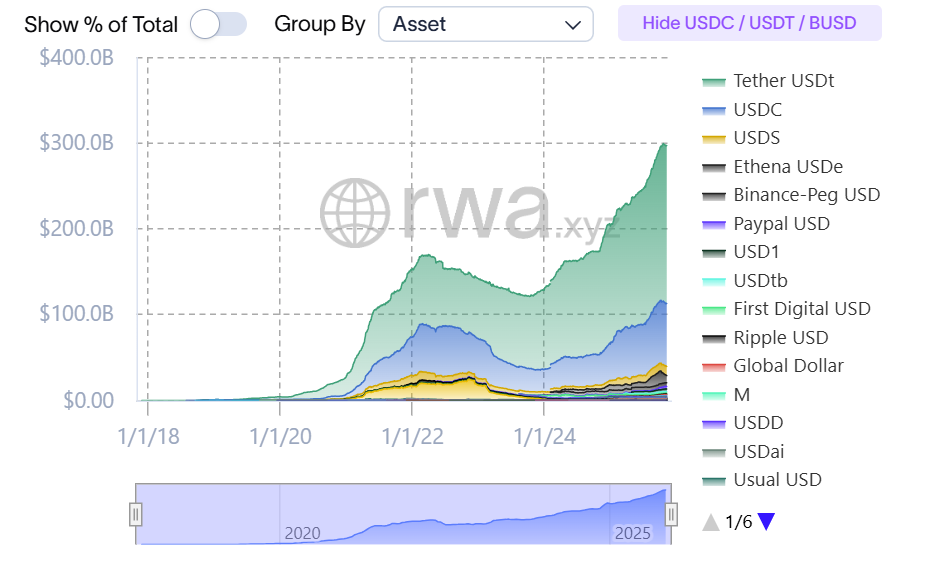

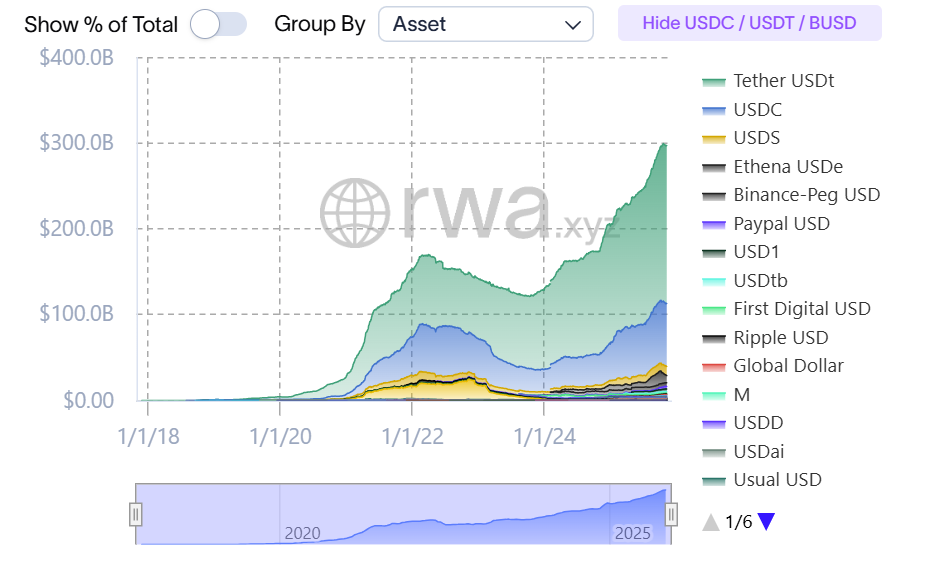

- Strategic investments are focused on building core blockchain infrastructure, stablecoins, and DeFi platforms.

- Telcoin and Hercle are raising significant capital to expand banking services and strengthen cross-border payment solutions.

- Decentralized exchanges like Momentum continue to grow rapidly and attract funding from major institutional investors.

