- Crypto whales and long-term holders are increasingly selling their assets, contributing to the continued market suppression.

- Analyst Jordi Visser compares current trends in cryptocurrencies to the aftermath of the dot-com bubble in 2000, highlighting similar sell-side pressures.

- Some believe Bitcoin could bottom near $100,000, while others warn that it could fall to $92,000 if bearish momentum continues.

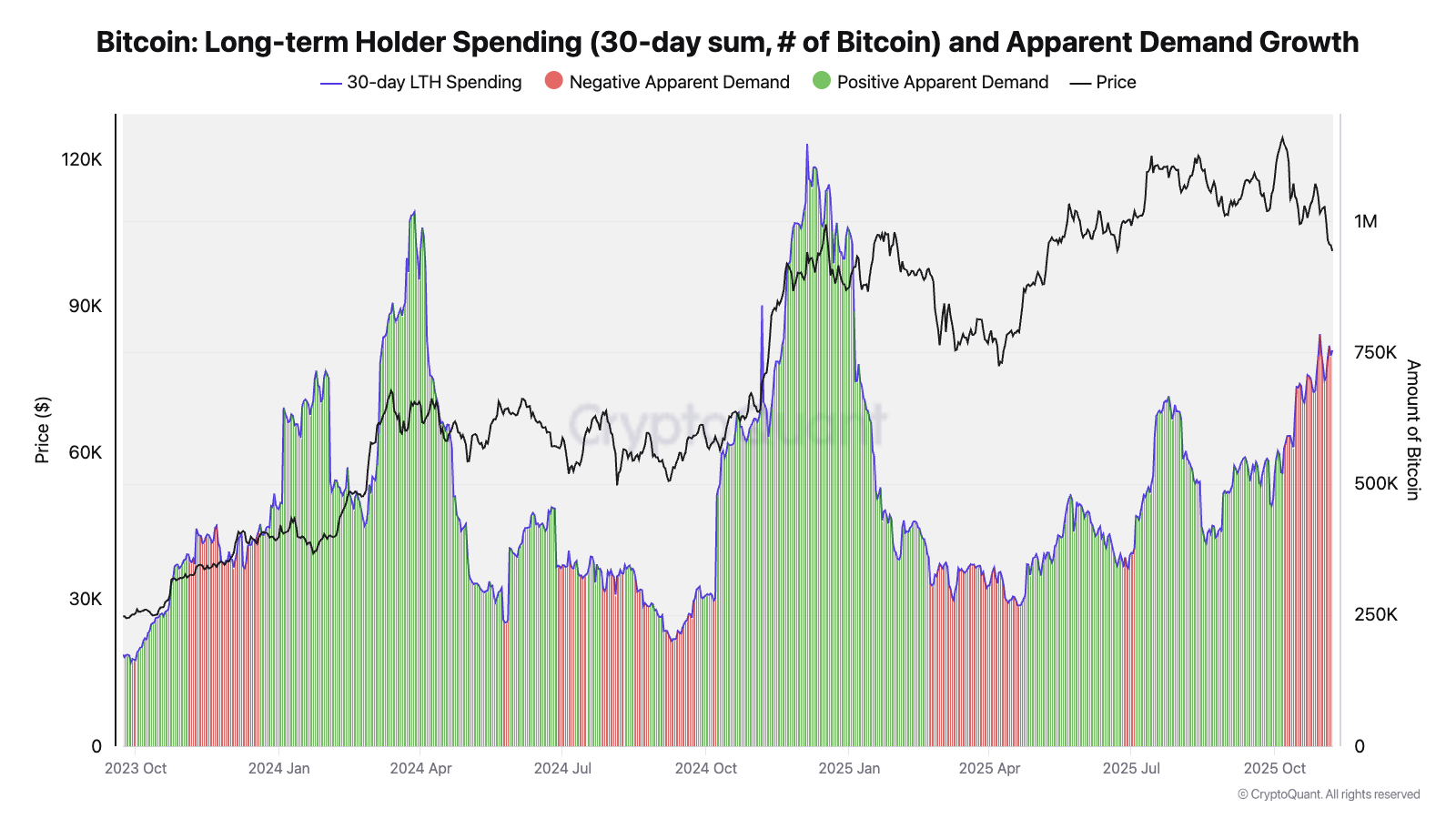

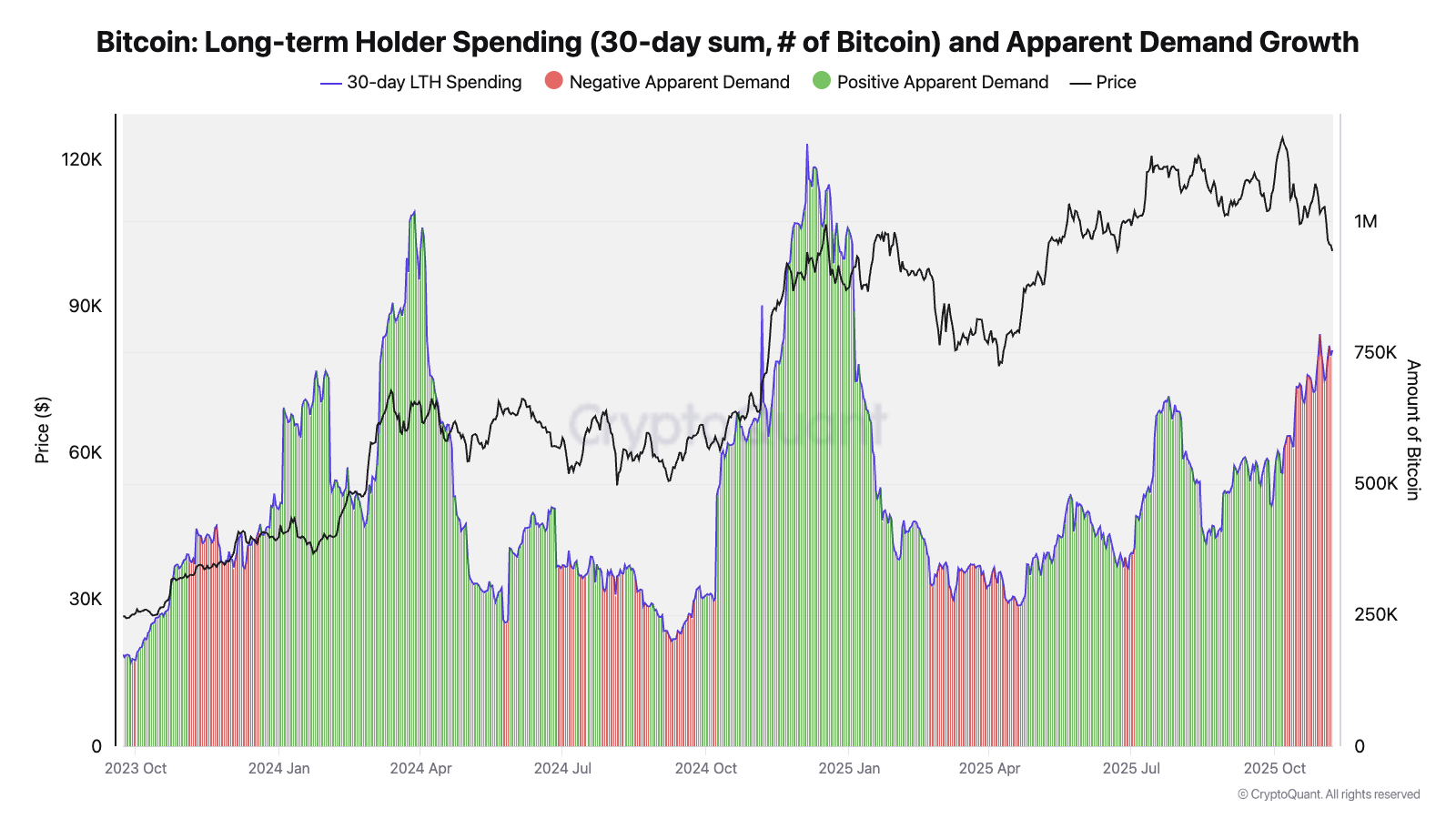

- Selling by long-term holders has accelerated since October, but weaker demand is holding back an overall price recovery.

- Market analysts have suggested that the consolidation phase is nearing an end and a breakout could occur sometime next year.

Cryptocurrency market sentiment reflects the aftermath of the dot-com crash

Crypto whales and long-time investors are currently selling off heavily, putting continued downward pressure on the price. The move is similar to the period following the dot-com crash in the early 2000s, when tech stocks plummeted by as much as 80%, resulting in more than a decade of market stagnation before reaching record highs again.

During that time, venture capitalists were tied up with mandated holding periods, forcing them to hold or sell at distressed prices. This selling pressure spread throughout the market, delaying recovery. As one analyst explained:

“Many stocks traded below their IPO prices. We are seeing a similar situation unfolding now, with venture capitalists and insiders selling on the upswing, creating sustained sell-side pressure across assets such as Solana, Ethereum, and Bitcoin.”