- Innovative companies are developing institutional-grade trading and payments infrastructure to support mainstream adoption.

The once-booming venture capital landscape within the cryptocurrency industry is showing signs of cooling down with less activity in high-profile funding rounds in the fourth quarter of 2025. Industry experts say the slowdown is due to a combination of factors, including macroeconomic uncertainty and increased competition from emerging AI technologies. Kaden Stadelmann, CTO of Komodo Platform, emphasized that AI is attracting significant interest from investors and often overshadows traditional crypto projects. This change has contributed to a cautious approach among venture companies and favors a more resilient segment of the blockchain ecosystem.

Interestingly, much of the remaining investment activity is currently focused on core Bitcoin (BTC) projects, which often rely on community support rather than traditional VC funding. Gabe Salinas, CEO of Alamo Labs, noted that Bitcoin-centric ventures benefit from grassroots support, highlighting the strength of decentralization at the core of the ecosystem. Nevertheless, some sectors remain vibrant, particularly those developing underlying blockchain infrastructure such as stablecoins, payment solutions, and decentralized trading platforms.

Telcoin advances digital asset banking with $25M funding

Fintech innovator Telcoin has secured $25 million in a pre-Series A funding round to accelerate the launch of its digital asset banking platform, scheduled for later this year. This funding will support Telcoin’s compliance with the Nebraska Digital Asset Depository Institution (N-DADI) Charter, a pioneering US state-level licensing framework that enables the storage and management of digital assets under regulatory oversight. The capital raised will also facilitate the deployment of eUSD, a new stablecoin pegged to the US dollar that, unlike traditional transaction-focused stablecoins, is specifically designed to streamline payments and transfers within the Telcoin ecosystem.

Related: Circle discusses implementation of the GENIUS Act: ‘Simple, powerful rules’

Hercle secures $60 million to expand stablecoin infrastructure

Hercle, a company specializing in stablecoin infrastructure for digital payments, has announced a significant funding round totaling $60 million. The round, led by F-Prime and with $10 million in equity, also includes a $50 million financing facility to enhance liquidity. Hercle’s platform, which has processed more than $20 billion across more than 200 institutional customers, is focused on fast transaction settlement (90% settled within five minutes) with the goal of enabling efficient cross-border payments at scale.

Sui Blockchain’s Decentralized Exchange Momentum Raises $10 Million

Momentum, a leading decentralized exchange (DEX) on the Sui blockchain, has raised $10 million at a valuation of $350 million. The funding was led by HashKey Capital with participation from Anchorage Digital and other strategic investors. Founded by former Libra and Amazon engineer Wendy Fu, Momentum boasts over 2.1 million users and total transaction volume of over $22 billion. The company plans to expand beyond the Sui network through cross-chain integration and aims to develop compliance capabilities to facilitate regulated participation by institutional investors.

Temple Digital raises $5 million for institutional trading infrastructure

Powered by Canton Network, Temple Digital Group has secured $5 million in seed funding led by Paper Ventures. The startup is developing a trading platform for institutional investors that combines traditional market features such as order books and post-trade reporting with blockchain features such as tokenization, instant payments, and digital wallets. The funds will be used to expand product offerings and integrate deeper into Canton’s ecosystem, which has attracted significant investment from major financial firms such as Goldman Sachs and BNP Paribas to accelerate the adoption of blockchain in trading infrastructure.

Arx Research secures $6.1 million to facilitate stablecoin payments for merchants

Arx Research, which focuses on digital payments hardware and software, has raised $6.1 million to accelerate manufacturing and prepare for product launch. The company’s flagship device, Burner Capital, is a handheld point of sale (PoS) terminal that allows merchants to seamlessly accept both stablecoins and traditional currencies. Integrated with Flexa technology, the device supports multiple cryptocurrencies, including Bitcoin, Ethereum, and Solana, and aims to foster widespread acceptance of digital currencies in everyday commerce.