Visser made it clear that a similar long-term trend in the crypto market is unlikely. Instead, he pointed to the aftermath of the dot-com crash as an analogy for current sell-side dynamics, suggesting that the ongoing consolidation phase could end within a year, paving the way for a new rally.

The analysis comes amid growing concerns that Bitcoin and the broader crypto market are in a bearish trend. The recent price decline in October confirmed that, leading many analysts to lower their bullish expectations for the asset class.

Related: $100 Billion of Old Bitcoin Moved, Sparking OG vs. Trader Debate

Is the Bitcoin price stable around $100,000?

Some analysts are interpreting Bitcoin’s recent price movements as a sign of a potential bottom near $100,000. However, concerns remain that continued selling pressure could push the price back towards $92,000 if demand does not recover significantly.

Crypto analyst Julio Moreno said long-term holders and whales typically sell at all-time highs, but there is nothing inherently wrong with the sale. Rather, the problem is a shrinking demand that cannot absorb the increasing supply of Bitcoin in the market, a situation that could prolong the consolidation phase.

Moreno emphasized that this increase in selling coincides with a decline in buyer demand, suggesting a return in interest is needed to stabilize prices and trigger a new bullish phase.

As the broader crypto market navigates this period of uncertainty, the coming months could be crucial in determining whether Bitcoin and other cryptocurrencies find a solid bottom or experience further declines.